The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

August 29, 2025US PERSONAL INCOME AND OUTLAY, JULY 2025 Month over month (July 2025 vs June 2025, seasonally adjusted)

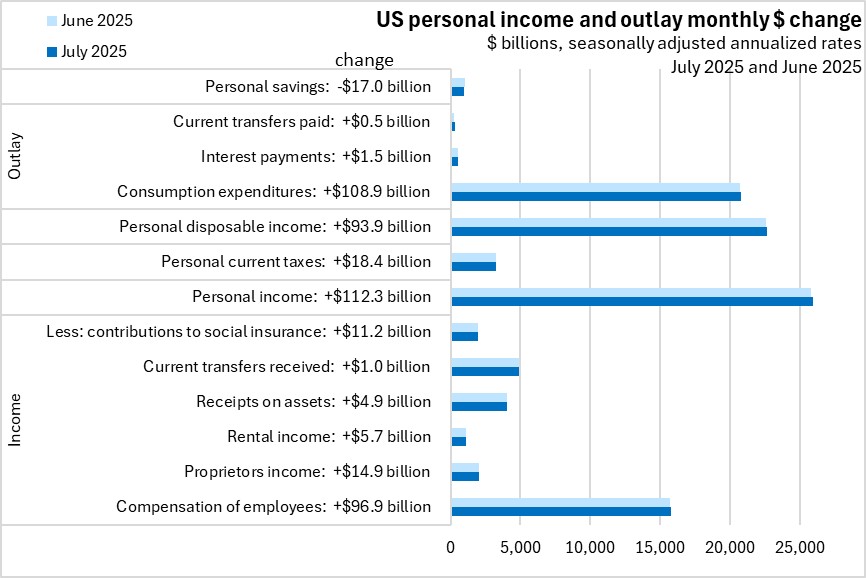

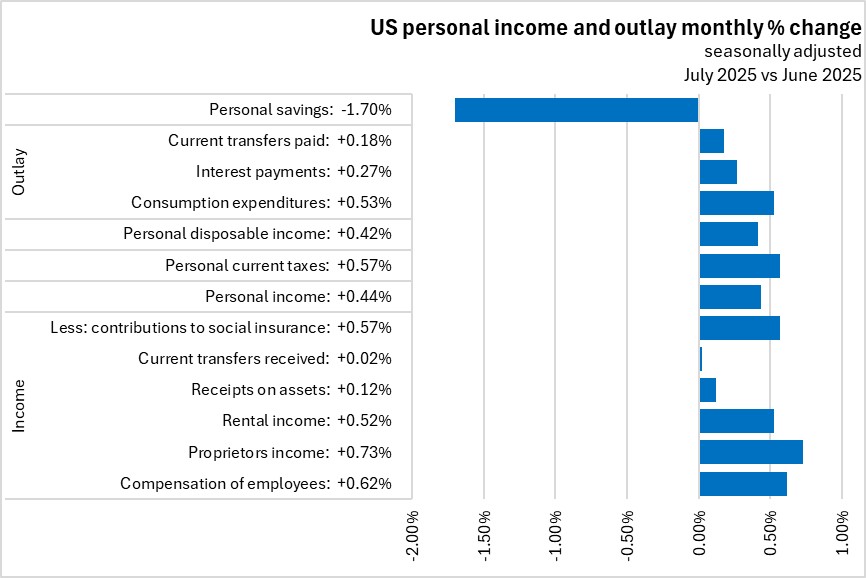

US personal income increased by $112.3 billion (+0.44%). Employee compensation was up $96.9 billion (+0.62%). Personal disposable income was up $93.9 billion (+0.42%) while personal consumption expenditures (PCE) increased by $108.9 billion (+0.53%).

US personal savings continued to decrease by falling $17.0 billion (-1.7%).

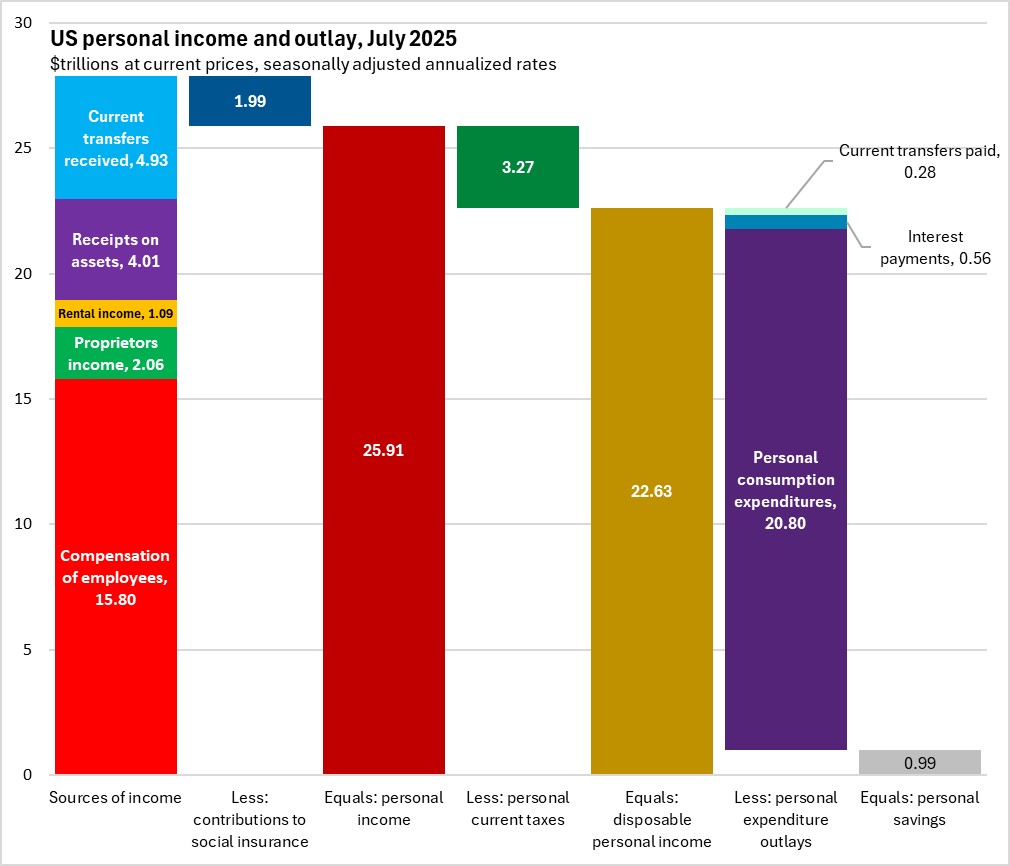

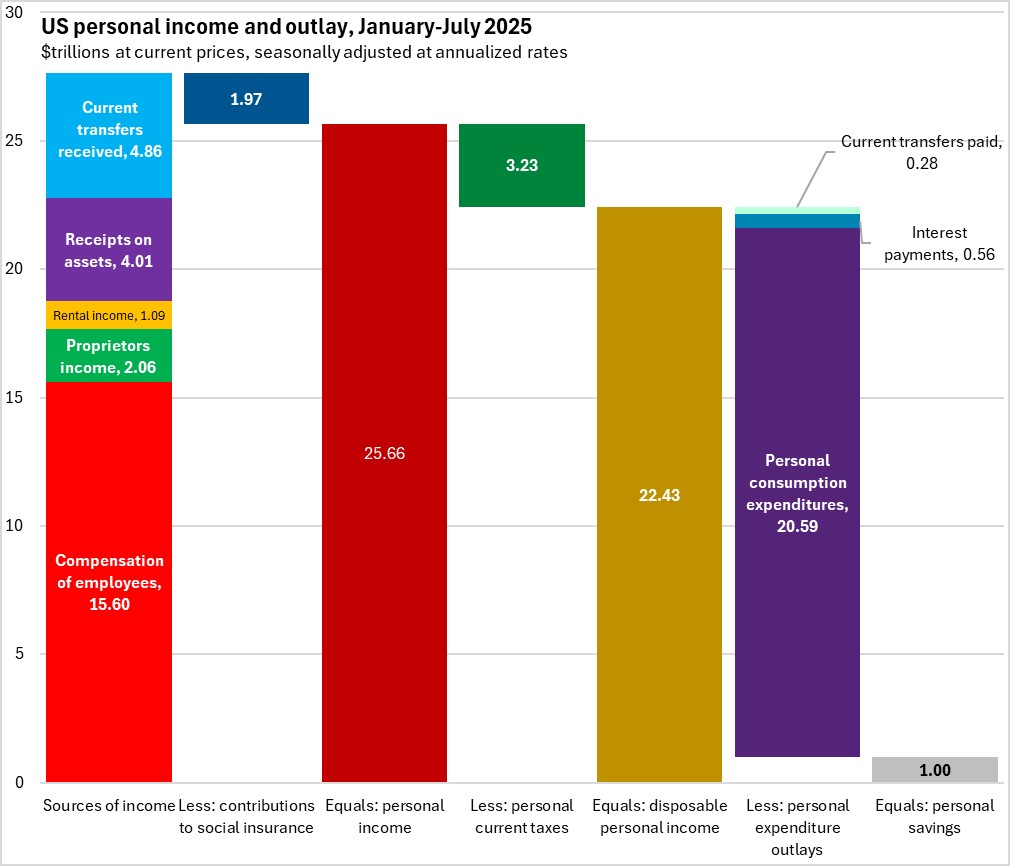

US personal income is calculated as the sum of employee compensation ($15.80 trillion), proprietors' income ($2.06 trillion), rental income ($1.09 trillion), receipts on assets ($4.01 trillion) and current transfers received ($4.93 trillion), less contributions to social insurance programs ($1.99 trillion). Personal income ($25.91 trillion) less personal current taxes ($3.27 trillion) equals disposable income ($22.63 trillion).

The outlay of US personal disposable income consists of personal consumption expenditures ($20.80 trillion), interest payments ($0.56 trillion) and current transfers paid ($0.28 trillion) with personal savings ($0.99 trillion) accounting for the remaining amount.

Trends

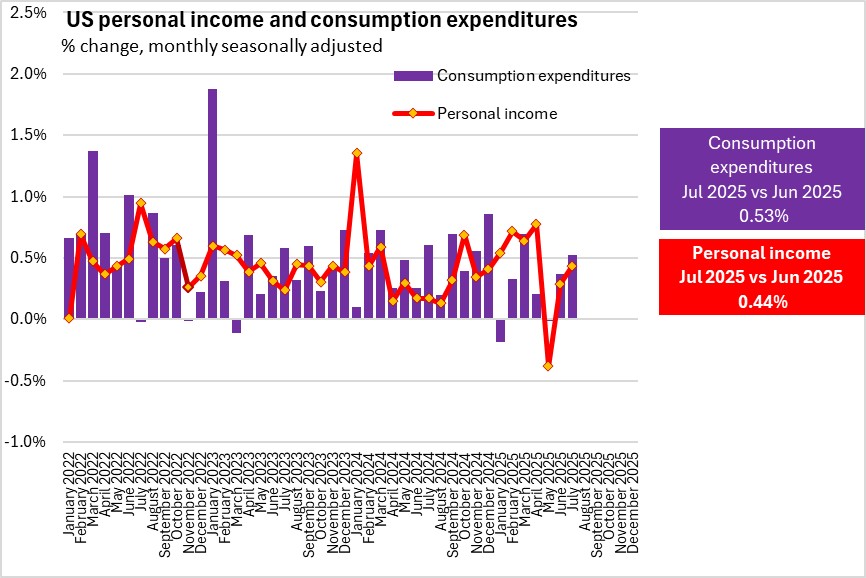

US personal income continued to rebounded after the decrease in May and increased owing mainly to the rebound of current transfers.

US consumer spending rebounded as well for the second time in 2025.

Year over year (July 2025 vs July 2024, seasonally adjusted)

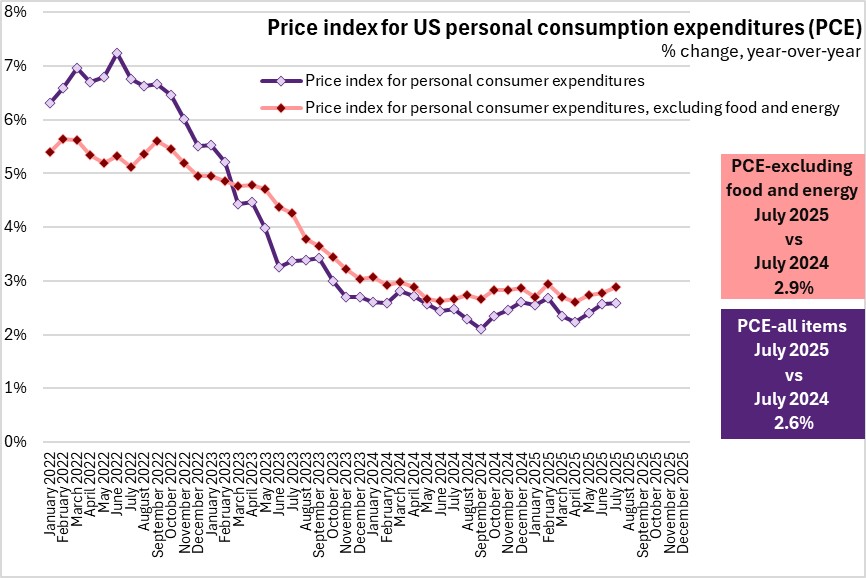

Growth in the price index for personal consumption expenditures (all items) was 2.6% year-over-year. Year-over-year growth in the price index for all items excluding food and energy was 2.9%, and outpaced all items PCE inflation for the 29th consecutive month.

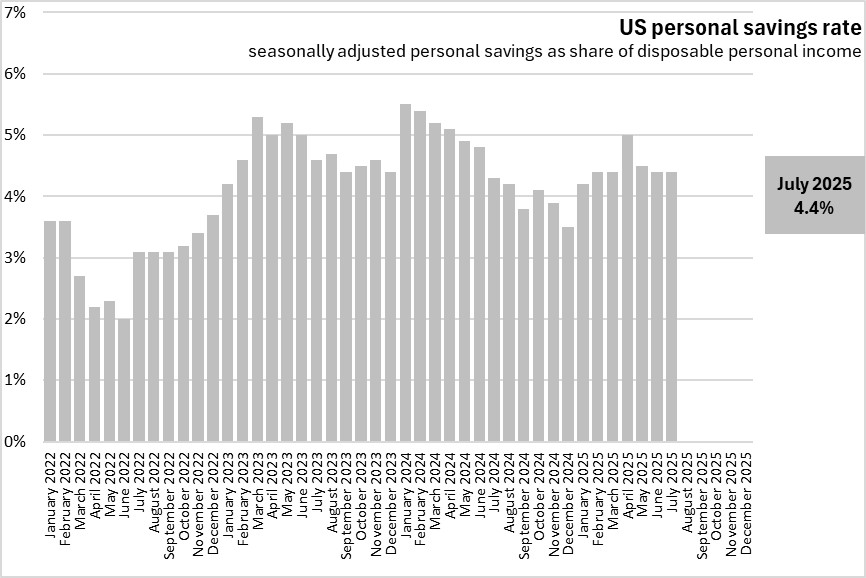

With similar growth rates for personal income and personal consumption the US personal savings rate remained steady at 4.4% of disposable personal income in July 2025.

Year-to-date (January-July 2025 vs January-July 2024)

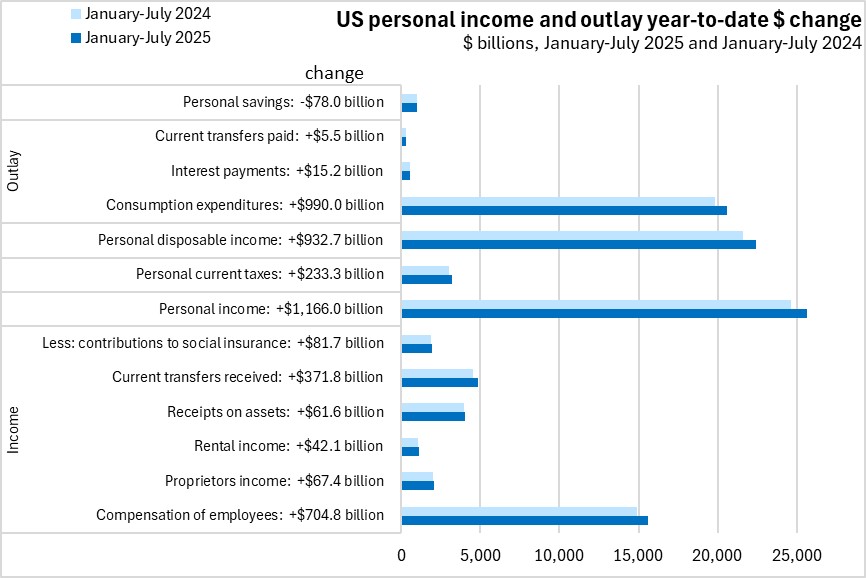

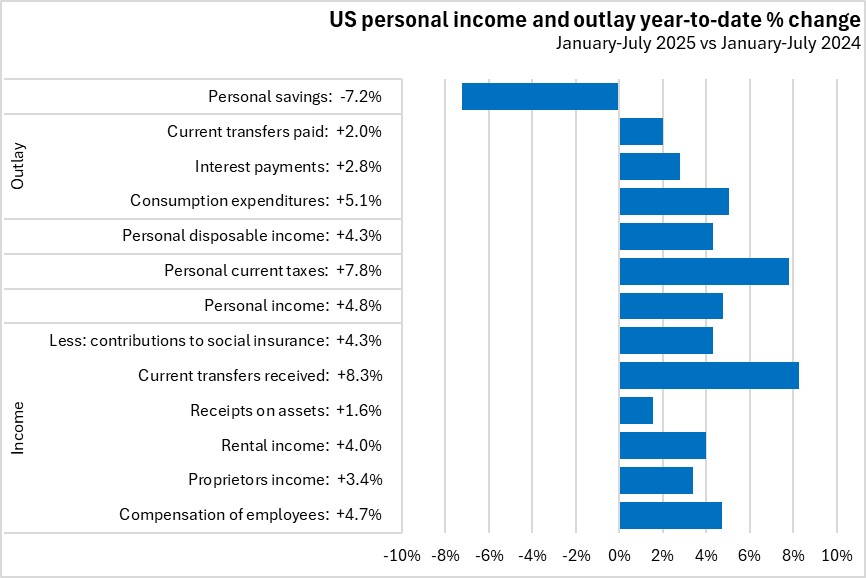

In the first seven months 2025, US personal income increased by 4.8% from the same period in 2024. There were gains from all income sources led by growth in current transfers received (+8.3%). Personal consumption expenditures grew by 5.1%. Personal savings declined 7.2%.

US Bureau of Economic Analysis. Press release, July 2025; Data retrieved Federal Bank of St Louis, Table 2.6. Personal Income and Its Disposition, Monthly NIPA

<--- Return to Archive