The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

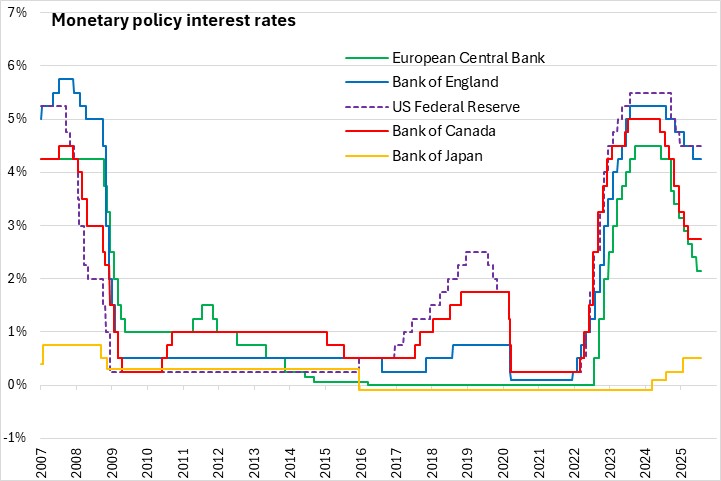

July 24, 2025EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would leave the three key ECB interest rates unchanged. The interest rates on the deposit facility, main refinancing operations and the marginal lending facility will remain at 2.0%, 2.15%, 2.4% respectively.

The European economy grew faster than expected in the first quarter of 2025, in part due to frontloading of exports ahead of expected tariffs, bolstered by stronger private consumption and investment. Recent surveys point to modest expansion in both the manufacturing and services sectors, however higher actual and expected tariffs are making firms more hesitant to invest.

Labour markets have been robust, with rising real incomes and solid private sector balance sheets expected to continue to support consumption. The May unemployment rate was 6.3%, near its lowest level since the introduction of the Euro. Easing financing conditions are supporting domestic demand, including housing markets, with higher public investment in defence and infrastructure also expected to further support growth.

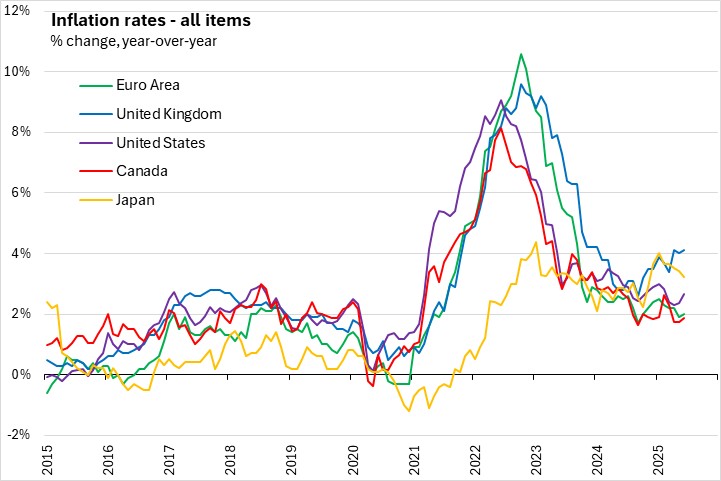

Inflation was 2.0% in June, up from 1.9% in May. Indicators of underlying inflation are overall consistent with achieving the two per cent medium-term target. Labour costs are moderating, with year-over-year growth in employee compensation slowing to 3.8% in the first quarter, down from 4.1% in the last quarter of 2024. Short-term consumer inflation expectations declined in both May and June.

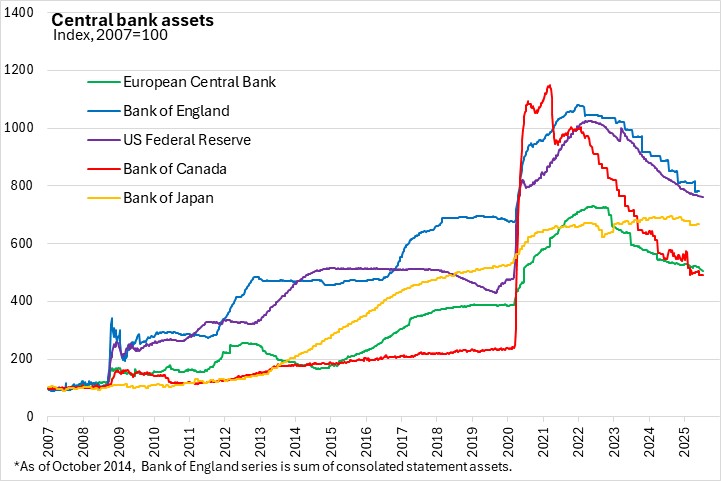

The asset purchase programme (APP) and Pandemic Emergency Purchase Programme (PEPP) portfolios are declining at a measured and predictable pace, as the Eurosystem no longer reinvests principal payments from maturing securities.

The Governing Council notes it is determined to see inflation sustainably stabilise at its 2.0% medium-term target. The transmission protection Instrument is also available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

The next scheduled monetary policy meeting will be on September 10-11, 2025.

Source: European Central Bank: Monetary Policy Decisions; Monetary Policy Statement (Press Conference); Macroeconomic Projections June, 2025

<--- Return to Archive