The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

August 27, 2025BUSINESS OPENING AND CLOSING, MAY 2025 Monthly (May 2025 vs April 2025, seasonally adjusted)

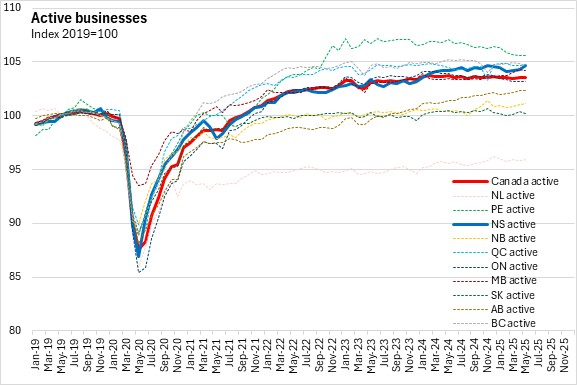

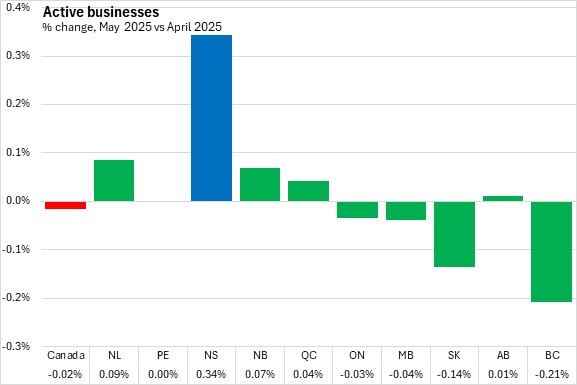

The number of active businesses in Nova Scotia edged up by 0.34% from April 2025 to May 2025, rising by 72 to 21,030 active businesses.

Nationally, active businesses declined by 0.02%, with gains in five provinces. Nova Scotia posted the fastest gain and Saskatchewan and British Columbia reported the largest declines in active businesses.

A business will be classified as 'opening' if it had no employment in the previous month and then has employment in the next month. A business is 'closing' if it had employment in the previous month and no employment in the current month. For opening and closing, the reason could be a permanent change (i.e. business exit) or temporary for reasons such as seasonal operations, capital maintenance or restructuring. Continuing business are those that had employment in both the current and previous month. Active businesses are the sum of continuing and opening business in the current month.

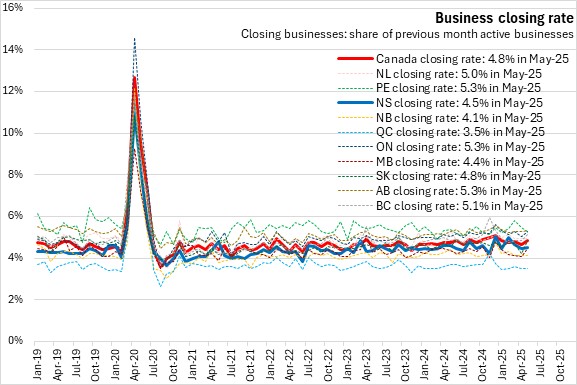

The rate at which business either opened, continued or closed can be examined to see how the number of active businesses has changed. The calculation for the opening, continuing and closure rates are based on the number of active businesses in the previous month.

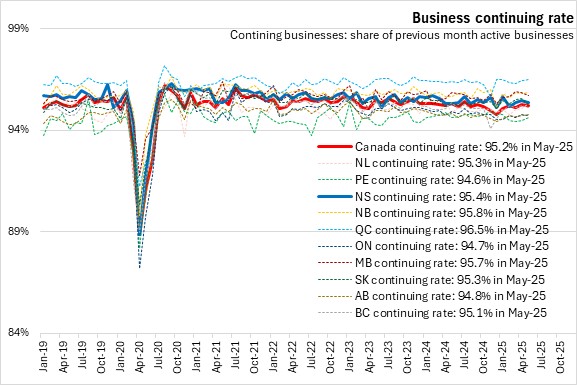

Most businesses continue operating each month. In May 2025, Nova Scotia's business continuing rate was 95.4%, slightly above the national average (95.2%). Québec reported the highest business continuing rates (96.5%) while Prince Edward Island reported the lowest continuing rate (94.6%).

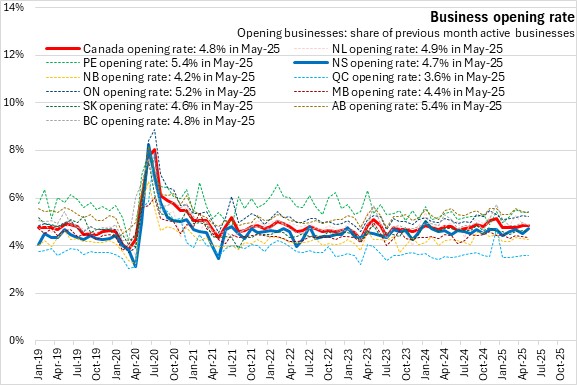

Nova Scotia's business opening rate was 4.7% in May 2025, below the national average of 4.8%. Prince Edward Island and Alberta had the highest business opening rates (5.4%) while Québec had the lowest (3.6%).

Nova Scotia's business closing rate was 4.5% in May 2025, just below the national average of 4.8%. Alberta, Ontario and Prince Edward Island reported the highest business closing rate (5.3%), while Québec had the lowest business closing rate (3.5%).

Year-over-year (May 2025 vs May 2024)

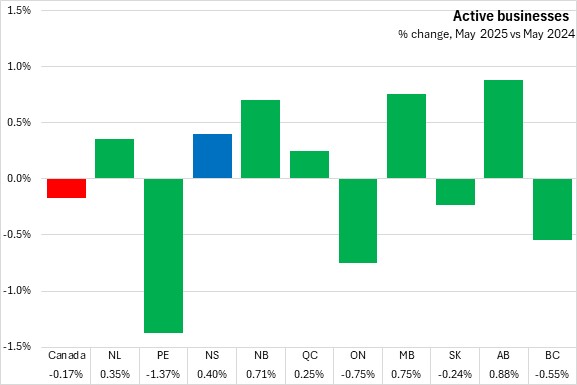

Compared with May 2024, the number of active businesses was up 0.40% for Nova Scotia. Nationally, active businesses were down 0.17% compared to May 2024. Alberta reported the largest increase in active businesses and Prince Edward Island reported the largest year-over-year percentage decline in active businesses.

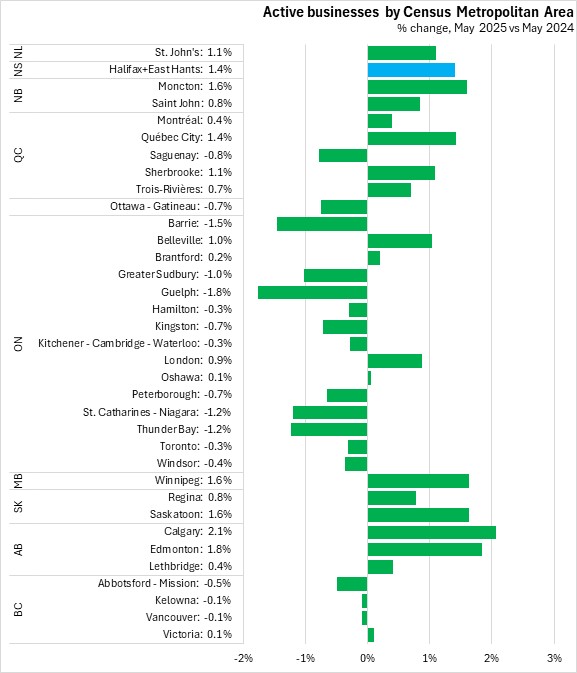

The number of active businesses in the Halifax and East Hants Census Metropolitan Area was up 1.4% from May 2024 to May 2025.

Out of 35 CMAs, 19 reported growth in active businesses over the past 12 months. Calgary, Edmonton, Moncton and Saskatoon reported the largest gains in the number of active businesses while Guelph and Barrie reported the largest decline.

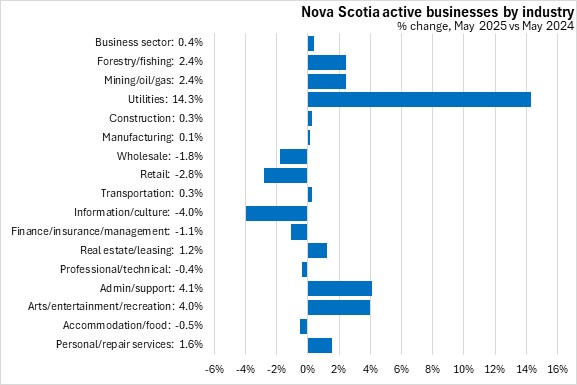

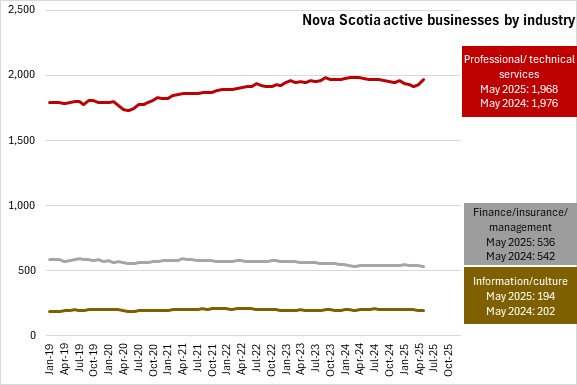

Compared with May 2024, ten sectors saw an increase in active businesses in Nova Scotia in May 2025 with the largest percentage increase in utilities. The steepest decline was in information/culture services.

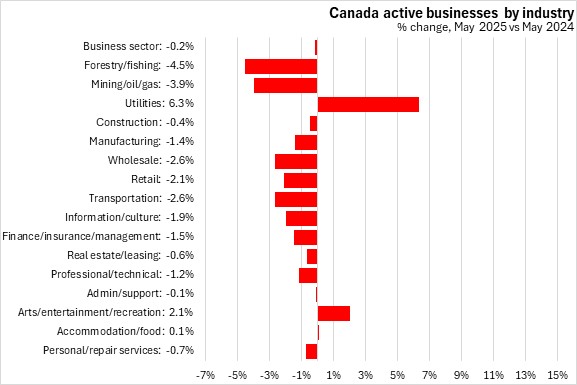

Nationally, the number of active businesses was down for all business sector industries except utilities, arts/entertainment/recreation, and accommodation/food, with the largest declines in forestry/fishing and mining/oil/gas.

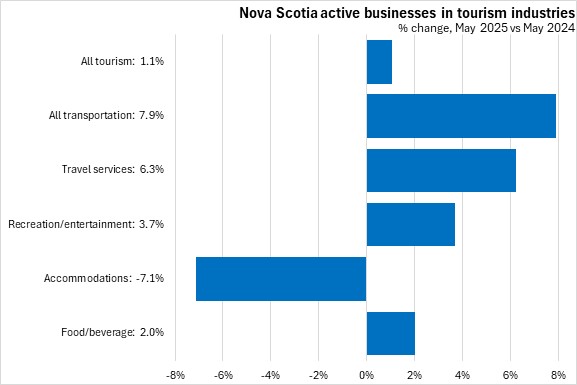

Statistics Canada has broken out specific data for tourism-related industries. Compared with May 2024, the number of active tourism-related businesses rose 1.1% in Nova Scotia as of May 2025, with gains in all subsectors except accommodations.

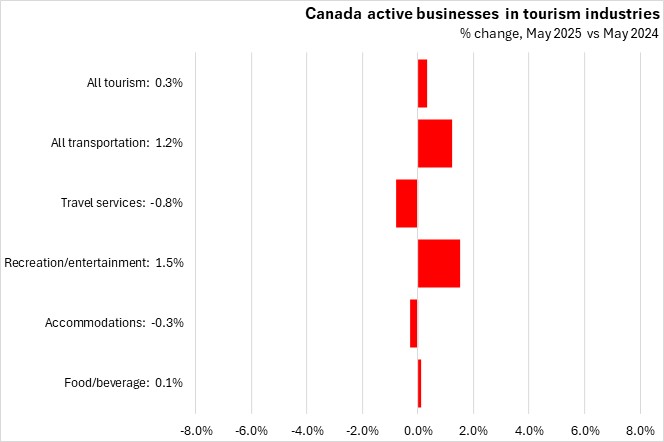

Nationally the number of tourism-related businesses edged up 0.3% from May 2024 to May 2025. Transportation, recreation/entertainment, and food/beverages reported growth while accommodations and travel services declined.

Trends

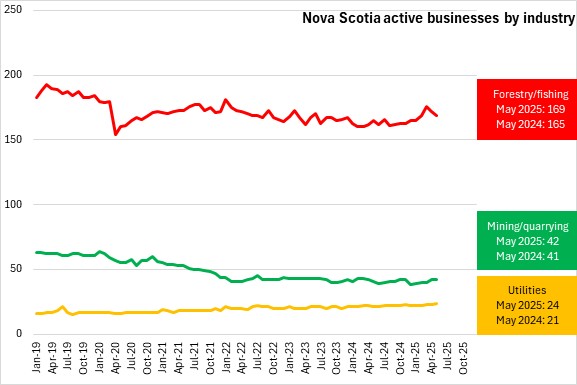

There has been a downward trend in forestry/fishing active businesses, but in the three months prior to April there was a substantial rise in active businesses. Active businesses in forestry/fishing declined in April and in May from their recent peak in March 2025. Mining/quarrying has been steadily declining, but stabilized in April and May. Utilities have slowly started growing starting in March 2025.

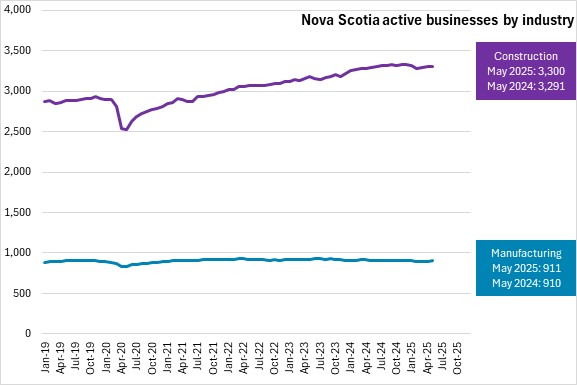

From 2020-2025, the number of active businesses in construction grew at a steady pace with a slight dip in the end of 2024. Growth resumed in recent months. Manufacturing businesses have remained stable for the past 3 years, with only a slight gain in recent months.

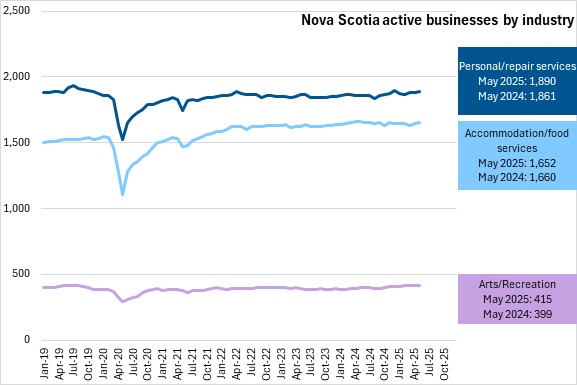

There have been small gains in active businesses for personal/repair businesses in recent months, and small gains in arts/recreation in recent months. Accommodation/food services had small gains in recent months.

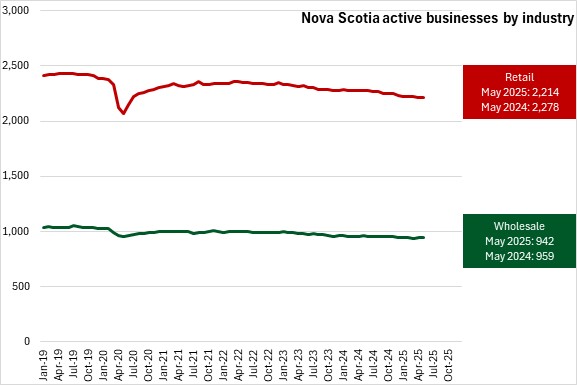

Retail and wholesale businesses have declined in the past two years.

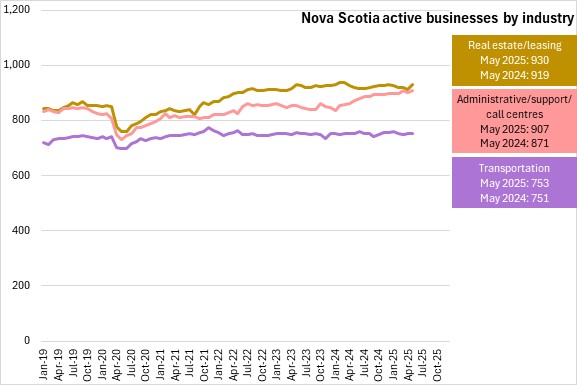

Active businesses in transportation have been fairly stable from 2022. The number of active businesses in real estate/leasing have recently grown and administrative/support/call centers have seen modest growth since 2024.

Professional/technical services active businesses have grown in recent months after steady gains in the last year. The decline in finance/insurance/management businesses has slowed, while the number of active businesses in information/culture has been stable.

The source data is seasonally adjusted. The data may not aggregate due to firms being classified into multiple industry or geography.

Source: Statistics Canada. Table 33-10-0270-01 Experimental estimates for business openings and closures for Canada, provinces and territories, census metropolitan areas; Methodology: Business Opening and Closing

<--- Return to Archive