The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

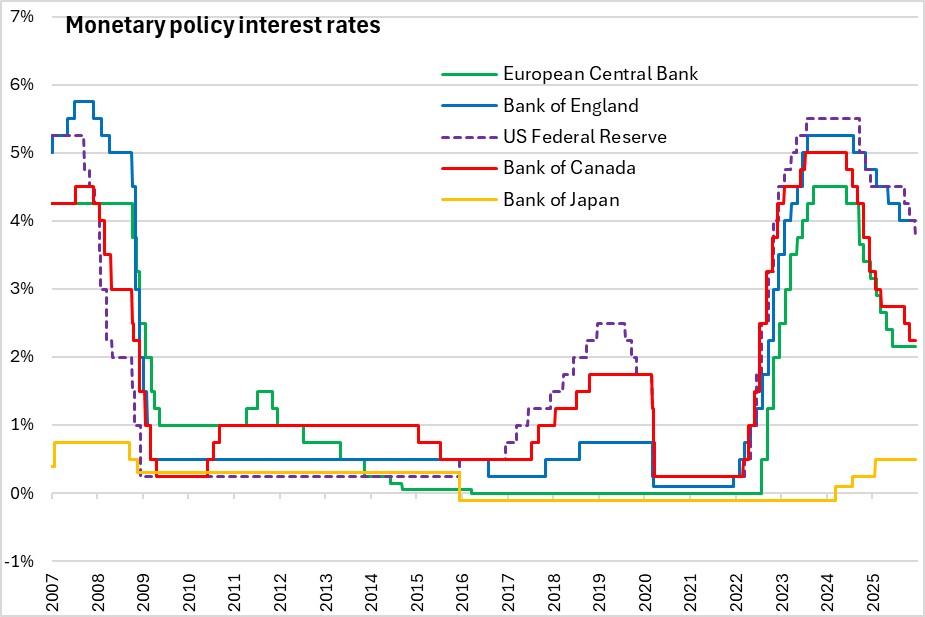

December 10, 2025US FEDERAL RESERVE MONETARY POLICY At its scheduled Federal Open Market Committee (FOMC) meeting on December 10th, the US Federal Reserve announced that it will cut the target range for the federal funds rate by 0.25 percentage points to a range of 3.5% to 3.75%.

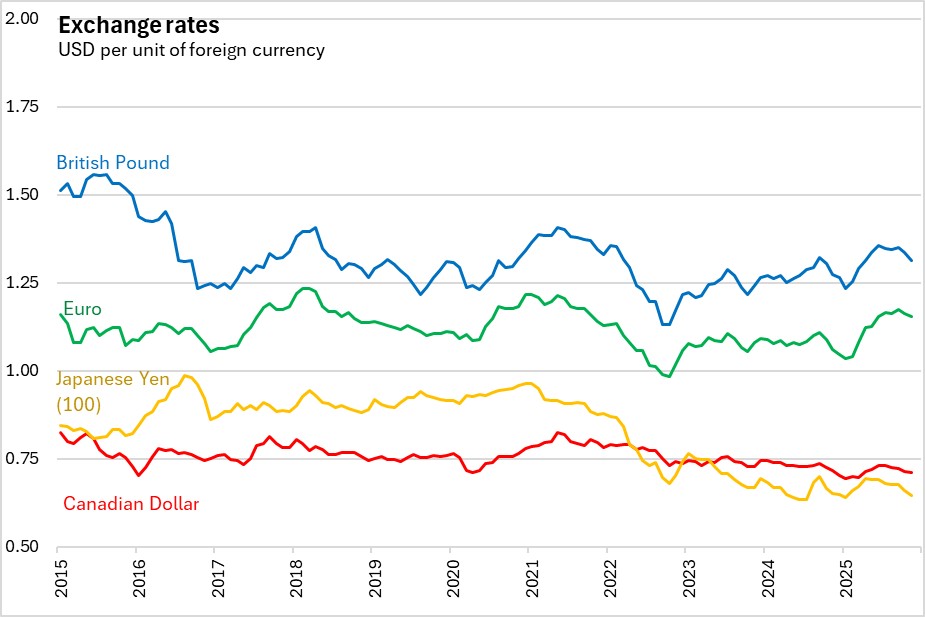

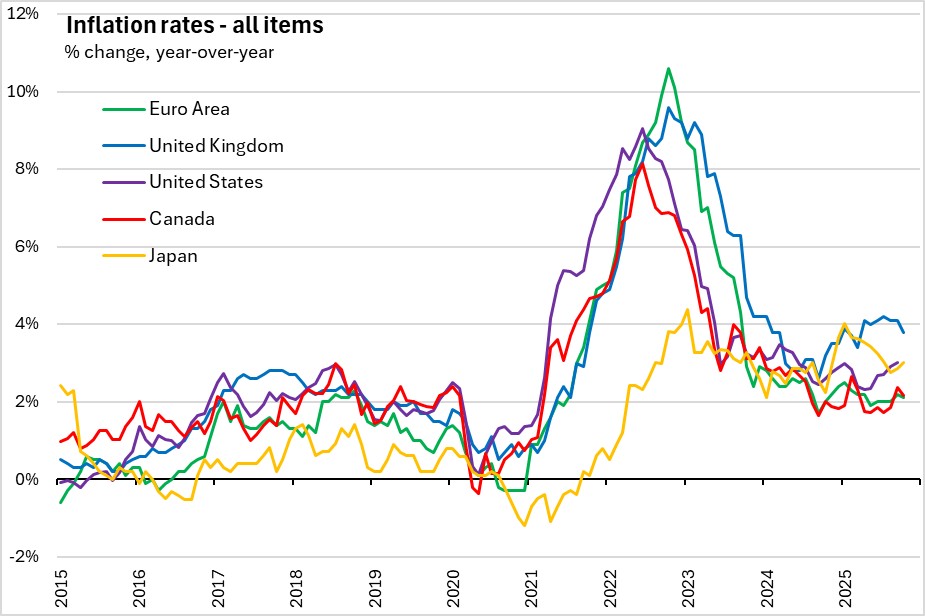

The Committee notes that based on available data, growth of economic activity has been expanding at a moderate pace. The Federal Reserve Committee has also released their projection material and expect real GDP to grow 1.7% in 2025, 2.3% in 2026, and 2.0% in 2027. Job gains have slowed, and the unemployment rate has edged up through September. Unemployment rate is estimated at 4.5% in 2025, 4.4% in 2026, and fall to 4.2% in 2027. Inflation has moved up and remains somewhat elevated. PCE inflation is projected at 2.9% in 2025, 2.4% in 2026, and 2.1% in 2027. Uncertainty about the economic outlook remains elevated, and the Committee remains attentive to the risks on both sides of its dual mandate and judges that downside risks to employment have risen in recent months.

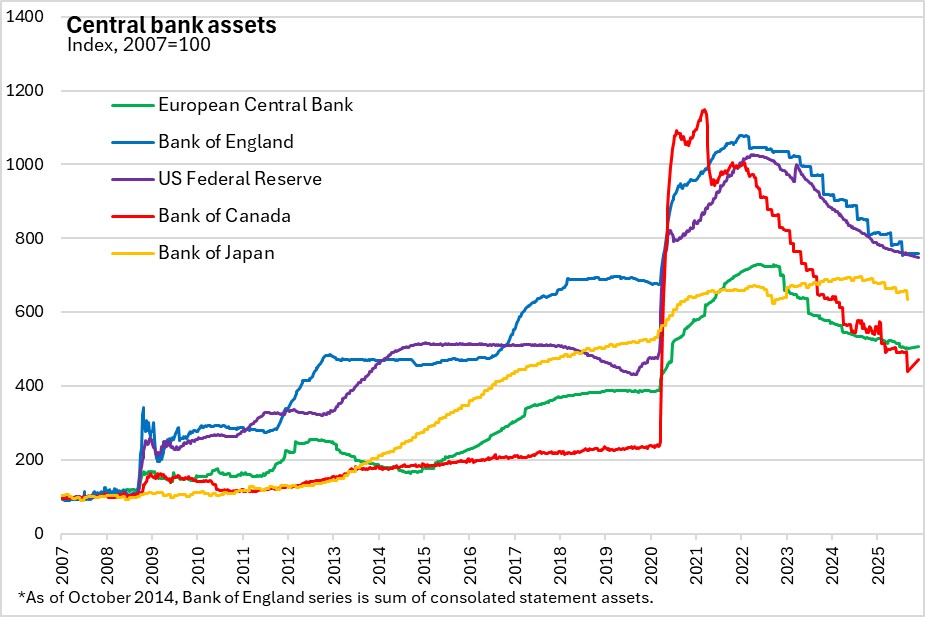

The Committee judges that the reserve balances have declined to acceptable levels and will initiate purchases of short-term Treasury securities as needed to maintain the acceptable level on an ongoing basis.

The Committee seeks to achieve maximum employment and returning inflation to 2% over the long run. The Committee will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments to achieve its goals.

The next scheduled FOMC meeting will be held on January 27-28, 2026.

Source: US Federal Reserve, FOMC Press Release; Summary of Economic Projections

<--- Return to Archive