The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

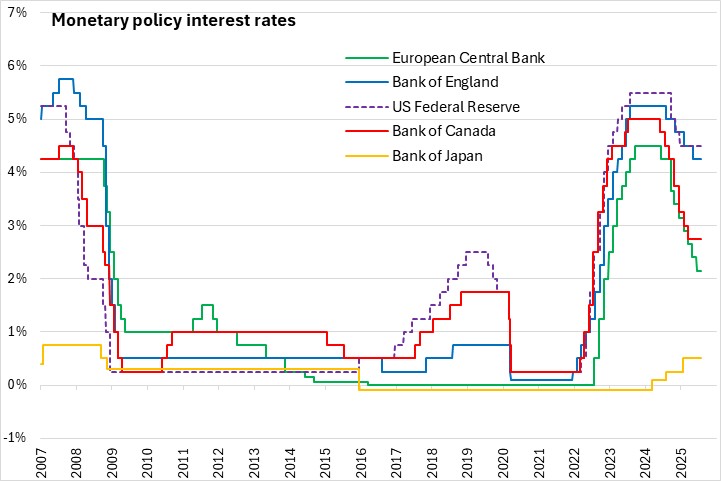

July 31, 2025BANK OF JAPAN MONETARY POLICY On July 31, 2025, the Policy Board of the Bank of Japan decided to maintain their uncollateralized overnight call rate at around 0.5%.

Japan’s economic growth is projected to moderate with a slow in overseas economies and a decline in domestic corporate profits. Thereafter, economic growth is predicted to rise as overseas economies return to a moderate growth path. Real GDP growth expectations are largely unchanged from the previous outlook report. It remains highly uncertain how trade and other policies will affect overseas economic activity, with risks to economic activity skewed to the downside for 2025 and 2026.

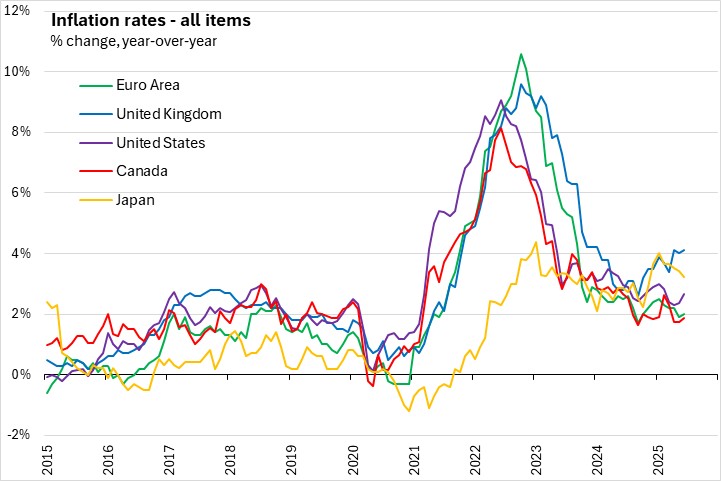

Inflation expectations have risen moderately. Pressure on CPI less fresh food is expected to wane, and underlying CPI is expected to be sluggish due to deceleration in the economy. Medium- and long-term inflation expectations have risen, with a projected sense of labour shortage growth and economic growth.

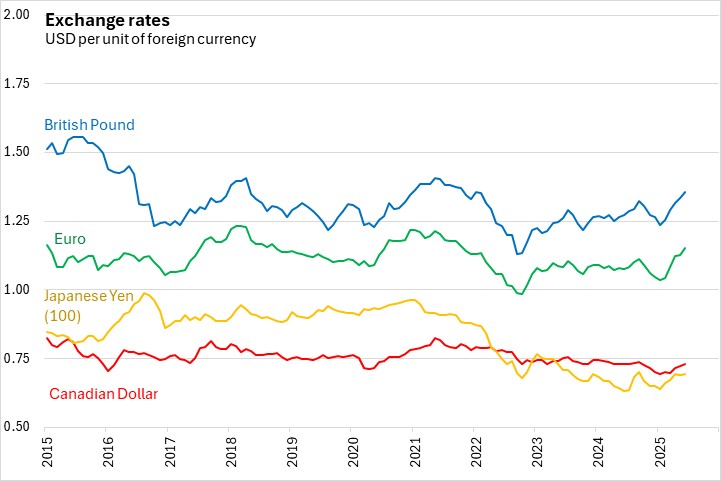

The Bank of Japan is focused on developments in the financial and foreign exchange markets and their impact on Japan's economic activity and prices.

The Bank will release their next monetary policy statement on September 18, 2025.

Source: Bank of Japan, Statement on Monetary Policy, Outlook for Economic Activity and Prices

<--- Return to Archive