The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

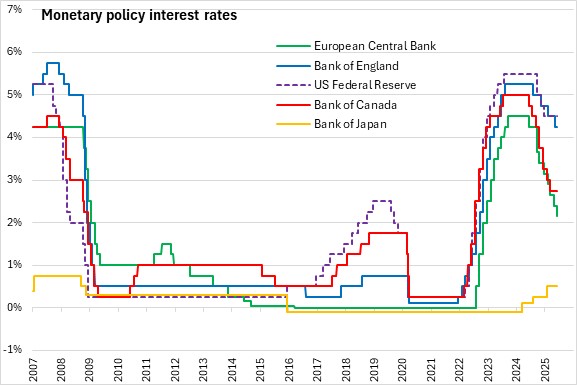

June 05, 2025EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would reduce the three key ECB interest rates by 25 basis points. The interest rates on the deposit facility, main refinancing operations and the marginal lending facility will be at 2.0%, 2.15%, 2.4% respectively effective June 11th.

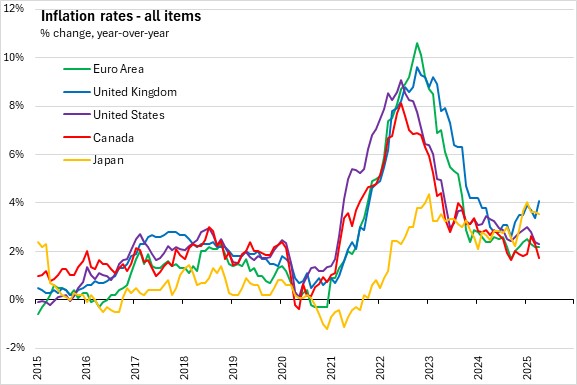

Trade uncertainty remains high, and tariffs have a negative impact on the outlook for global growth. The baseline scenario assumes US tariffs to be at their levels announced on April 9th. Global real GDP is projected to grow by 3.1% in 2025, down from the rate of 3.6% recorded last year. It is expected to decrease further, to 2.9% in 2026, before stabilising at 3.2% in 2027. Global inflation is projected to remain on a downward trajectory, moderating to 3.3% this year from 4.0% in 2024, and declining further to 2.8% in 2026 and 2.5% in 2027.

The European economy grew by 0.3% in the first quarter of 2025 mainly supported by a strong impulse from the frontloading of exports. Industrial activity picked up in the first quarter supported by demand for goods and activity in services sector likely continued to increase. Defence and infrastructure investment to continue and should also help growth. Growth is expected to slow in the second and third quarters of 2025 as global uncertainty weighs on growth. Real GDP is projected to be 0.9% in 2025, rise to 1.1% in 2026, and then to 1.3% in 2027.

Labour markets have remained resilient, labour incomes are rising, and easier financing conditions with past interest rate cuts should help consumers and firms withstand the fallout from a volatile global environment. The unemployment rate is projected to be 6.3% in 2025 and 2026 and fall to 6.0% in 2027.

Inflation is currently around the 2.0% medium-term target. HICP inflation is projected to be around 2.0% in 2025, then fall to 1.6% in 2026 and rise to 2.0% in 2027.

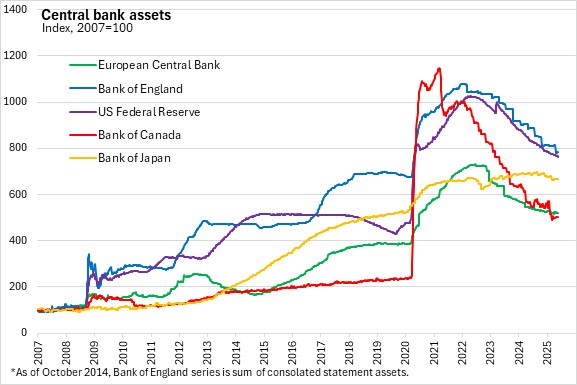

The asset purchase programme (APP) and Pandemic Emergency Purchase Programme (PEPP) portfolios are declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities.

The Governing Council notes it is determined to see inflation sustainably stabilise at its 2.0% medium-term target. The transmission protection Instrument is also available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

The next scheduled monetary policy meeting will be on July 23-24, 2025.

Source: European Central Bank: Monetary Policy Decisions; Monetary Policy Statement (Press Conference); Macroeconomic Projections June, 2025

<--- Return to Archive