The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

December 11, 2025CANADA NATIONAL BALANCE SHEET ACCOUNTS, Q3 2025

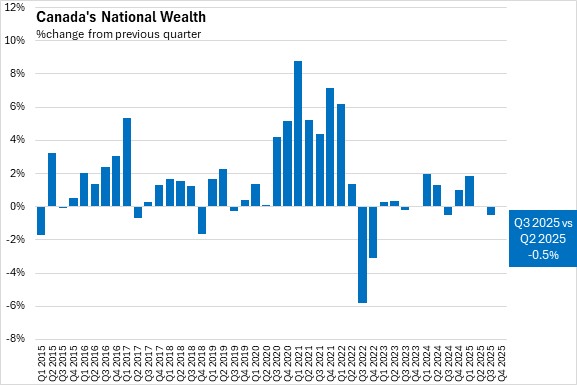

In the third quarter of 2025, Canadian national wealth (the total value of non-financial assets) decreased 0.5% to $17,456.7 billion. This follows growth of 0.02% in the second quarter of 2025. Residential real estate fell in the third quarter of 2025. Financial assets increased as equity markets continued to remain resilient amid uncertainty in the third quarter. Statistics Canada notes that wealth is not evenly distributed across households, as the wealthiest 20% of households held almost 70% of financial assets.

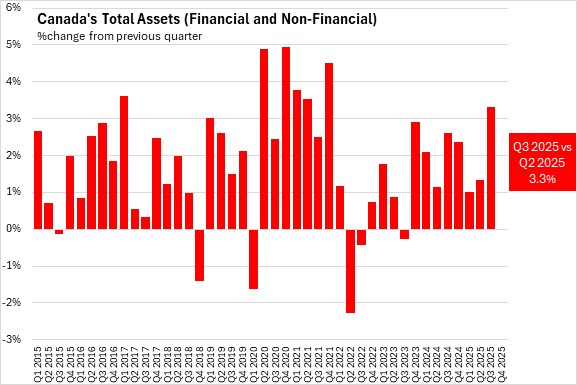

Total assets, including financial and non-financial assets rose by 3.3% to $73,298.8 billion at the end of Q3 2025, following 1.3% growth in Q2 2025.

Household sector

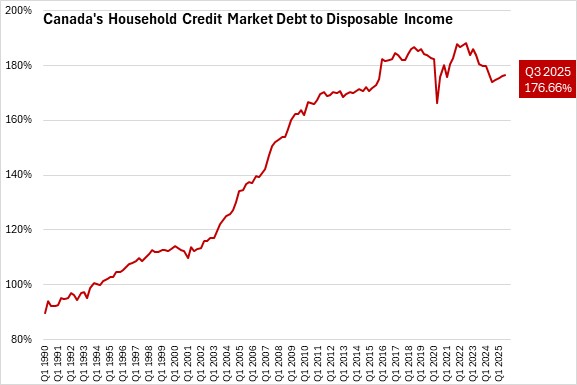

Household credit market debt as a proportion of household disposable income increased to 176.66% in Q3 2025.

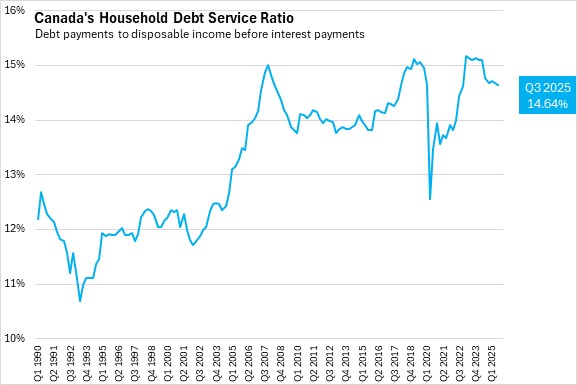

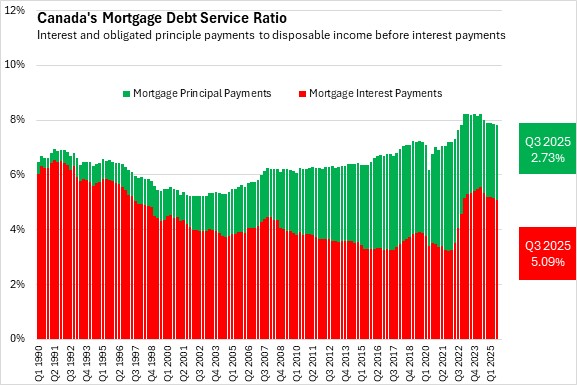

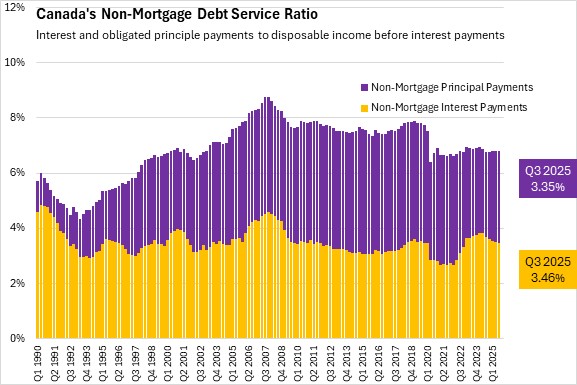

In Q3 2025, household debt payments decreased to 14.64% of disposable income. Mortgage interest payments were down 8 basis points to 5.09% of disposable income, while non-mortgage interest payments were down 6 basis points to 3.46% of disposable income. Principle payments were up for both mortgage loans and non-mortgage loans as a share of disposable income.

Government sector

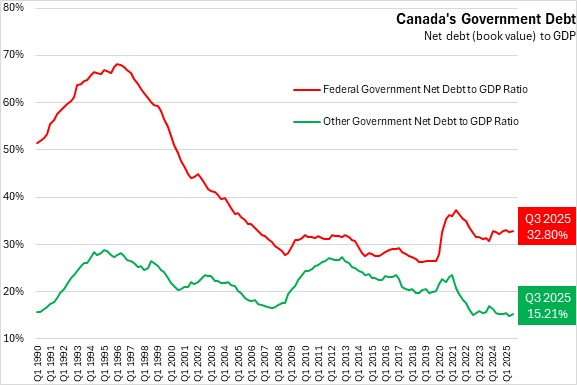

At the end of Q3 2025, federal government net debt (book value) edged up to 32.80% of GDP. Net debt of other levels of government increased to 15.21% of GDP.

Corporate sector

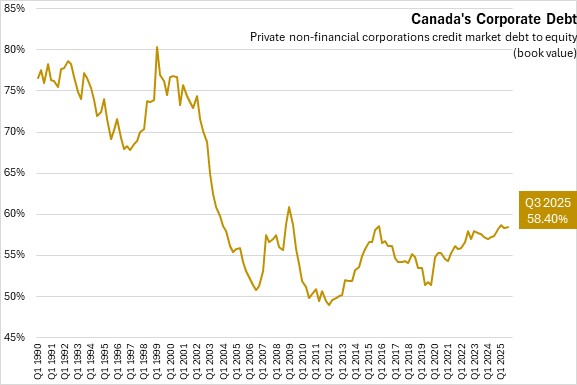

The credit market debt to equity ratio of non-financial private corporations edged up to 58.40 cents of credit market debt for every dollar of equity in Q3 2025, up from 58.31 cents in the second quarter.

Source: Statistics Canada. Table 11-10-0065-01 Debt service indicators of households, national balance sheet accounts; Table 36-10-0580-01 National Balance Sheet Accounts (x 1,000,000); Table 38-10-0235-01 Financial indicators of households and non-profit institutions serving households, national balance sheet accounts; Table 38-10-0236-01 Financial indicators of corporate sector, national balance sheet accounts; Table 38-10-0237-01 Financial indicators of general government sector, national balance sheet accounts; Table 38-10-0238-01 Household sector credit market summary table, seasonally adjusted estimates

<--- Return to Archive