The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

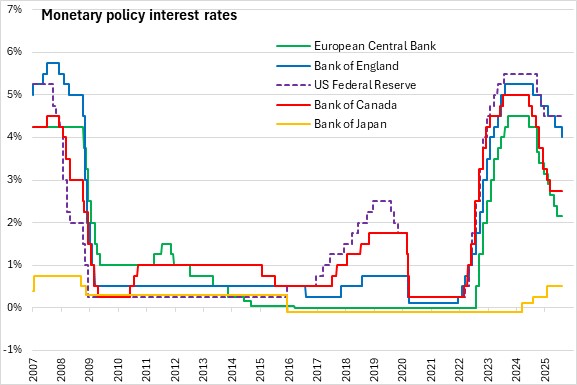

August 07, 2025BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to reduce the Bank Rate by 25 basis points to 4.0%.

The baseline projections of the August Monetary Policy Report are based on a 14% tariff established on July 29 by the US. There were several tariffs announced on July 29 on other countries, but were not implemented, thus they were not part of the baseline projections. Euro Area GDP grew by 0.1% in 2025 Q2 driven by unwinding of front-loading of exports in Q1. Military actions between Iran and Israel in June led to a rise in oil prices but these have since fallen.

UK GDP has grown 0.7% in Q1 2025, stronger than expected in the May projection. The recent strength reflects mostly temporary factors that don’t clearly show underlying momentum in GDP. Exports had been expedited to the US ahead of tariffs taking effect in the first quarter. Based on monthly GDP, headline GDP is expected to have grown by 0.1% in Q2. Four quarter GDP growth is expected to be 1.2% in 2025 Q3, 1.3% in 2026 Q3, 1.5% in 2027 Q3 and 1.7% in 2028.

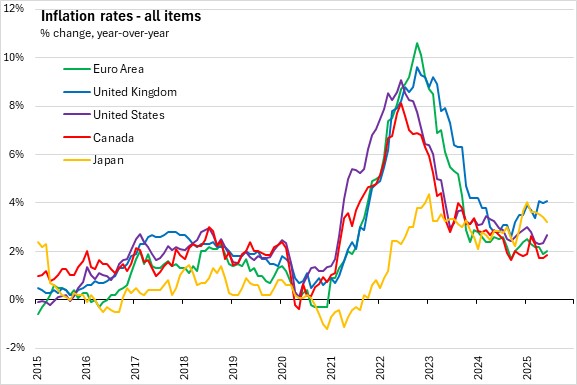

Twelve-month CPI increased to 3.6% in June, higher than the expectations in May Monetary Policy report. The rise was mostly due to previous increases in energy prices and stronger than expected food price inflation. Four quarter CPI inflation is expected to be 3.8% in Q3 2025, 2.7% in Q3 2026, 2.0% in Q3 2027 and Q3 2028. The number of job vacancies declined, and recruitment difficulties are normalizing from previously elevated levels. Unemployment rate is forecasted to be 4.8% in Q3 2025, 4.9% in Q3 2026, 4.8% in Q3 2027 and Q3 2028.

The Committee judged that a careful approach to the further withdrawal of monetary policy restraint remained appropriate. The timing and pace of future reductions in the restrictiveness of policy would depend on the extent to which underlying disinflationary pressures would continue to ease. Monetary policy was not on a pre-set path, and the Committee would remain responsive to the accumulation of evidence. The Committee would decide the appropriate degree of monetary policy restrictiveness at each meeting.

The next scheduled monetary policy meeting will be on September 18, 2025.

Source: Bank of England, Monetary Policy Summary, August 2025; Monetary Policy Report (August)

<--- Return to Archive