The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

September 15, 2025NEW MOTOR VEHICLE SALES, JULY 2025 Year-to-date (January-July 2025 vs January-July 2024, unadjusted)

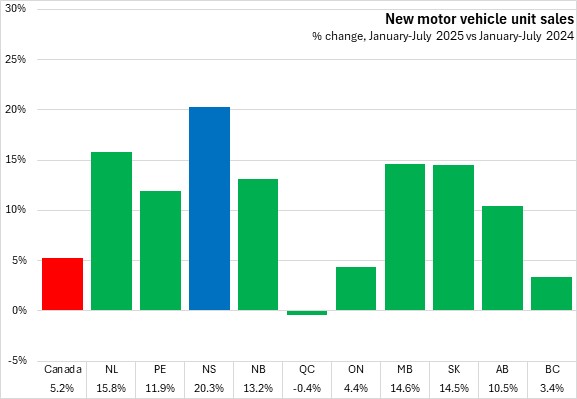

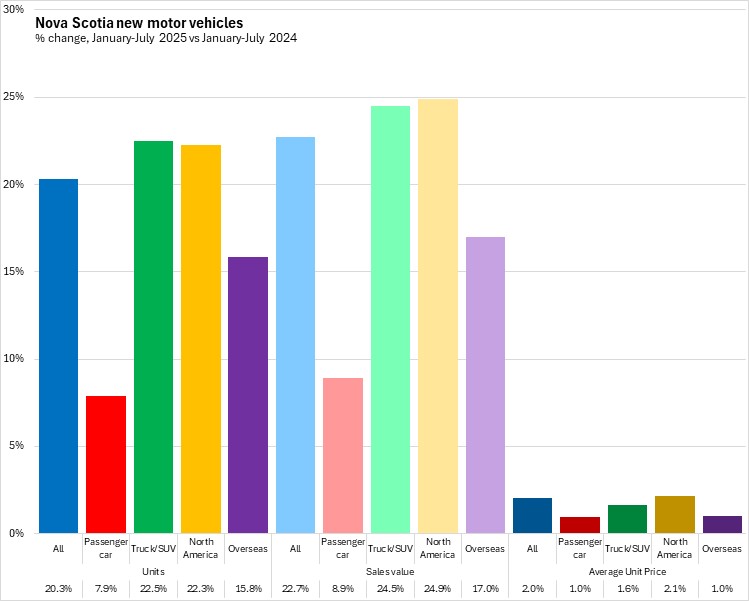

Compared with January-July 2024, Nova Scotia unit sales of new vehicles (+20.3%) reported a faster gain than any other provinces with national unit sales up 5.2%. Sales were up in all provinces except Québec.

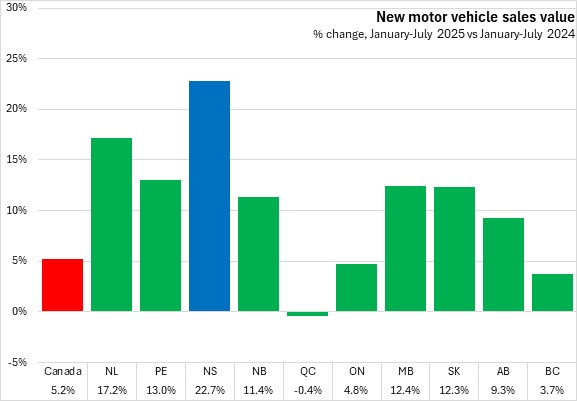

The sales values of new vehicles increased 22.7% in Nova Scotia from January-July 2024 to January-July 2025, the fastest gain among provinces. National sales values were up 5.2% with gains in all provinces except Québec.

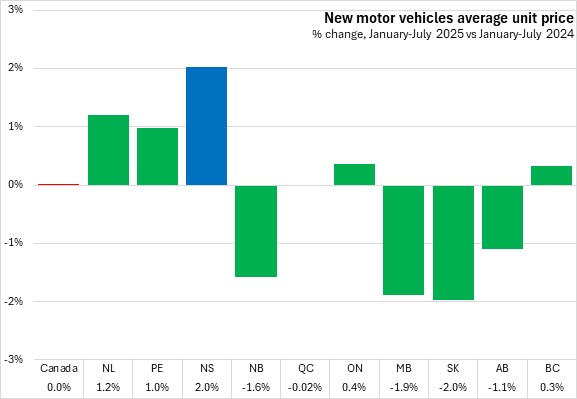

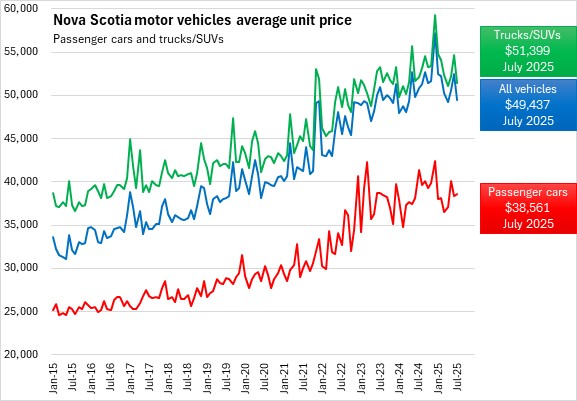

Compared to January-July 2024, average unit prices were up 2.0% in Nova Scotia in January-July 2025, the fastest gain among provinces. National average unit prices were essentially unchanged with increases in five provinces. Saskatchewan and Manitoba had the largest declines in average unit prices.

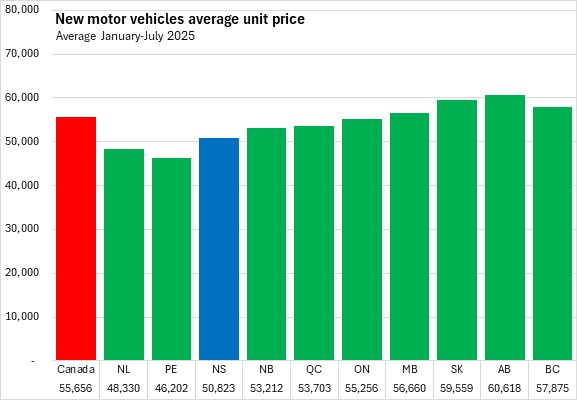

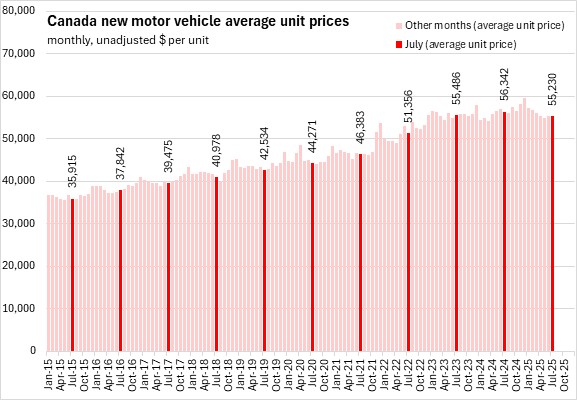

The average price of a new vehicle over January-July 2025 was $50,823 in Nova Scotia - third lowest among provinces ahead of Prince Edward Island and Newfoundland and Labrador. Nationally, the average price of a new vehicle was $55,656 in January-July with the highest value in Alberta.

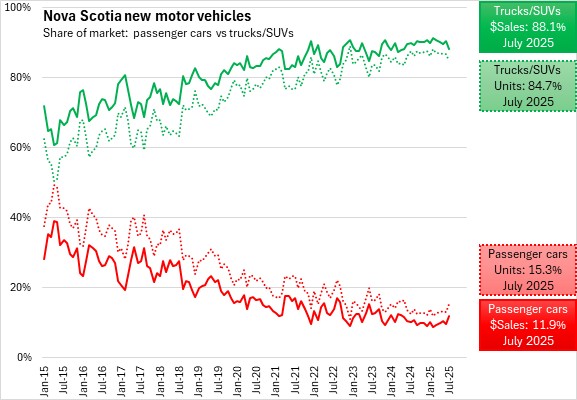

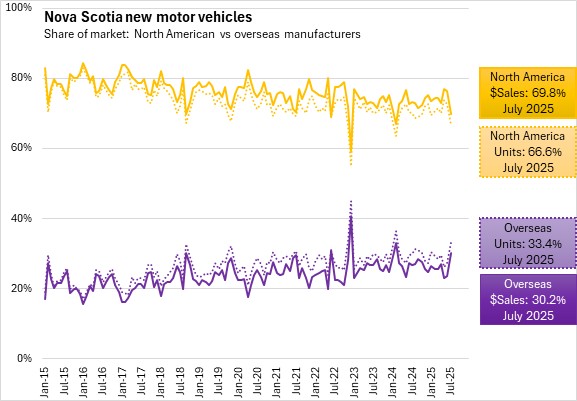

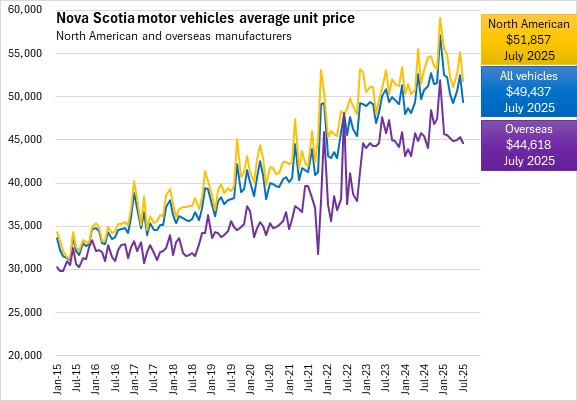

Compared with January-July 2024, unit sales and sales values were up faster for Trucks/SUVs than passenger cars. North American manufacturers saw faster increases in unit sales and sales values compared to overseas manufactures. Average sales prices were up for all vehicle types and country of manufacture.

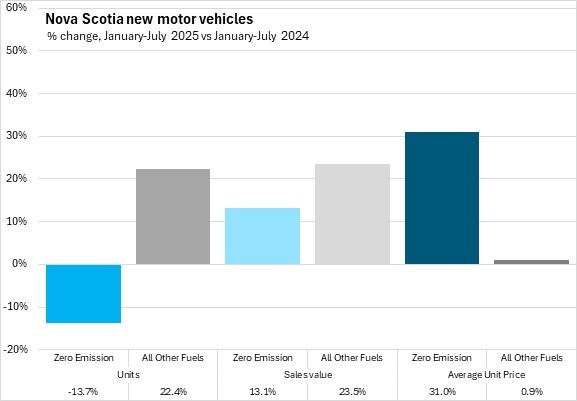

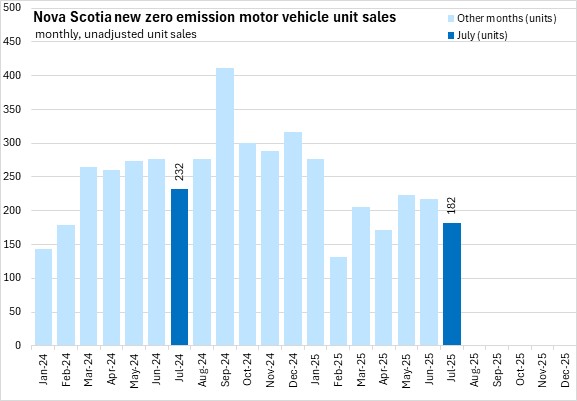

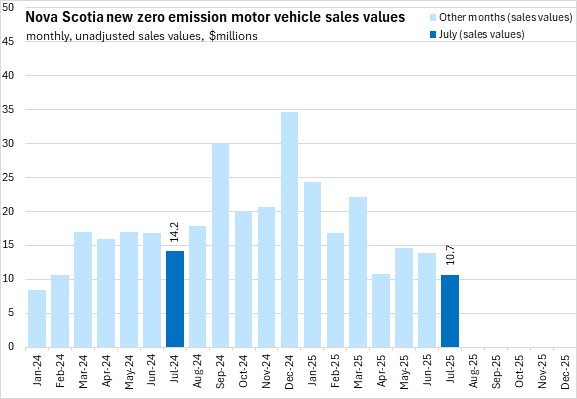

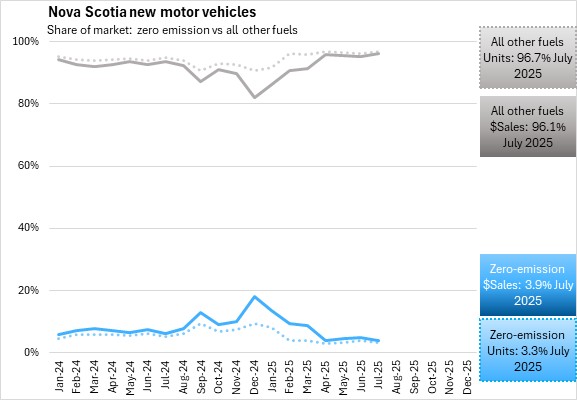

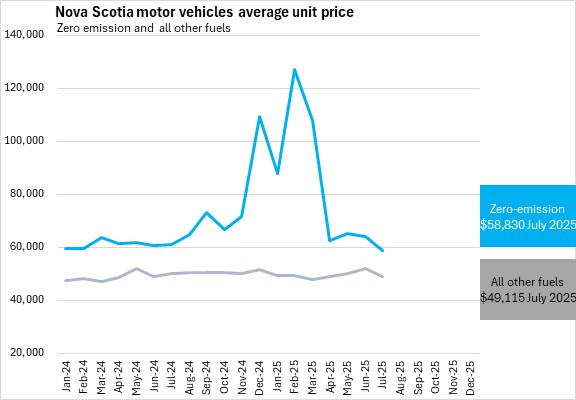

Starting with the January 2024 reference month, new data has been released on vehicle sales by fuel type. Zero emission vehicle unit sales were down 13.7% in January-July 2025 compared with January-July 2024, while sales values increased 13.1% owing to a 31.0% rise in average unit prices. Other fuel type vehicles, which account for the majority of vehicles sold, saw unit sales increase 22.4% while sales values increased 23.5%, with average unit price for other fuel type vehicles up 0.9%.

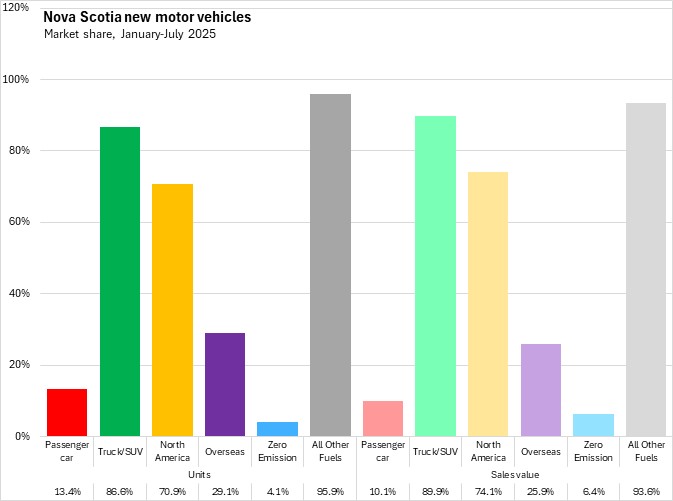

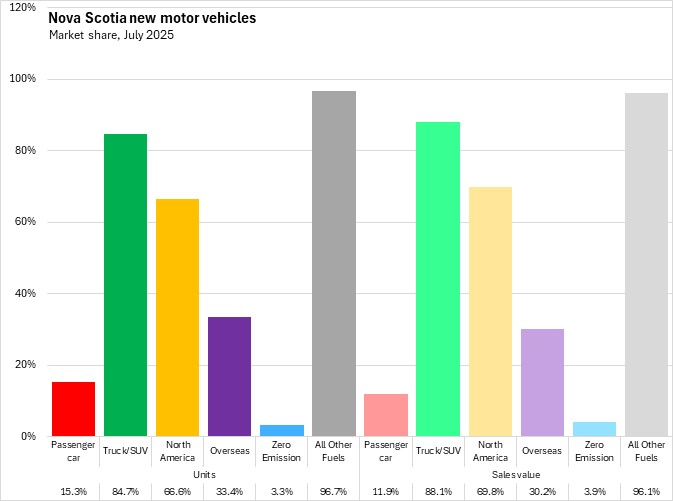

In January-July 2025, trucks/SUVs accounted for 86.6% of unit sales and 89.9% of sales values. North American manufacturers accounted for 70.9% of Nova Scotia's unit sales and 74.1% of sales values in January-July 2025. Zero emission vehicles made up 4.1% of unit sales, and 6.4% of sales values, while all other fuel types accounted for 95.9% of unit sales and 93.6% of sales values.

Year-over-year (July 2025 vs July 2024, unadjusted)

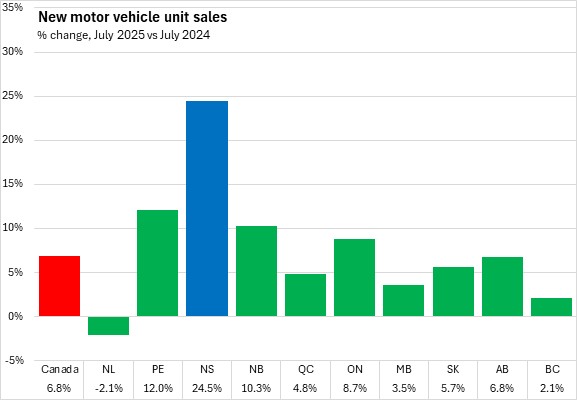

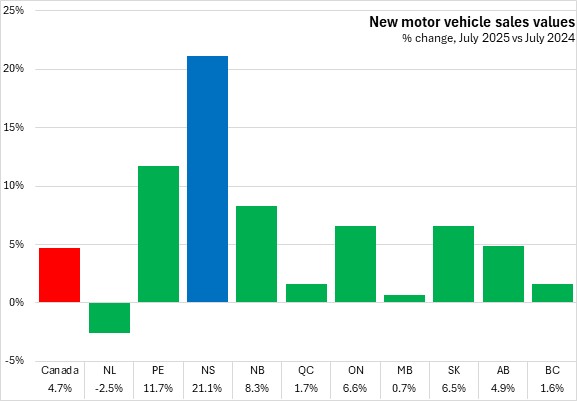

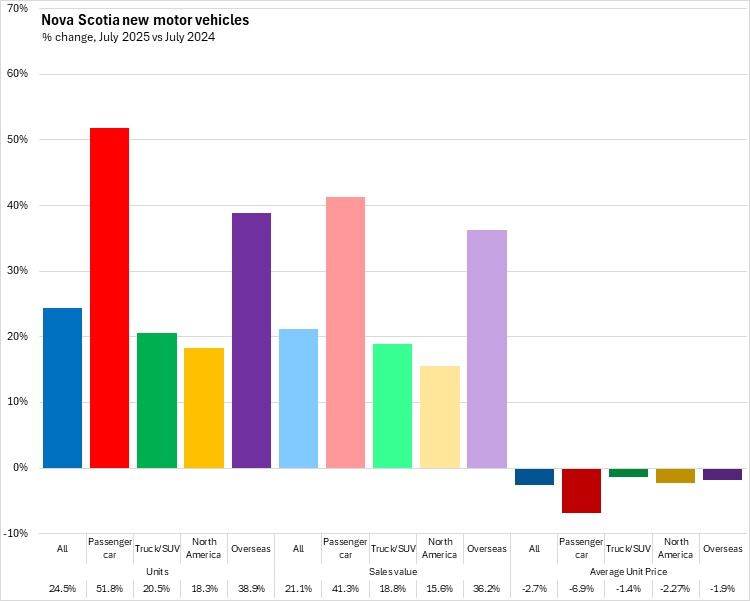

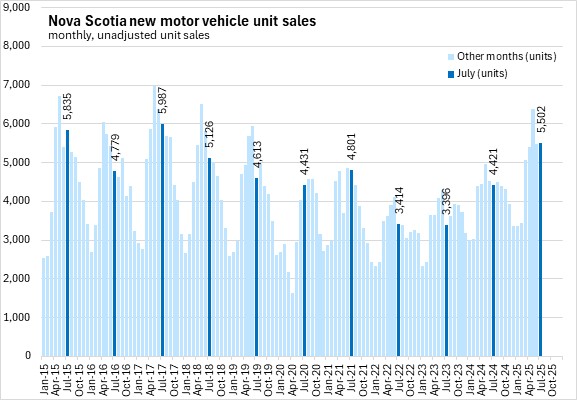

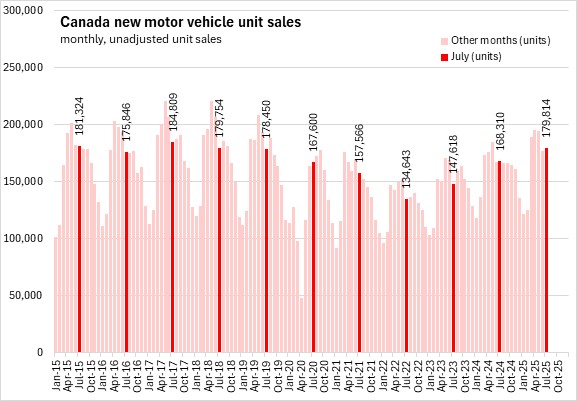

Compared with July 2024, Nova Scotia unit sales of new vehicles (+24.5%) reported a faster gain than any other province. National unit sales were up 6.8% year-over-year with gains in all provinces except Newfoundland and Labrador.

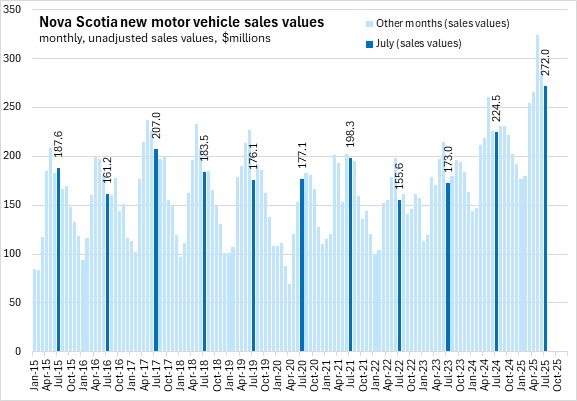

The sales values of new vehicles increased 21.1% in Nova Scotia from July 2024 to July 2025, the largest gain among provinces. National sales values were up 4.7% with gains in all provinces except Newfoundland and Labrador.

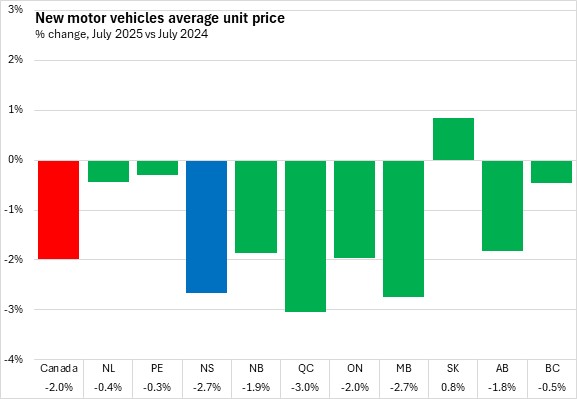

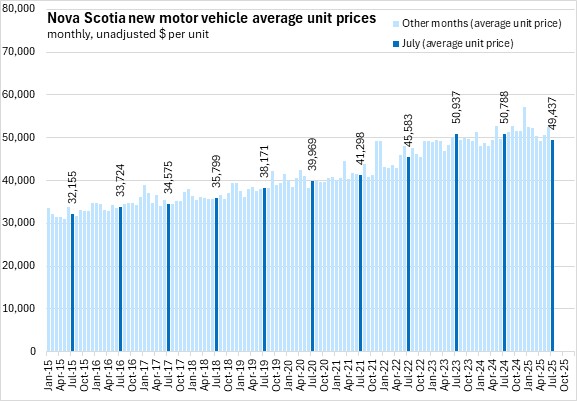

Compared to July 2024, average unit prices were down 2.7% in Nova Scotia in July 2025, the second fastest decline (tied with Manitoba) among provinces. Average unit prices were down 2.0% nationally with declines in all provinces except Saskatchewan. Québec had the steepest year-over-year decline in average motor vehicle prices.

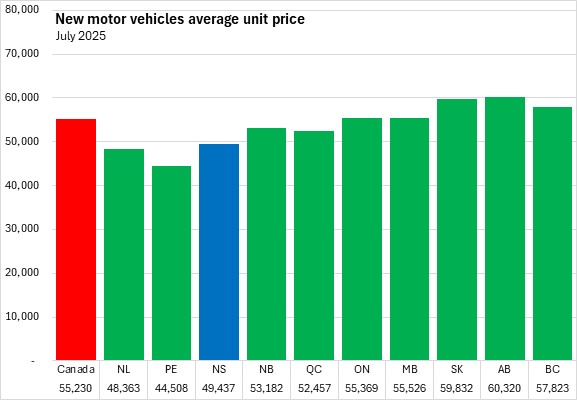

The average price of a new vehicle in July 2025 was $49,437 in Nova Scotia - third lowest among provinces ahead of Prince Edward Island and Newfoundland and Labrador. Nationally, the average price of a new vehicle was $55,230 in July with the highest value in Alberta.

Compared with July 2024, unit sales and sales values were up for all vehicle categories, led by passenger cars and overseas-manufactured vehicles. Average unit prices were down for all categories.

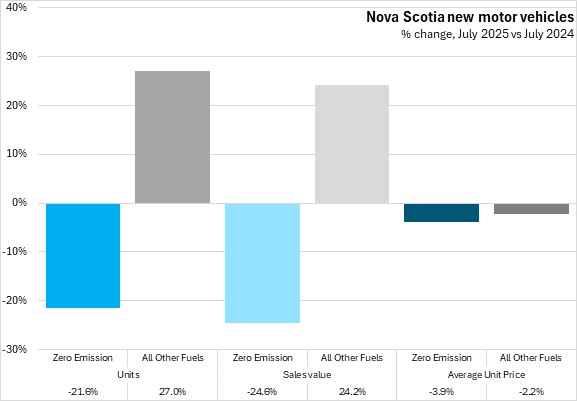

Zero emission vehicle unit sales were down 21.6% in July 2025 compared with July 2024, while sales values declined 24.6% and average unit prices decreased 3.9%. The low overall number of zero emission vehicles sold in Nova Scotia (182 in July 2025) can lead to volatility in unit sales, sales values, and prices. Other fuel type vehicles, which account for the majority of vehicles sold, saw unit sales increase 27.0% while sales values increased 24.2%, and the average unit price for other fuel type vehicles declined 2.2%.

In July 2025, trucks/SUVs accounted for 84.7% of unit sales and 88.1% of sales values. North American manufacturers accounted for 66.6% of Nova Scotia's unit sales and 69.8% of sales values in July 2025. Zero emission vehicles made up 3.3% of unit sales, and 3.9% of sales values, while all other fuel types accounted for 96.7% of unit sales and 96.1% of sales values.

Trends

Nova Scotia's unit sales of 5,502 in July 2025 were stronger than those reported in the same month of any year since 2017.

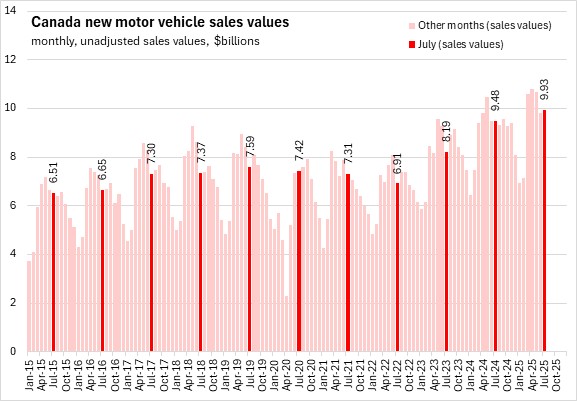

Increased unit sales have resulted in July 2025 motor vehicle sales values well above comparable months in previous years.

Nova Scotia average unit prices have generally increased in the last year, despite periodic declines.

Zero-emission vehicles are currently a small share of the new motor vehicle market in Nova Scotia. Due to the small number of vehicles sold, there can be volatility in the year-over-year or year-to-date comparisons for unit sales, sales value and average prices. Nova Scotia zero-emission vehicle unit sales and sales values were down compared to July 2024.

Across Canada, national unit sales are above any comparable month since 2019, but below levels observed from 2015-2017.

National sales values for July 2025 were above values in comparable months in recent history.

National average unit sales prices have returned to levels seen in early 2024. July 2025 average unit prices were down from July 2024.

There has been a steady trend of increasing market share for trucks/SUVs while the market share of passenger cars declines. This trend has become less volatile in recent months.

Over the last twenty years, there has been a slow decline in market share for North American manufacturers while overseas manufacturers' market share rises. In recent years, market shares for North American and overseas manufactures have stabilized.

The market share for new zero-emission vehicles has been declining this year since peaking in December of 2024.

Prices for trucks/SUVs (the bulk of the market) as well as passenger cars have fallen from their recent peak at the end of 2024.

Prices for vehicles from North American as well as overseas manufacturers are declining in recent months.

Average prices for zero-emission vehicles rose sharply in late 2024 before returning to previous averages in the spring of 2025. The low overall number of zero emission vehicles sold in Nova Scotia (182 in July 2025) can lead to volatility in prices.

Source: Statistics Canada. Table 20-10-0001-01 New motor vehicle sales

<--- Return to Archive