The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 07, 2025CANADA MULTIFACTOR PRODUCTIVITY GROWTH, 2023 Statistics Canada has released national results for multifactor productivity and related variables for the business sector for 2023.

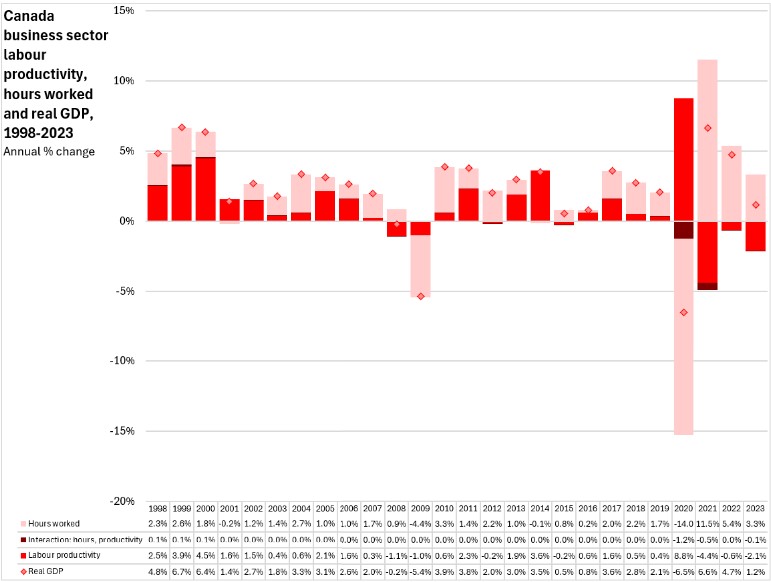

Growth in real value added (herein: real GDP) can be decomposed into growth in hours worked and growth in labour productivity. In most years, the interaction between changes in both labour productivity and hours worked is negligible, but with larger movements in productivity and hours worked, this interaction offsets some of the labour productivity gain.

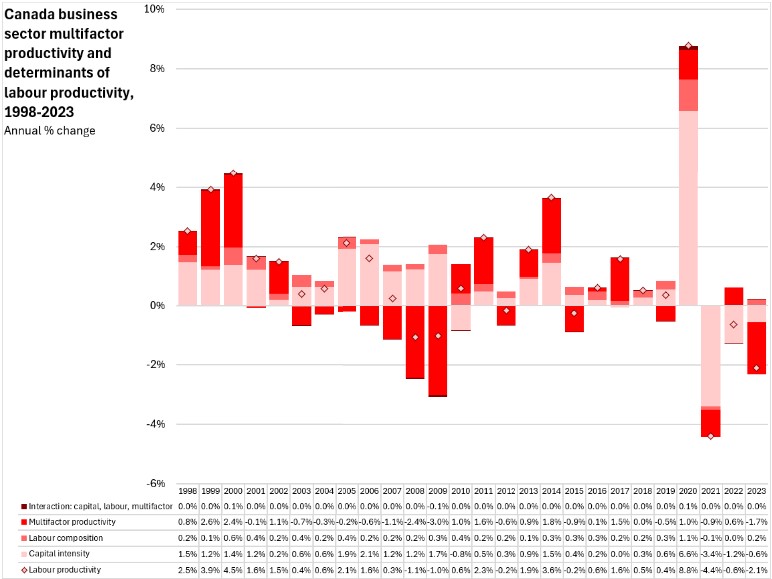

Growth in labour productivity can be further decomposed into growth in capital intensity (ie: the amount of capital used in production), labour composition (ie: skills upgrading) and multifactor productivity. Multifactor productivity is the residual of economic growth that cannot otherwise be accounted for and is meant to reflect intangible contributions to economic growth from unobserved variables such as branding, economies of scale, technology, management practice or entrepreneurship.

Previously released data for Canada's labour productivity in 2023 showed a continued rebound in hours worked (+3.3%) that was partially offset by a 2.1% decline in labour productivity, resulting in an increase in business sector real GDP of 1.2%.

This reflects continued recovery in economic activity after the pandemic, during which labour intensive and lower productivity employment hours were significantly disrupted. With significant declines in hours worked for labour-intensive, lower-productivity activities, overall business sector labour productivity appeared to rise as many higher-productivity industries continued with less disruption. As lower productivity, labour-intensive workers returned to normal employment hours over 2021-2023, overall business sector labour productivity declined as these industries resumed their usual contribution to overall hours worked.

Multifactor productivity estimates further decompose the sources of provincial labour productivity changes in 2023.

Canada's business sector capital intensity reduced labour productivity for the third year in a row in 2023. Although labour composition (e.g., skills) contributed positively to labour productivity in 2023, this was more than offset by falling multifactor productivity (-1.7%).

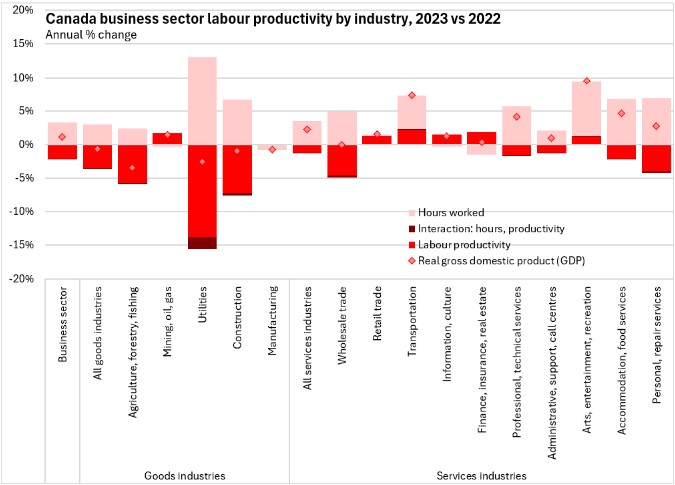

Among industries, Canada's 2023 productivity declines were spread across most business sector industries. Only mining/oil/gas, retail, transportation, information/culture, finance/insurance/real estate and arts/recreation reported higher labour productivity. Most industries reported substantial increases in hours worked, which was the primary explanation for rising output. Of note, agriculture/forestry/fishing, utilities and construction all reported lower real GDP in 2023 as declining labour productivity more than offset gains in hours worked.

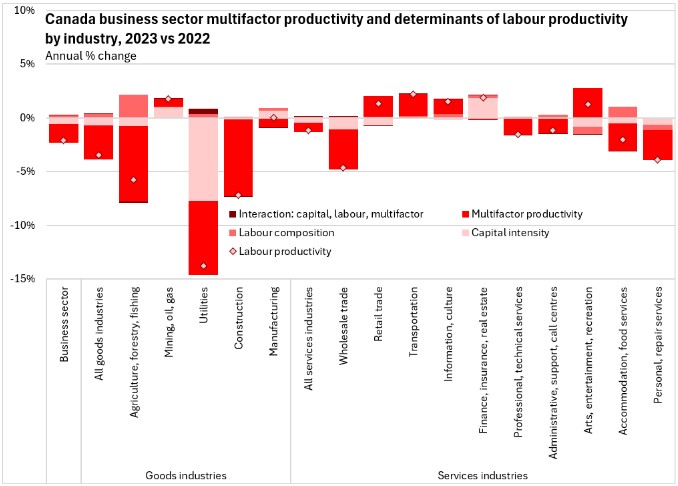

Capital intensity was a notable drag on labour productivity for utilities. There were more modest declines from capital intensity across many industries; only manufacturing and finance/insurance/real estate reported positive contributions to labour productivity as a result of capital intensity.

Labour composition generally contributed little to most Canadian industries' labour productivity in 2023. The exceptions were notable improvements resulting from labour composition in agriculture/forestry/fishing as well as in accommodation/food services. Arts/recreation reported a more sizable drag to labour productivity as a result of labour composition.

Multifactor productivity contributed to labour productivity declines for many industries (exceptions: mining/oil/gas, retail trade, transportation, information/culture and arts/recreation). The steepest declines in multifactor productivity were reported in agriculture/forestry/fishing, utilities, manufacturing, wholesale trade, personal/repair services and accommodation/food services.

Statistics Canada. Table 36-10-0208-01 Multifactor productivity, value-added, capital input and labour input in the aggregate business sector and major sub-sectors, by industry

<--- Return to Archive