The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

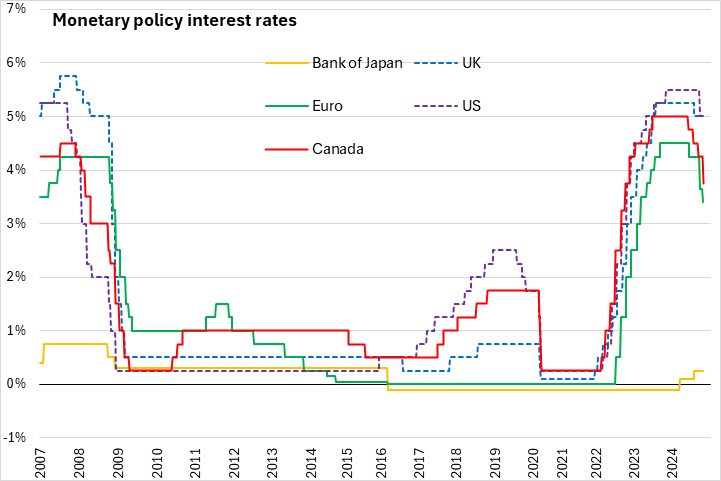

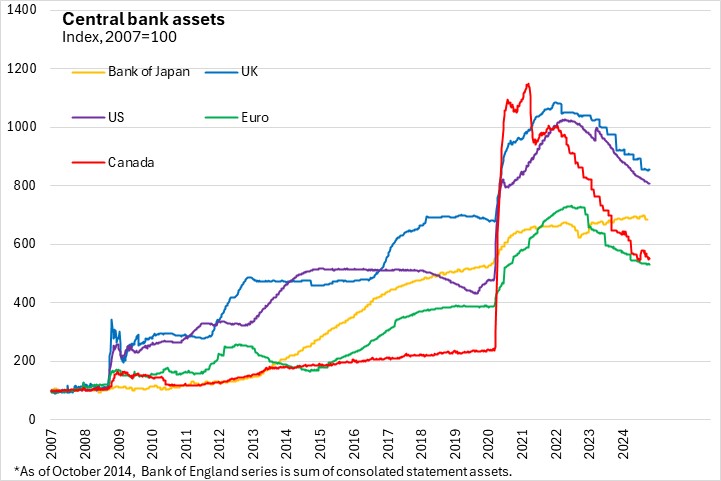

October 23, 2024BANK OF CANADA MONETARY POLICY The Bank of Canada reduced its target for the overnight rate by 50 basis points to 3.75%, with the Bank rate reduced to 4.0% and the deposit rate down to 3.75%. The Bank is continuing its policy of balance sheet normalization.

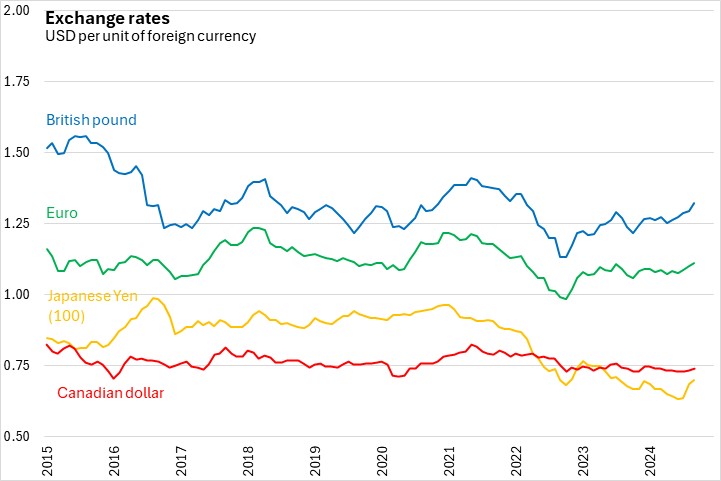

The Bank's outlook for the global economy anticipates real GDP growth of around 3% in each of the next two years as stronger growth in the US offsets weaker conditions in China and recovering economic growth in the Euro Area.

Canada's economy grew by 2% in the first half of 2024 and the Bank expects a slightly slower pace for the rest of the year. Although energy exports have boosted growth with the completion of the Trans Mountain Expansion pipeline, labour markets and residential construction activity remain soft nationally. Despite persistent excess supply, wage growth has outpaced productivity growth. Newcomers to Canada as well as younger workers have borne a disproportionate share of labour market weakness.

In the Bank's revised economic outlook, gradual strengthening of the Canadian economy is expected after reductions in interest rates. Canada's real GDP growth is projected to accelerate from 1.2% in 2024 to 2.1% in 2025 and 2.3% in 2026.

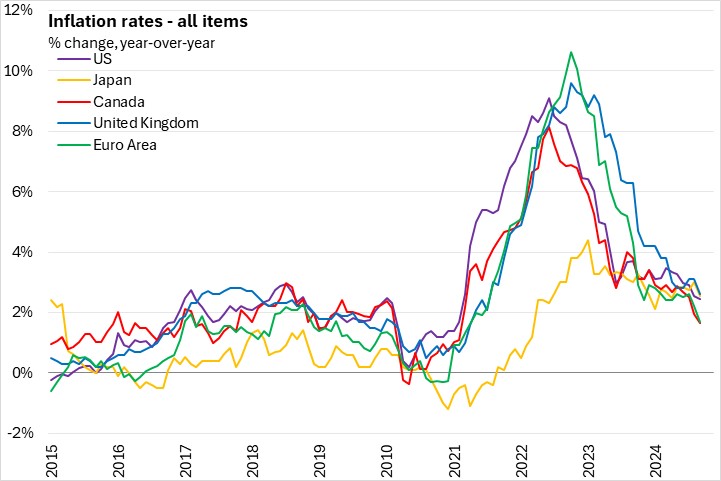

Although all-tems inflation has slowed to 1.6% as of September, shelter cost price growth remains elevated. The Bank of Canada's core measures of inflation have also slowed to <2.5%. The Bank assumes that narrowly-based inflationary pressures will lead to normalized inflation expectations around the target range.

The Bank expects that further reductions in the target for the overnight rate will be warranted under this economic outlook. Further reductions will be guided by data.

The next scheduled date for announcing the overnight rate is December 11, 2024.

Source: Monetary Policy press release, Monetary Policy Report-October 2024

<--- Return to Archive