The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

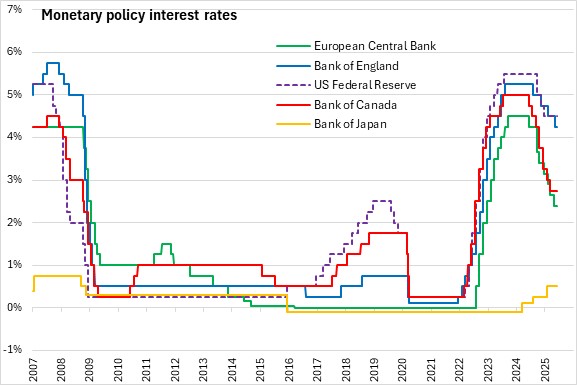

June 04, 2025BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 2.75%, with the Bank rate kept at 3.0% and the deposit rate at 2.7%.

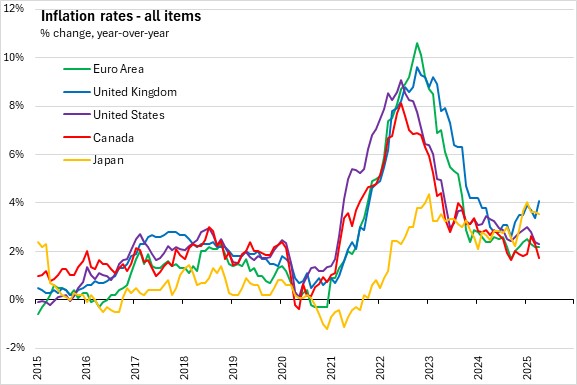

In recent months, the global economy has been resilient and reflected a surge in activity prior to tariffs. The United States had strong domestic demand, but higher imports pulled down GDP in the first quarter. Inflation in the U.S. has eased but remains above 2.0% with effects of tariffs still to come. Europe’s economy continued to growth with support from exports in the first few months of 2025 and defence spending is set to increase. China’s economy has slowed with waning effects from past fiscal support and the high tariffs impacting exports to the U.S. Oil prices have remained close to their levels at the time of the April Monetary Policy Report (MPR).

Canadian economic growth in the first quarter was at 2.2%, stronger than the April MPR. The surge of exports to the US and the inventory accumulation prior to tariffs have boosted the activity. There was strong spending on machinery and equipment which held up growth in business investment. Consumption slowed and housing activity declined driven by sharp contraction in resales. Government spending also declined.

The labour market has weakened and unemployment has risen to 6.9%. Employment has held up across sectors less exposed to trade. The economy is expected to be weaker in the second quarter of 2025.

CPI inflation eased to 1.7% in April with the elimination of federal consumer carbon tax. Excluding taxes, inflation rose 2.3% in April, higher than expected in the April MPR. Short term inflation expectations have risen with both businesses and consumers expecting trade conflicts to push up prices.

Governing Council will continue to asses the risks and uncertainties facing the Canadian economy. These include: the extent to which higher US tariffs reduce demand for Canadian exports; how much this spills over into business investment, employment and household spending; how much and how quickly cost increases are passed on to consumer prices; and how inflation expectations evolve.

The Governing Council will be assessing downward pressures on inflation from weaker economy and upward pressure on inflation from higher costs. The Bank is committed to maintain price stability for Canadians.

The next scheduled date for announcing the overnight rate target is July 30, 2025 and will publish its next Monetary Policy Report on the same day.

Source: Monetary Policy press release; Monetary Policy press conference

<--- Return to Archive