The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

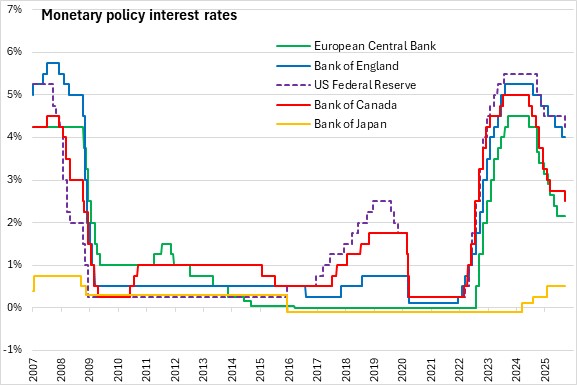

September 18, 2025BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain the Bank Rate at 4.0% in their September meeting.

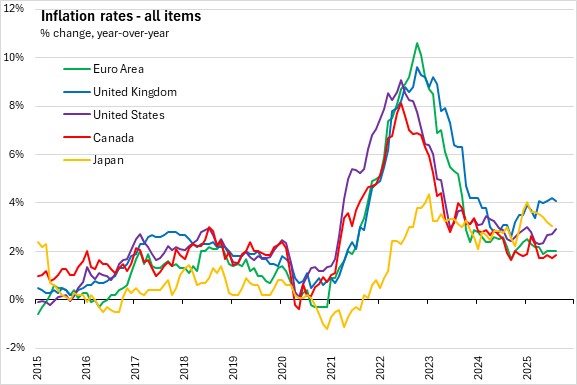

UK-weighted global GDP was estimated to have grown by 0.4% in Q2 2025. Euro Area GDP has expanded by 0.1% and US GDP by 0.8%. The euro-area and US labour markets had remained close to balance. Twelve-month HICP euro-area inflation was unchanged at 2.0% in August, with core inflation remaining at 2.3%. Twelve-month US CPI inflation had increased to 2.9% in August from 2.7% in July, with core inflation remaining at 3.1%. Recent indicators suggest that global growth in Q3 2025 would be stronger than assumed in the August Report.

Since the meeting in August, the US effective tariff rate had risen and was now estimated to be close to 20%. Resilient global growth in the first half of the year could be, in part, attributed to frontloading of exports to the US, lag in implementation of tariffs, and rerouting of some trade goods through alternative routes. As a result, the impact of higher tariff rates could be slower, although not necessarily smaller, than previously assumed.

UK GDP has grown 0.3% in Q2 2025, stronger than expected in the August report. Household consumption had risen by 0.1%, while business investment had fallen by 4.0% and government expenditure had risen by 2.0%. UK export volume to the US had fallen by 27%, accounted for by weakness in vehicle and metal exports. Bank staff expected headline GDP to increase by around 0.4% in 2025 Q3, slightly stronger than the underlying trend in growth.

Twelve-month CPI increased to 3.8% in August and is expected to increase slightly in September before returning to the 2% target thereafter. The rise was mostly due to previous increases in energy prices and stronger than expected food price inflation. Core CPI had been 3.6% in August, inline with the August Report. The number of job vacancies declined in the three months to August. The unemployment rate remained unchanged in the three months to July. Slack was continuing to build slowly in the labour market, although with no signs currently that a sharper loosening was underway.

The Committee judged that a careful approach to the further withdrawal of monetary policy restraint remained appropriate. The timing and pace of future reductions in the restrictiveness of policy would depend on the extent to which underlying disinflationary pressures would continue to ease. Monetary policy was not on a pre-set path, and the Committee would remain responsive to the accumulation of evidence.

The next scheduled monetary policy meeting will be on November 6, 2025.

Source: Bank of England, Monetary Policy Summary, September 2025

<--- Return to Archive