The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

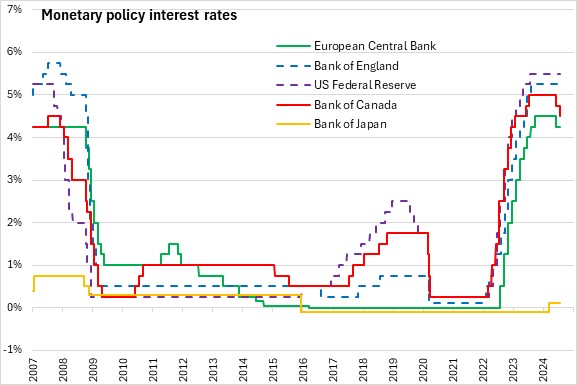

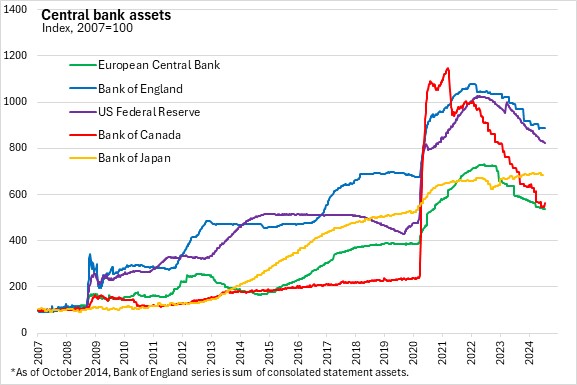

July 24, 2024BANK OF CANADA MONETARY POLICY The Bank of Canada reduced its target for the overnight rate to 4.75%, with the Bank rate reduced to 5.0% and the deposit rate down to 4.75%. The Bank is continuing its policy of balance sheet normalization.

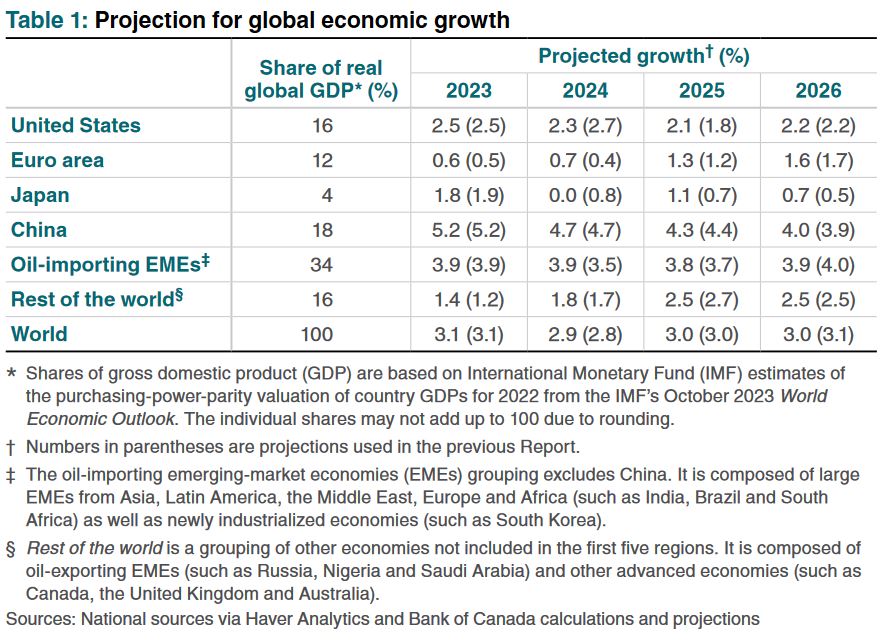

Global economy is projected to grow at around 3.0% over the next couple of years, in line with the current pace and the Bank’s April projections. Emerging market economies growth has been revised up as a result of stronger investments and exports.

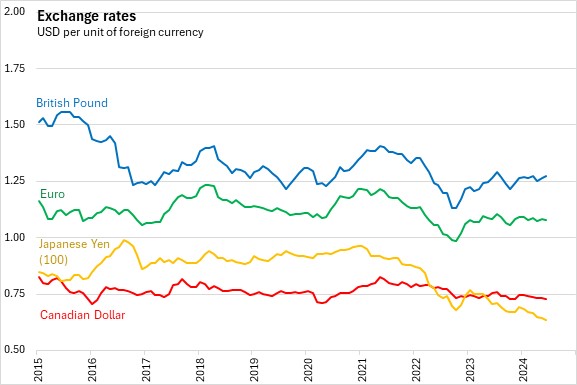

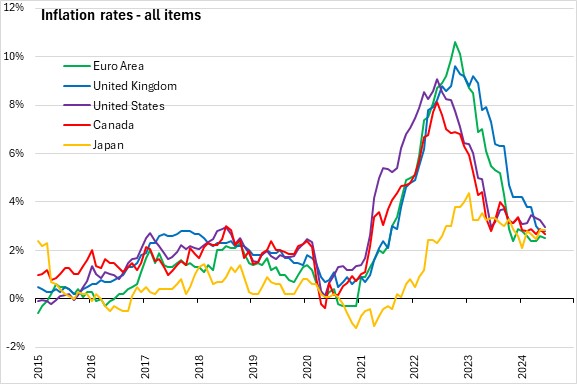

US economy has slowed over the first half of the year, down to an average of 1.5% from about 4.0% in the second half of 2023. Growth in consumption and government spending has eased, which reflects past increases in interest rates. Growth in GDP is expected to rise in the second half of 2024 supported by growth in exports and consumption. US inflation has eased, but still above the Federal Reserve’s target of 2.0%. US inflation is projected to eased gradually in the coming quarters as service prices moderate along with easing in the labour market.

Growth in the Euro Area was just above 1.0% in the first half of 2024 led by a recovery in services. Past energy shocks and disruptions continue to weigh on the manufacturing sector. Growth is forecast to rise around 1.5% in 2026 supported by a resilient labour market, rising real income and gradual decline in interest rates. Inflation has been around 2.5% in the recent months. Majority of the upward pressure is from tourism related activities, such as accommodation and restaurants. Inflation is expected to remain close to current levels in the coming quarters as a reflection of strength in wage growth and a strong demand in services.

In recent quarters, China’s growth has been modest. Drop in export prices have fueled foreign demand, but growth in domestic demand has been weak. Growth is projected to slow as export growth moderates. This slowdown in exports is partially offset by policy support for infrastructure spending.

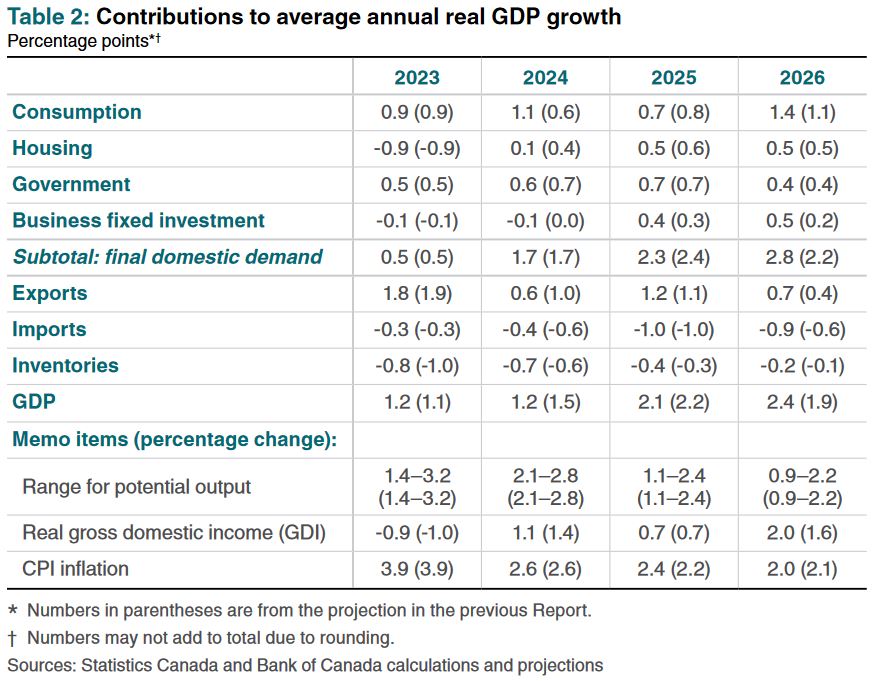

Economic growth in Canada grew roughly at 1.75% in the first quarter of 2024. This was driven by strong population growth, however, on a per-person basis, GDP contracted in the fourth consecutive quarter due to weak household spending. Residential investment also fell 2.5% in the second quarter reflecting spring resale market and weaker renovation spending mainly due to still-high interest rates. Growth in government spending is projected to pick up and business investment growth is to grow by 3.5% due to large oil and gas drilling activity. Economic growth is forecast to increase in the second half of 2024 and beyond as interest rates gradually ease: 2.1% in 2025 and 2.4% in 2026. Population growth is assumed to have slowed over the next two years.

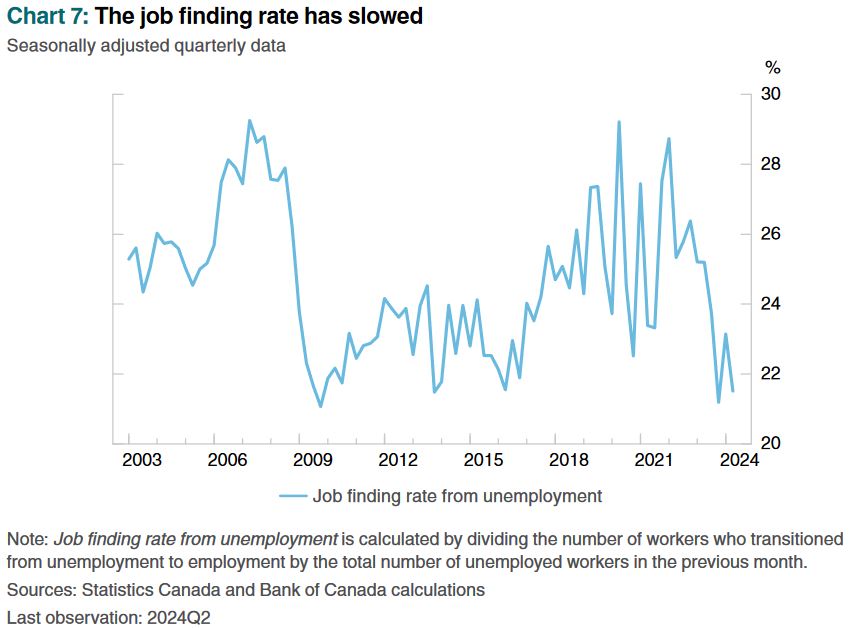

The labour market has cooled significantly as a result of falling job vacancies, which are now near their historical averages. Unemployment rate has come up from about 5.0% in 2022 to 6.4% in June 2024 with youth and newcomers more impacted.

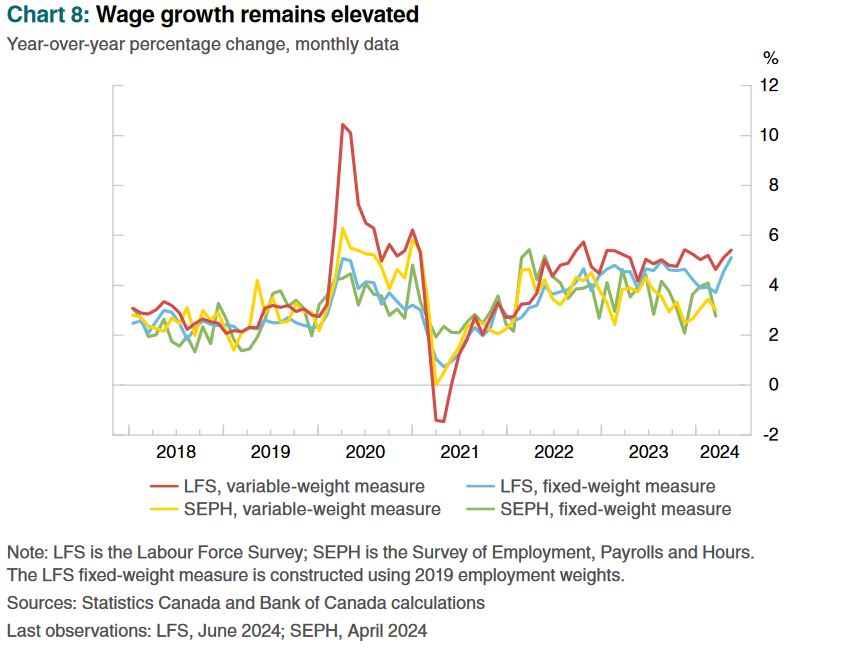

Wage growth remains elevated relative to productivity growth. With the job vacancy rate now back to normal levels, further weakness in employment growth is likely to show up in higher unemployment rather than lower job vacancies.

Inflation has eased from 3.4% in December to 2.7% in June. Goods inflation has fallen from 2.4% to 0.3%, while services inflation has increased from 4.3% to 4.8%. The Bank’s preferred measures of core inflation are expected to slow to about 2½% in the second half of 2024 and ease gradually through 2025. Ongoing excess supply is lowering inflationary pressures. At the same time, price pressures in some important parts of the economy—notably shelter and some other services—are holding inflation up.

With continued evidence of inflation easing, Bank of Canada agreed to decreasing the policy interest rate by 25 basis points. Risks to the outlook for inflation still remain, such as services price inflation could persist, and geopolitical developments could fuel renewed inflation. The downside risks are weaker household spending and weaker global activity. The Governing Council is closely watching the balance between demand and supply, inflation expectations, wage growth, and corporate pricing behaviour. The Bank remains committed to brining price stability for Canadians.

The next scheduled date for announcing the overnight rate target is September 4, 2024. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection on October 23, 2024.

Bank of Canada: Rate Announcement; Monetary Policy Report

<--- Return to Archive