The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 31, 2024CANADIAN ECONOMIC ACCOUNTS Q1 2024

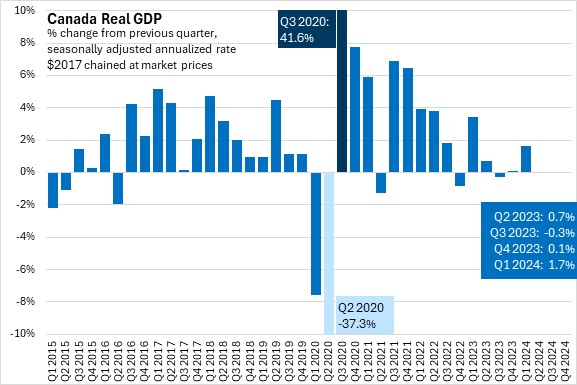

Canada’s Real Gross Domestic Product (GDP) grew 1.7% (all figures seasonally adjusted at annual rates) in the first quarter of 2024, following a 0.1% gain in Q4 2023.

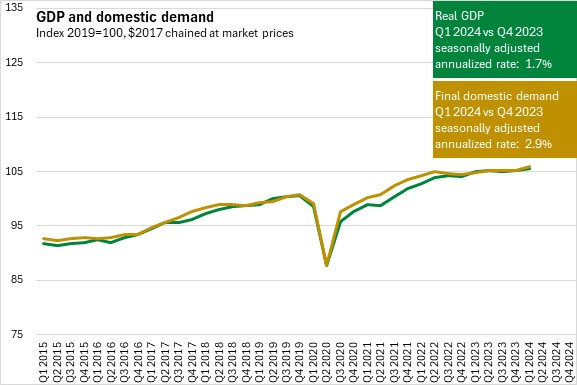

Growth was broad based across all major expenditure categories, offset by rising real imports and declining inventory accumulation. With little change in net exports, Canada's real GDP growth was driven primarily by domestic demand.

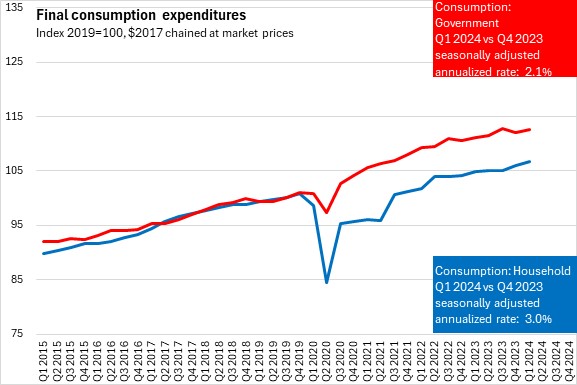

Household consumption growth increased at a seasonally adjusted annualized rate of 3.0% in Q1. The increase was led by higher spending on services - notably rent, telecommunications and air transport. Real consumer spending outpaced population growth for the first time in three quarters (though per capita real goods expenditures were down for the 10th consecutive quarter). Government consumption rose 2.1% in Q1.

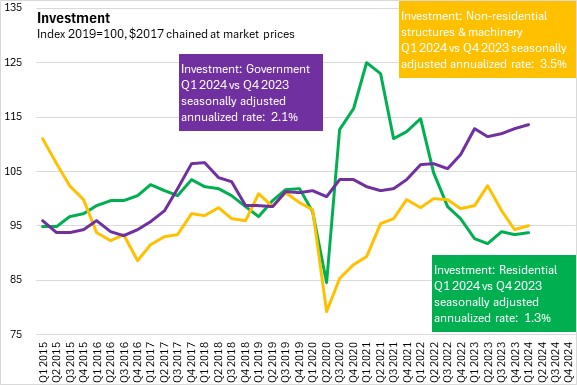

Residential investment icnreased by 1.3% in Q1 2024 on stronger ownership transfer costs (representing resale activity rather than new construction).

Non-residential investment rose 3.5% in Q1, particularly on engineering construction investment in the oil and gas sectors as well as machinery and equipment investment (mostly imported).

Government investment was up 2.1% in the first quarter of 2024.

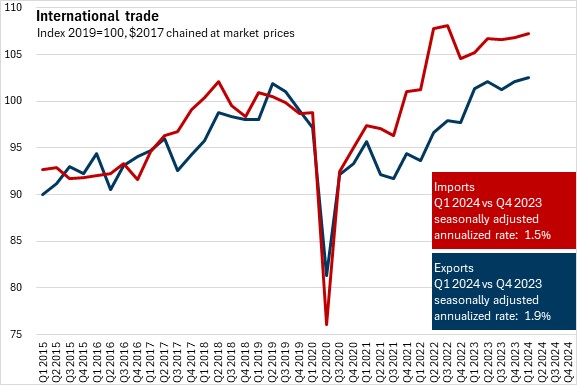

Exports increased 1.9% in Q1 on metals exports, offset by declines in vehicles and crude oil. Imports rose by 1.5% led by clothing/footwear/textiles and electricity along with waste/scrap of metal and glass. Canada's terms of trade (the ratio of the price of exports to the price of imports) fell 1.2% in Q1 2024, the 6th decline in the last 7 quarters.

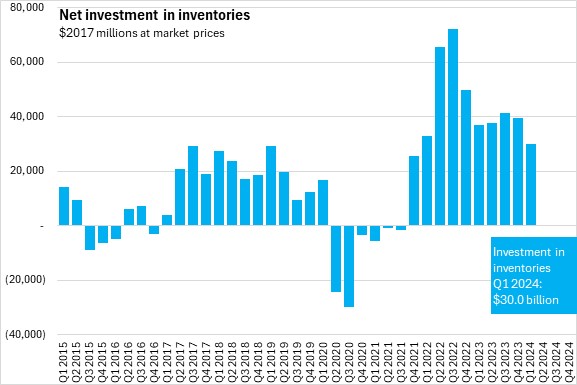

Investment in inventories was $30.0 billion in Q1, as inventories continue to slow after peaking in Q3 2022. Statistics Canada noted lower accumulations in retail motor vehicles.

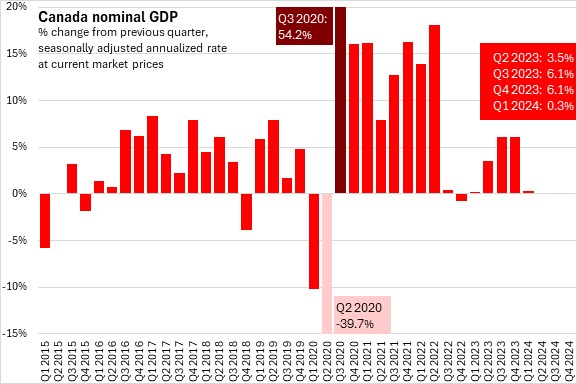

Nominal GDP increased at a seasonally adjusted annualized rate of 0.3% in Q1, slowing substantially from the 6.1% pace set in Q4 2023.

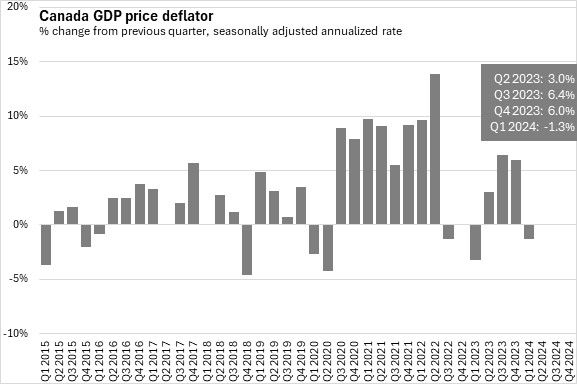

The overall GDP deflator (reflects overall price of domestically produced goods and services) declined by 1.3% on annualized basis.

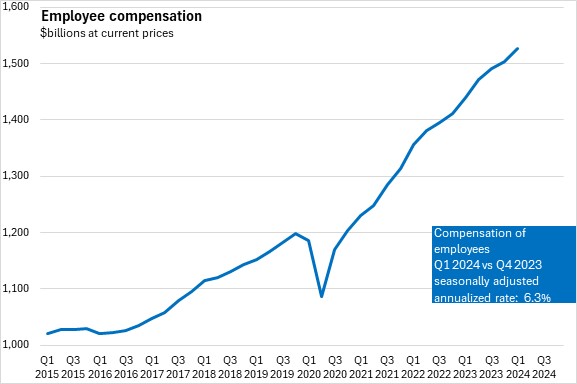

Employee compensation (measured in current prices, not real volumes) was up by a seasonally adjusted annualized rate of 6.3% in Q1, rebounding after a slowdown in Q4 2023. Services producing industries led the rebound in employee compensation, particularly with the end of strike action in Quebec's education industry.

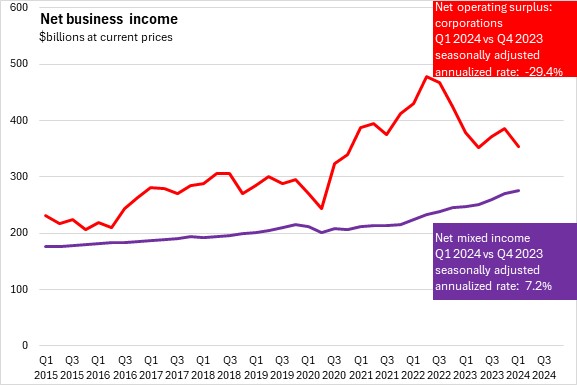

Lower operating surplus for non-financial companies (-29.4% annualized) was attributed to declining oil and gas industry operating surpluses. Net mixed income of unincorporated businesses was up 7.2% in Q1.

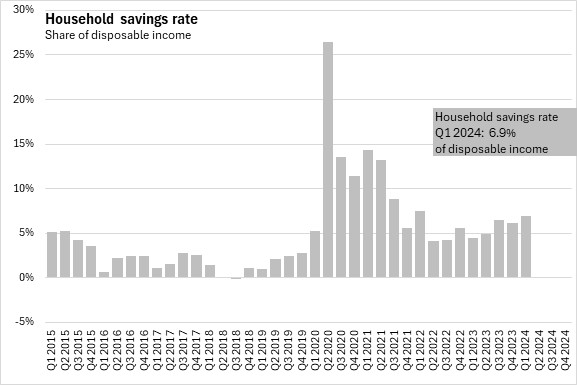

The household savings rate rose to 6.9% of disposable income in Q1 as rising disposable income outpaced increases in consumption.

Source: Statistics Canada. Table 36-10-0103-01 Gross domestic product, income-based, quarterly (x 1,000,000), Table 36-10-0104-01 Gross domestic product, expenditure-based, Canada, quarterly (x 1,000,000), Table 36-10-0112-01 Current and capital accounts - Households, Canada, quarterly

<--- Return to Archive