The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

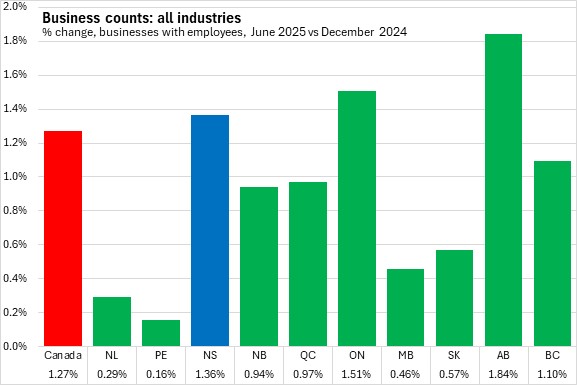

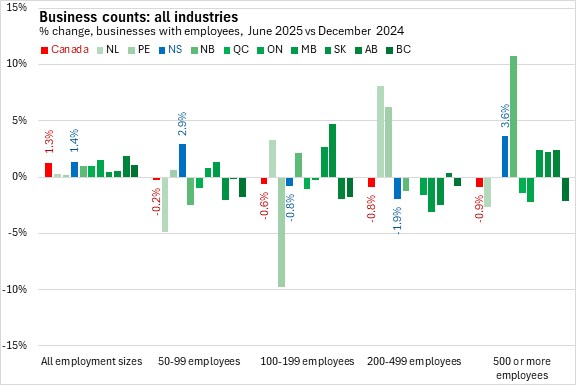

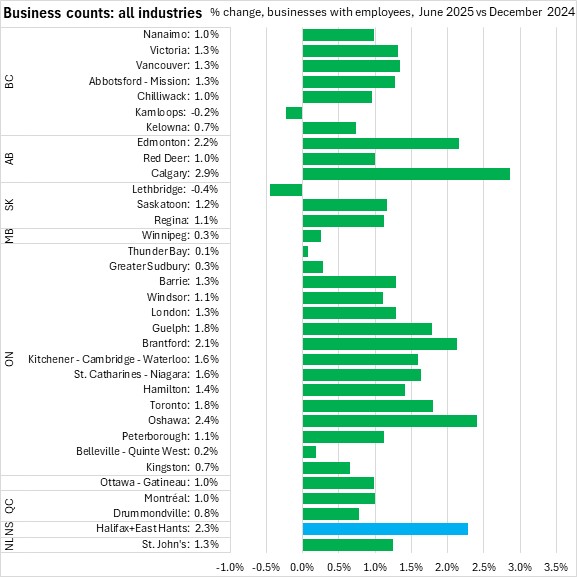

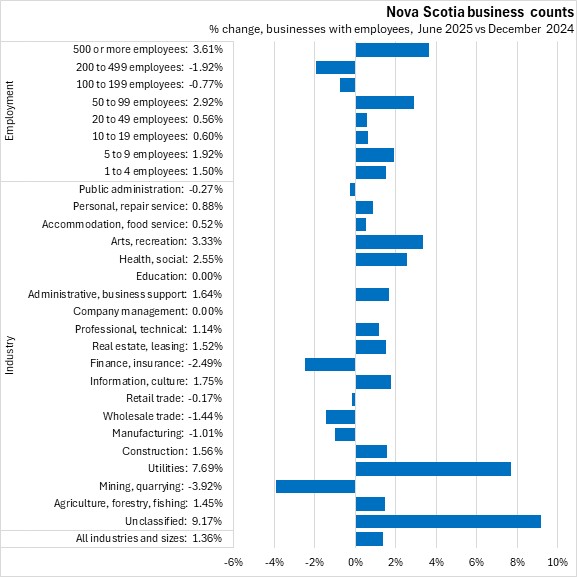

August 15, 2025BUSINESS COUNTS, JUNE 2025 The number of business locations in Nova Scotia with employees increased 1.36% between December 2024 and June 2025. Across Canada, business counts increased by 1.27% with gains in all provinces. Alberta and Ontario reported the fastest growth in business counts over this period (followed by Nova Scotia). Growth was slowest in Prince Edward Island.

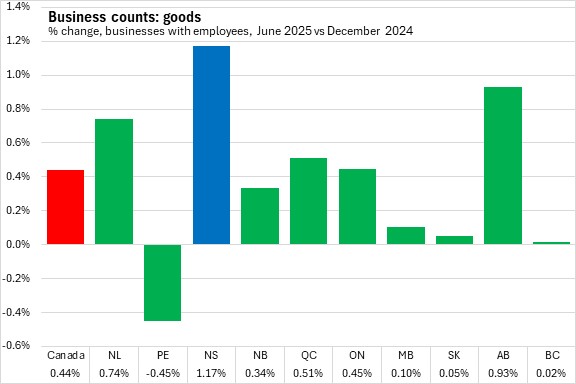

The number of goods producing locations increased 1.17% in Nova Scotia - the fastest gain among provinces. Nationally, the count of goods producing businesses was up 0.44% with gains in all provinces except Prince Edward Island (gains in British Columbia and Saskatchewan were negligible).

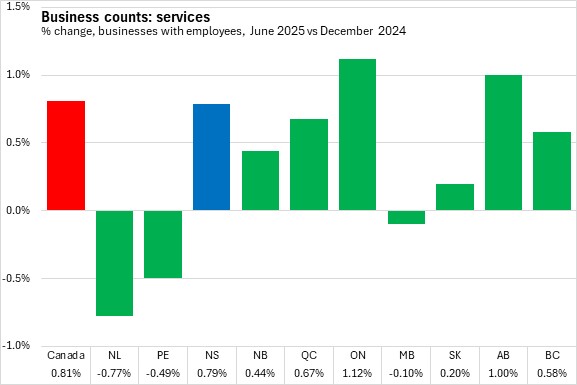

The number of service businesses was up 0.79% in Nova Scotia - slightly slower than the national average growth rate (0.81%). The numbers of service businesses were up in seven provinces (led by Ontario and Alberta). Newfoundland and Labrador, Prince Edward Island and Manitoba reported declines in the number of service businesses.

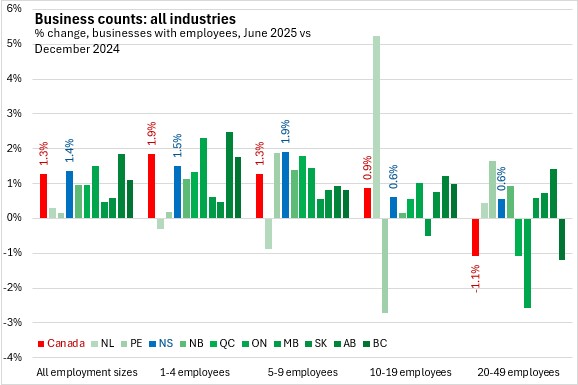

Grouping business counts by employment size, Nova Scotia reported growth in all employment size categories except for those between 100 and 199 employees as well as those with between 200 and 299 employees. Growth was faster for large employers (500+ employees) in Nova Scotia as well as for those with 50-99 employees.

Across Canada, all categories of medium and large employers (20-49, 50-99, 100-199, 200-499 and 500+) reported falling business counts. Canadian business counts were up only for those with 20 or fewer employees (1-4, 5-9 and 10-19), though this was sufficient to generate overall growth in business counts in Canada.

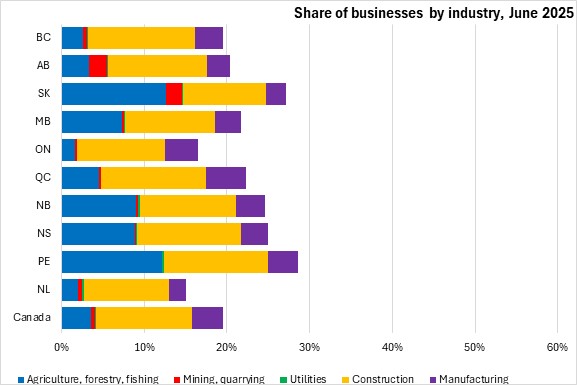

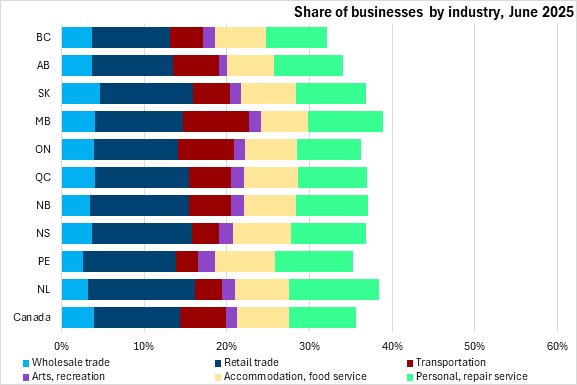

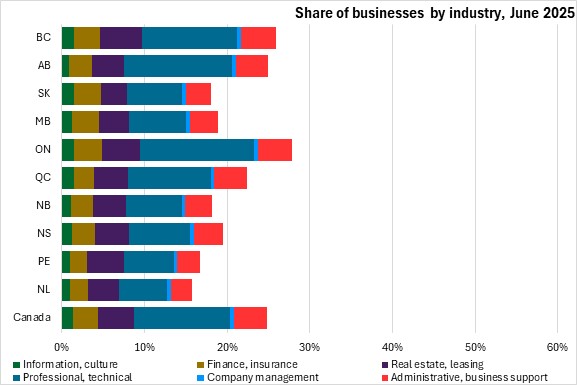

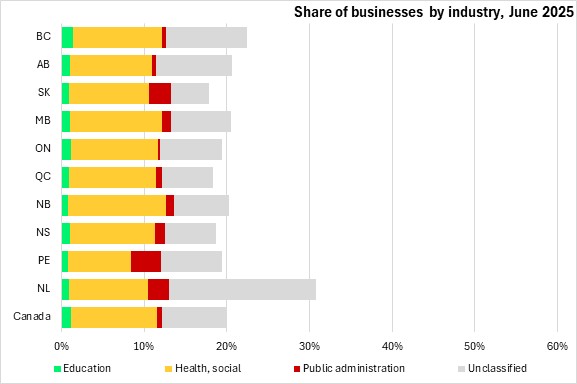

The number of businesses in a particular industry or location is not an indicator of its economic significance; employment, output and income generated are better indicators of economic contributions. However, in addition to growth rates, the relative share of businesses by industry provides some insight on the economic structure of a particular location, relative to other jurisdictions.

Across Canada, businesses in goods industries make up a larger share of all businesses in Saskatchewan and the Maritime provinces. Goods businesses are a lower share of all businesses in Ontario and Newfoundland and Labrador.

Distribution (wholesale, retail, transportation) and personal service industries make up a more consistent share of business counts across the country, with somewhat higher shares in Newfoundland and Labrador and Manitoba.

Real estate, finance, professional services, information and culture, company management as well as administrative and business support businesses are notably more concentrated in Canada's four most urban provinces: Ontario, British Columbia, Alberta and Québec.

Health, social, education and public administration businesses make up a similar share of business counts across most provinces. Newfoundland and Labrador reported a higher portion of unclassified businesses.

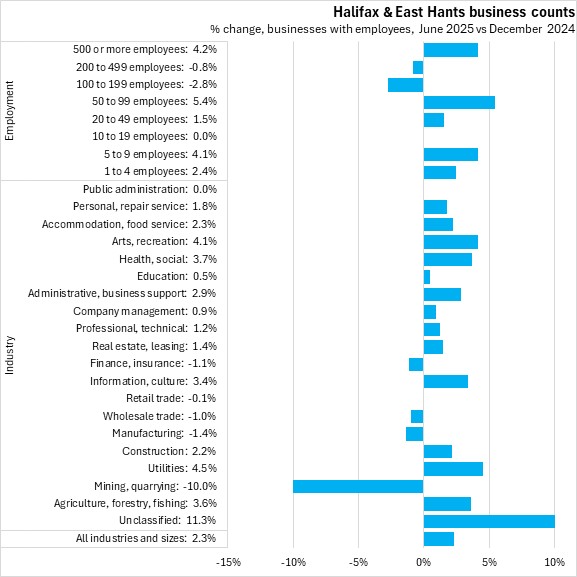

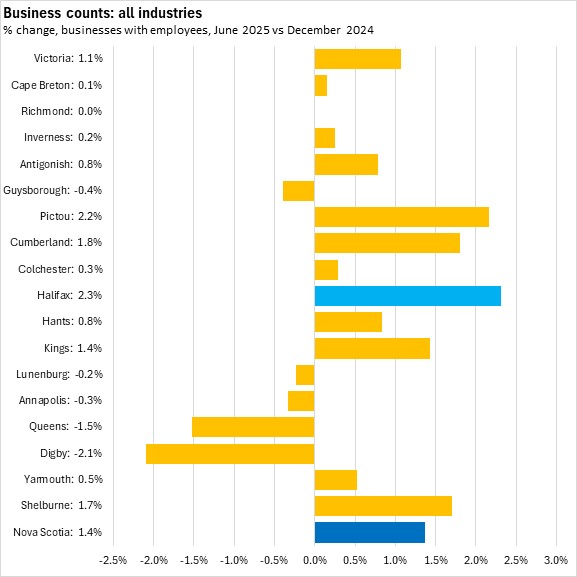

Among Canada's Census Metropolitan Areas (CMA), Halifax and East Hants reported a 2.3% increase in business counts across all industries and sizes, trailing only Calgary and Oshawa. Kamloops and Lethbridge posted the only declines in business counts.

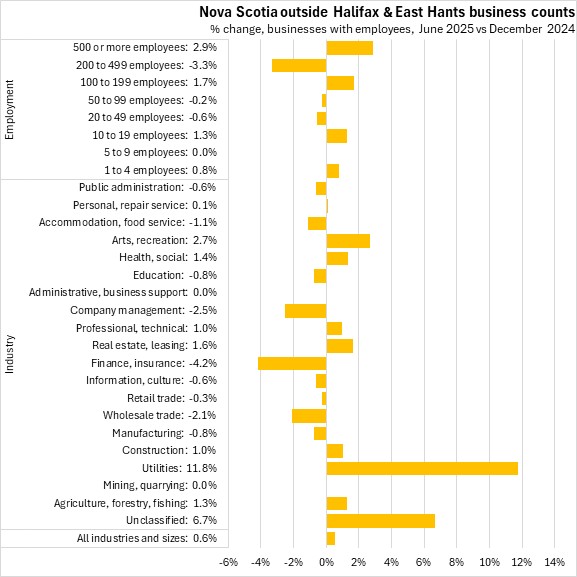

Among Nova Scotia's industries (apart from unclassified businesses), business counts in utilities reported the largest percentage gains from December 2024 to June 2025. Declines were reported in business counts among Nova Scotia's public administration, finance/insurance, retail trade, wholesale trade, manufacturing and mining/quarrying industries.

In the Halifax and East Hants Census Metropolitan Area, agriculture/forestry/fishing, utilities, arts/recreation, information/culture and health/social had the fastest growth in business counts (among industries for which classifications were available). in Halifax/East Hants business counts were down for mining/quarrying, manufacturing, wholesale trade, retail trade and finance/insurance.

Business counts were up for most employment size categories in Halifax/East Hants, with the exceptions of businesses with 100-199 employees, 200-499 employees and 10-19 employees (unchanged).

Across Nova Scotia outside Halifax and East Hants, the business count grew fastest for utilities. Finance/insurance reported the steepest decline in business counts among classified businesses. The number of businesses with 500 or more employees grew faster than any other employment size category while there was a stronger decline among businesses with 200-499 employees.

Among Nova Scotia's counties, Halifax and Pictou reported the fastest percentage growth in business counts from December 2024 to June 2025. Of the 5 counties reporting declining business counts, Digby and Queens Counties reported the sharpest declines.

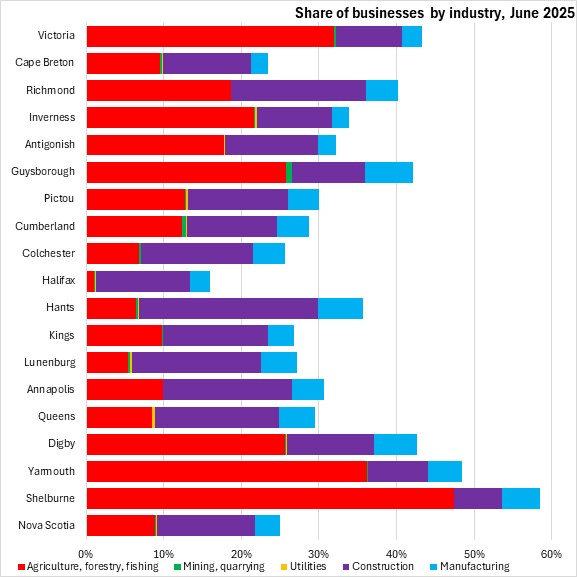

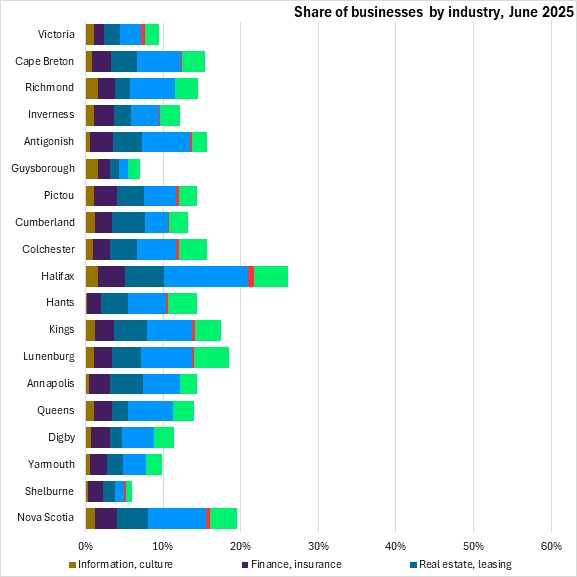

Among Nova Scotia's counties, goods-businesses are a larger share of total business counts in Shelburne, Yarmouth, Digby, Guysborough, Richmond and Victoria counties (notably from agriculture, forestry and fishing).

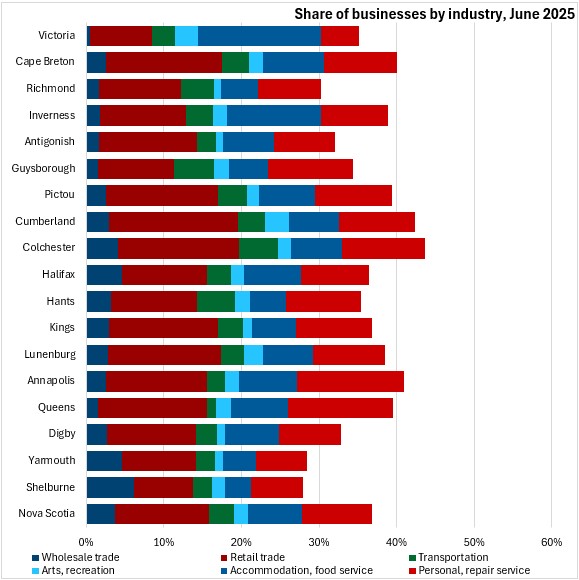

Distributive and personal services businesses are more uniformly distributed across Nova Scotia's counties, though with somewhat larger concentrations in Annapolis, Colchester, and Cumberland counties and smaller concentrations in Shelburne and Yarmouth counties.

Financial, real estate, professional and administrative services were more concentrated in Halifax - particularly for professional and technical services as well as real estate and leasing.

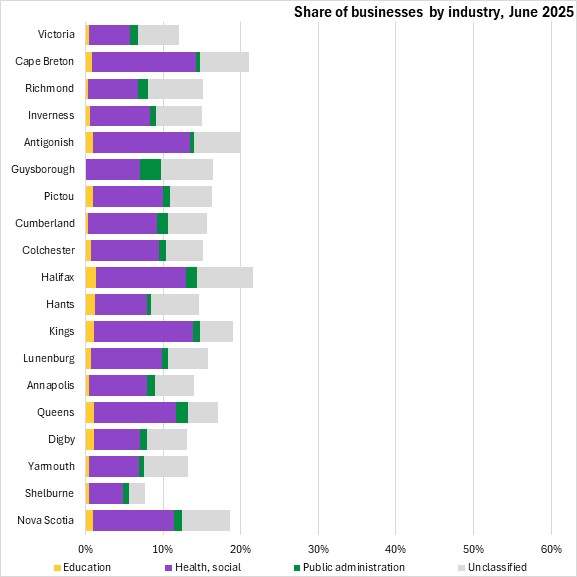

Health, social, education and public administration businesses were larger shares of all businesses in Halifax, Antigonish, Cape Breton, Kings and Queens counties.

Key definitions for Statistics Canada's Business Register:

Statistical Enterprise

An enterprise is the legal operating entity at the top of the operating structure. There is only one enterprise per operating structure. It is associated with a complete set of financial statements.

Statistical Establishment

A statistical establishment is the production entity or the smallest grouping of production entities which:

- Produces a homogeneous set of goods or services;

- Does not cross provincial boundaries; and

- Provides data on the value of output together with the cost of principal intermediate inputs used along with the cost and quantity of labour resources used to produce the output.

- For example, a plant in the manufacturing industry which provides accounting information regarding the value of shipments (sales), direct costs and labour costs is considered a single establishment. However, two stores in the retail industry may be considered one establishment if the accounting information, described in item (c) above, is not available separately, but is combined at a higher level.

Statistical Location

The location is an operating entity, specifically a production entity which:

- Conducts economic activity at or from a single physical location or group of locations;

- Resides within the smallest standardized geographical area;

- Is able to provide employment data at a minimum.

- Multiple locations can be found under a single enterprise.

Sources: Statistics Canada. Table 33-10-1014-01 Canadian Business Counts, with employees, June 2025; Table 33-10-1016-01 Canadian Business Counts, with employees, census metropolitan areas and census subdivisions, June 2025; Table 33-10-0764-01 Canadian Business Counts, with employees, December 2024; Table 33-10-0766-01 Canadian Business Counts, with employees, census metropolitan areas and census subdivisions, December 2024

<--- Return to Archive