The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

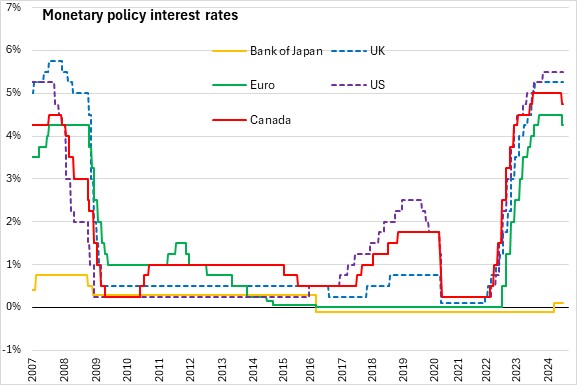

June 20, 2024BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain Bank Rate at 5.25%.

UK GDP growth was stronger than expected during the first half of 2024. However, Business surveys remain consistent with a slower pace of underlying growth of around 0.25% per quarter.

The MPC has examined that the labour market continues to loosen but it remains relatively tight by historical standards.

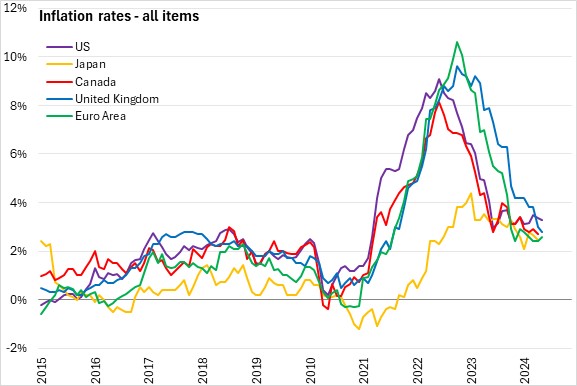

UK twelve-month inflation fell to 2.0% in May 2024. The decline in headline CPI inflation had been accounted for largely by base effects across both goods and services. The CPI inflation is expected to increase slightly in the second half of this year, mainly due to the smaller drag on twelve-month inflation from domestic energy bills.

The MPC will continue to monitor for persistent inflationary pressures, including tight labour market conditions, behaviour of wage growth and services inflation. The Bank of England no longer indicates that further tightening could be necessary but cautions that monetary policy will need to remain restrictive for an extended period long enough to achieve the 2% inflation target sustainably over the medium term.

The next scheduled monetary policy meeting will be on August 1, 2024.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive