The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

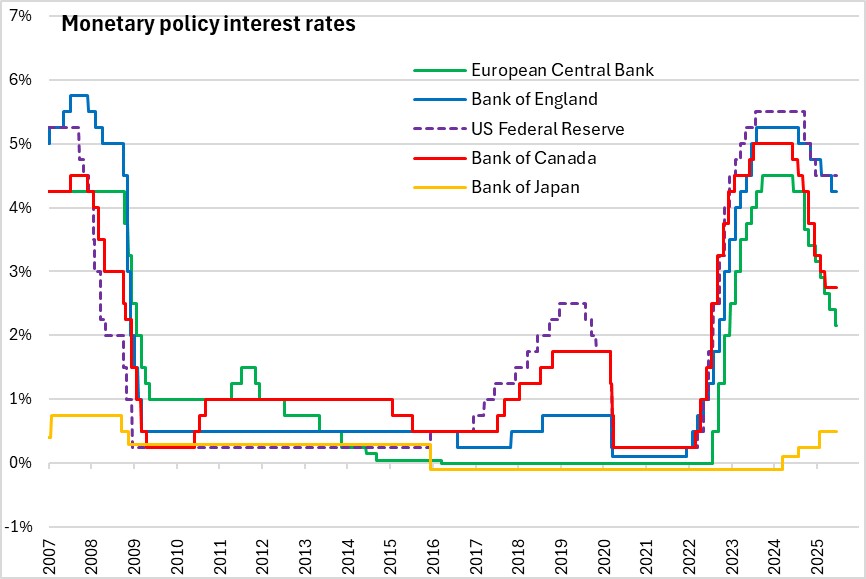

June 18, 2025BANK OF JAPAN MONETARY POLICY On June 17, 2025, the Policy Board of the Bank of Japan decided to maintain their uncollateralized overnight call rate at around 0.5%.

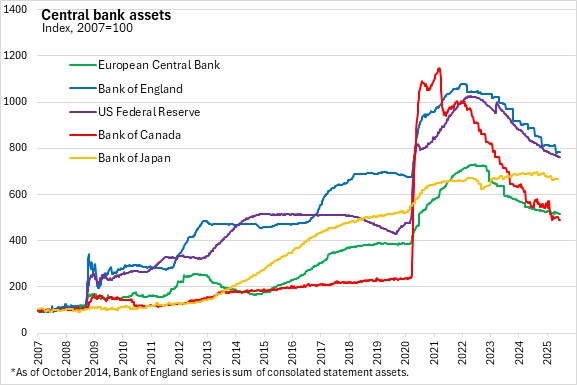

The Bank of Japan plans to reduce its purchase of Japanese government bonds (JGBs) to about 2 trillion yen in January-March 2027, cutting the down by about 400 billion yen each quarter until January-March 2026, and by 200 billion from then on.

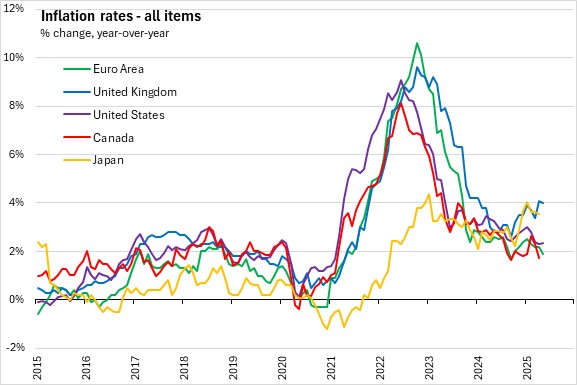

Japan’s economic activity has recovered moderately with exports and industrial production remaining mostly flat. There has been some front-loading due to increase in U.S. tariffs. Business fixed investment has been increasing with improving corporate profits. Private consumption has improved supported by growth in employment and income situation. CPI less fresh food has been around 3.5% recently with growth in wages passed to prices. Consumer sentiment has not improved with increasing prices. Housing investment has been weak, and public investment has been mostly flat.

Japan’s economic growth is projected to moderate with a slow in overseas economies and a decline in domestic corporate profits. Thereafter, economic growth is predicted to rise with overseas economies returning to a moderate growth path. Inflation expectations have risen moderately. Pressure on CPI less fresh food is expected to wane, and underlying CPI is expected to be sluggish due to deceleration in the economy. Medium- and long-term inflation expectations are rise with a projected sense of labour shortage growth and economic growth.

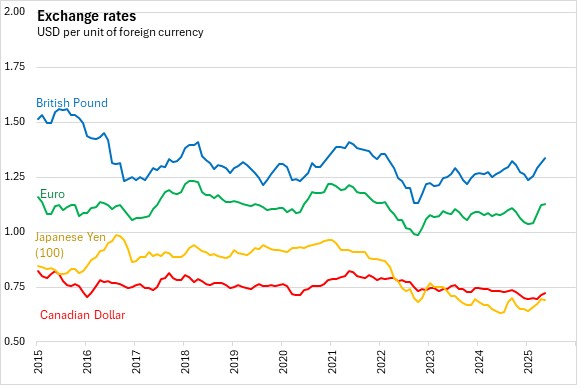

The Bank of Japan is focused on developments in the financial and foreign exchange markets and their impact on Japan's economic activity and prices.

The Bank will release their next monetary policy statement as well as the outlook on economic activity on July 31, 2025.

Source: Bank of Japan, Statement on Monetary Policy

<--- Return to Archive