The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

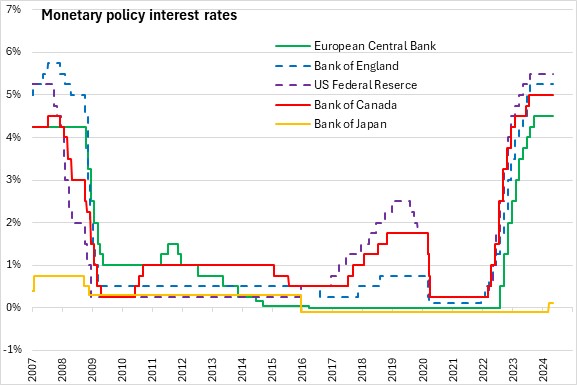

May 09, 2024BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain Bank Rate at 5.25%.

Last year showed modest weakness in UK GDP growth in England, but Bank of England estimated that GDP rose 0.4% in Q1 2024. The Bank of England projects that UK GDP will rise 0.2% in Q2 2024, accelerating to 0.9% in Q2 2025, to 1.2% in Q2 2026 and to 1.6% in Q2 2027. The announced policies in the spring budget are expected to boost level of GDP, particularly by reducing the national insurance contributions, and raise potential supply in labour by increasing participation rates. As a result, inflationary pressures are expected to moderate, though global economic growth has been stronger than expected in the US and Euro Area.

UK unemployment is projected to rise slightly to 4.3% in Q2 2024. Businesses have responded to short term demand by retaining their workers, but using them less intensively. Employment growth has remained positive but slow in recent quarters.

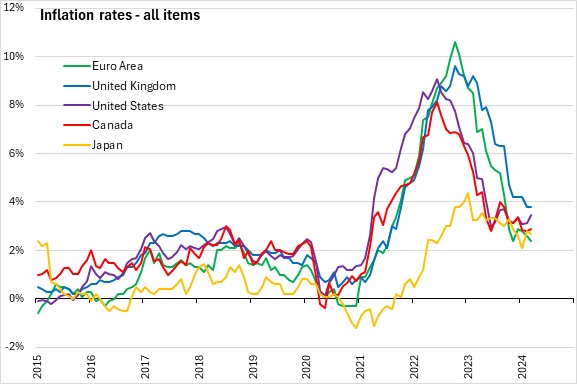

UK inflation is expected to return closer to 2% in the first half of 2024, but then increase slightly in the second half of the year. Twelve-month inflation decelerated to 3.5% in 2024 Q1 and again to 3.2% in March. CPI inflation excluding energy is projected to be around 3% during the second half of the year, owing to the persistence of domestic inflationary pressures.

The MPC will continue to monitor for persistent inflationary pressures, including tight labour market conditions, behaviour of wage growth and services inflation. The Bank of England no longer indicates that further tightening could be necessary, but cautions that monetary policy will need to remain restrictive for an extended period long enough to achieve the 2% inflation target sustainably over the medium term.

The next scheduled monetary policy meeting will be on June 20, 2024.

Source: Bank of England, Monetary Policy Summary; Monetary Policy Report - May 2024

<--- Return to Archive