The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 18, 2025NOVA SCOTIA BUDGET 2025-26 The Province of Nova Scotia has tabled its provincial budget for 2025-26, the first provincial budget for this fiscal year.

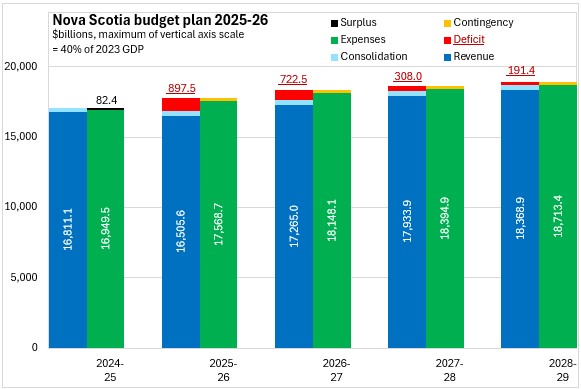

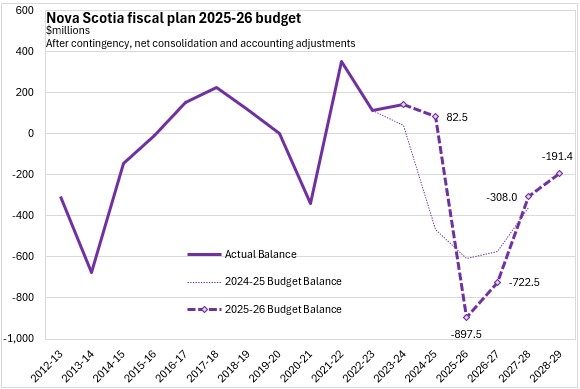

Nova Scotia's Budget for 2025-26 anticipates a deficit of $897.5 million after the inclusion of a $200 million contingency allowance for economic uncertainty. Nova Scotia's revenues are projected to decline by 1.8% from 2024-25 to 2025-26 as several tax reductions are implemented while one-time revenue lifts from prior year adjustments reported for 2024-25 are not repeated. Nova Scotia's expenditures are projected to grow by 3.7% from the 2024-25 forecast to the 2025-26 Budget estimate.

Nova Scotia's deficits are projected to narrow in the subsequent three fiscal years. By 2028-29, Nova Scotia's projected deficit of $191.4 million is smaller than the $200 million contingency allowance.

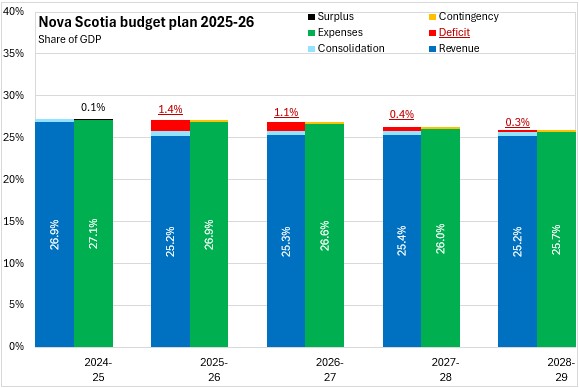

Measured as a share of GDP, the footprint of provincial government in the Nova Scotia economy amounts to 27.2% of GDP in 2026-26 (26.9% for expenditures and 0.3% for contingency). This is projected to contract to 26.0% of GDP by 2028-29. Nova Scotia's 2025-26 deficit amounts to 1.4% of provincial GDP estimated for 2025.

Nova Scotia's net debt to GDP ratio is projected to be 34.3% for 2025-26. Nova Scotia's net debt is projected to rise to 39.8% of GDP by 2028-29.

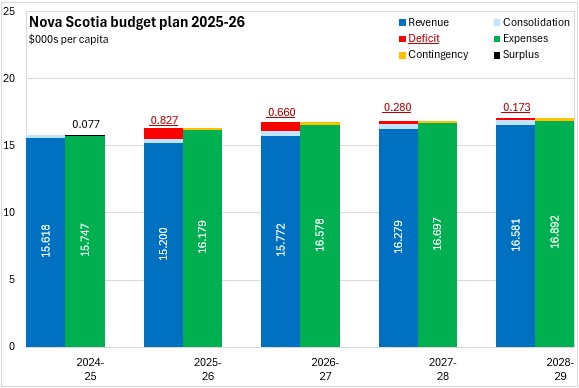

Nova Scotia's 2025-26 Budget expenditures amount to $16,179 per capita (with a further $184 per capita contingency provision), funded by revenues of $15,200 per capita and a deficit of $827 per capita, along with consolidation and accounting adjustments amounting to $337 per capita.

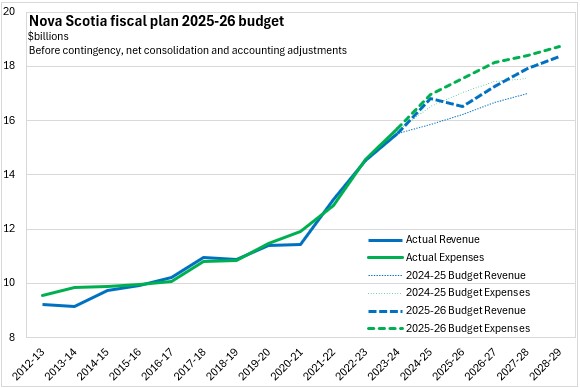

Upward revisions to previous economic estimates along with strong economic growth in 2023 caused Nova Scotia's revenues to substantially outperform expectations in 2024-25, including one-time effects from prior-year adjustments. Nova Scotia's expenditures were increased from the 2024-25 Budget Estimate.

For 2025-26, Nova Scotia's revenues are projected to decline following one-time prior year adjustments along with tax reductions. Even with these adjustments, Nova Scotia's revenues for 2025-26 are projected to be $265.2 million higher than projected for this fiscal year in the previous Budget. Nova Scotia's expenditures are projected to be $554.1 million above the 2025-26 outlook in the previous Budget.

Following 2025-26, Nova Scotia's revenues are projected to grow at a faster pace than expenditures, closing the deficit substantially.

Nova Scotia's strong economic growth pushed the Province's Budget balance for 2024-25 to a surplus of $82.5 million. The decline in revenues, provision for contingency and rising expenditures bring the estimate for the deficit in 2025-26 to $897.5 million, which is a larger deficit than was anticipated in last year's provincial Budget. The deficit for 2026-27 is also larger than previously estimated, but the outlook for the deficit in 2027-28 is slightly narrower than in the previous fiscal plan.

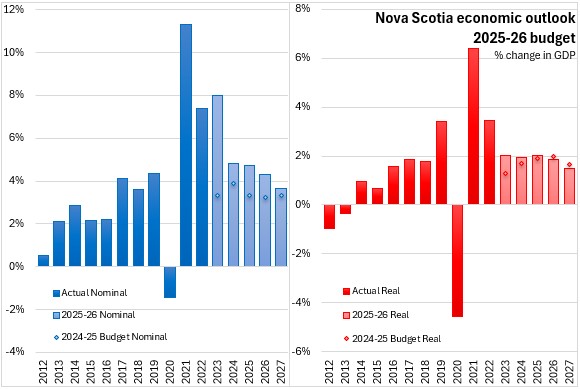

Nova Scotia's real GDP growth is estimated to have remained steady in 2024 at 1.9% while nominal growth slowed to 4.8% due to moderating inflation. Household consumption, business investment, government spending and exports all contributed to growth in 2024. Investment in residential structures rebounded with an estimated 18.5 per cent gain.

In 2025, Nova Scotia’s real GDP growth is projected to remain stable at 2.0 per cent while nominal GDP is expected to rise by 4.7 per cent. Nova Scotia’s economic growth is expected to get support from household consumption spending, tax reduction measures and government capital investments, while the threat of U.S. tariffs looms over exports. Exports of goods are projected to be weak, with some offsets from currency depreciation and tourism expansion. Residential investment is projected to continue growing in 2025, which should ease some housing pressures. Inflation is expected to remain within the Bank of Canada’s target range, with some upward pressure from currency depreciation and possibly from U.S. tariffs.

In 2026, Nova Scotia’s real GDP is projected to rise 1.8 per cent. Nominal GDP growth is projected to slow to 4.3 per cent in 2026. This outlook assumes that tariff threats will be of limited duration and that economic growth returns to the pace observed prior to the pandemic. In the medium term, Nova Scotia’s GDP growth is expected to slow further as population growth slows. However, the economic outlook does not include major projects that are being planned but not yet implemented.

Nova Scotia's economic outlook currently assumes some impact to international goods exports in the short run due to US tariffs. However, the magnitude and duration of US tariffs is a very significant uncertainty, and any changes could result in significant revisions to the economic outlook. The positive effects of tax reductions and higher government capital expenditures are incorporated into the outlook for household disposable income and consumption. However, their impacts could be felt through other parts of the economy, resulting in revision to the economic outlook.

Key Measures and Initiatives

Nova Scotia's 2025-26 Budget reflects the new government's priorities: laying the groundwork to unlock the province's potential, making life more affordable and building a healthy population. Key measures include:

Laying the Groundwork to Unlock Our Potential

- Reducing the small business rate for corporate income tax by 1 percentage point to 1.5% and raising the small business threshold from $500,000 to $700,000

- $4 million to strengthen resilience through preparations for offshore wind development, advancing the Critical Minerals Strategy, diversifying seafood markets, and implementing a Trade Action Plan along with a Seafood Sector Strategy

- $98.4 million in supports for local business through the Nova Scotia Loyal program, skilled workforce development, film industry support, retention and advancement of women in skilled trades, crop insurance, energy research and deterrence of illegal fisheries

- $40.4 million for climate initiatives and tree planting

Making Life More Affordable

- Indexing personal income tax brackets and credits at a rate of 3.1% for 2025

- Reducing the Harmonized Sales Tax rate to 14% starting April 1

- Extending a higher basic personal amount of $11,744 to all personal income tax filers

- Increasing minimum wage to $16.50 by October 1

- Removing tolls on Halifax Harbour Bridges as of April 1

- Expanding the school lunch program to an additional 77 schools (including all middle and junior high schools)

- Increasing funding for transformation of Nova Scotia's disability support system (a part of the Human Rights Remedy)

- Indexation of income assistance rates

- Increasing the non-resident deed transfer tax from 5% to 10% effective April 1

- Raising support levels for Nova Scotians experiencing or at risk of homelessness

- Constructing new public housing and expanding rent supplements

Building a Healthy Population

- Ongoing work for the Halifax Infirmary Expansion and Cape Breton Regional Municipality Health Care Redevelopment projects along with other medical facility renewals in Amherst, Yarmouth, South Shore and the IWK

- Capital funding for the One Person, One Record project, digital imaging equipment, facility repair, medical equipment repair

- Ongoing health funding to move towards publicly-funded universal mental health services, immunizations for COVID-19 and RSV, shingles vaccinations for those aged 65 and over, health care for those experiencing housing insecurity

- Replacing long-term care spaces

- Recruitment and retention of medical professionals, including a Physicians Retirement Fund, a Foreign Credential Recognition Program and expanded nurse training

- $100 million in continued supports to address Gender-Based Violence and Intimate Partner Violence

- Advancing Mi'kmaw language revitalization

- Creation of a Department of Emergency Management and the Nova Scotia Guard

- Expanding cellular service across the province

- Highway and bridge repair provisions in the Capital Plan

- Providing for storm damage repairs, procuring wildfire equipment and training as well as pre-construction planning and design work to protect the Chignecto Isthmus

- Making cyber-security and digitization investments

Nova Scotia Budget 2025-26

<--- Return to Archive