The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

September 29, 2025SURVEY ON RESEARCH ACTIVITIES AND COMMERCIALIZATION OF INTELLECTUAL PROPERTY IN HIGHER EDUCATION, 2023 Today, Statistics Canada has released results from the 2023 Survey on Research Activities and Commercialization of Intellectual Property in Higher Education, covering the reference period from April 1, 2023 to March 31, 2024. Research and development (R&D) partnerships or contracts provide postsecondary institutions with avenues to apply their academic expertise. Partnerships are typically long-term arrangements with shared funding and jointly developed intellectual property, while contracts are client-funded, and may grant exclusive use of the resulting intellectual property to the client. Results were reported by select provinces and regions, with Atlantic Canada including Newfoundland and Labrador, Prince Edward Island, Nova Scotia and New Brunswick. For the purposes of this survey, Rest of Canada (RoC) includes Manitoba, Saskatchewan, Yukon, Northwest Territories and Nunavut.

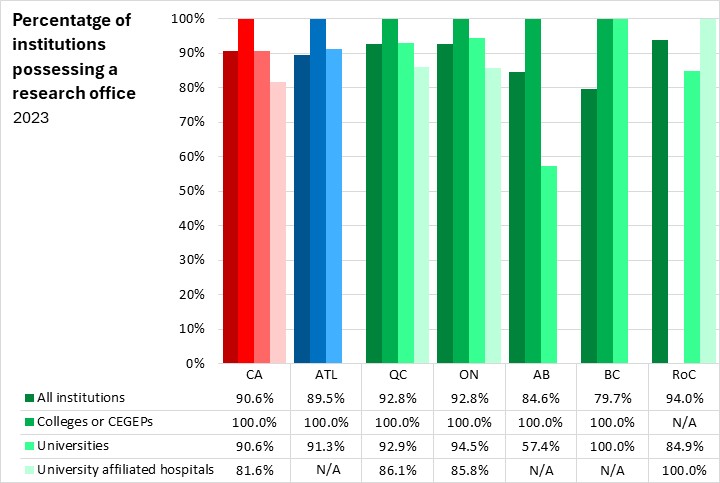

In Canada, 90.6% of all post-secondary institutions had formal research offices, with 100% of colleges/CEGEPs, 90.6% of universities, and 81.6% of university hospitals having a dedicated research office. Atlantic Canadian universities were more likely to have a research office than the national average, but lagged the national average on research offices in university hospitals (data suppressed). University research offices were most common in British Columbia, while the Rest of Canada (RoC) led in research offices in university hospitals. All colleges/CEGEPs reporting had a research office.

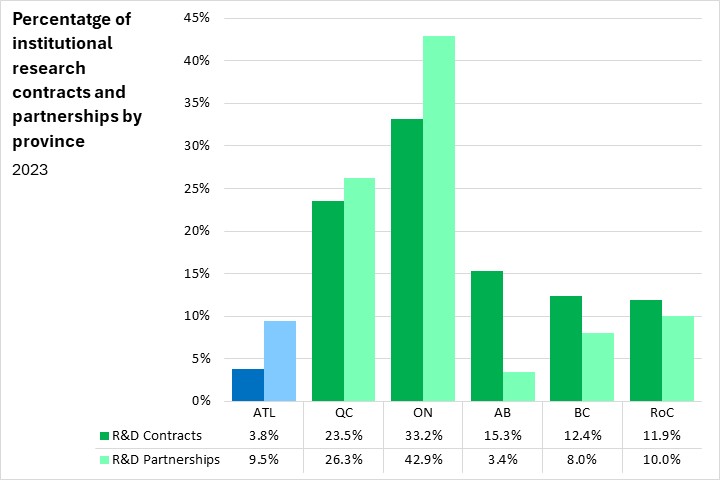

Across Canada in 2023, there were 49,431 R&D partnerships and 66,379 R&D contracts. Post-secondary institutions in Atlantic Canada had almost twice as many R&D partnerships (4,689) in 2023 as R&D contracts (2,500). Ontario had the largest share of Canadian research contracts (33.2%) and partnerships (42.9%). In eastern Canada it was more common for institutions to engage in R&D partnerships, while in Alberta, British Columbia and the rest of Canada it was more common for institutions to engage in R&D contracts.

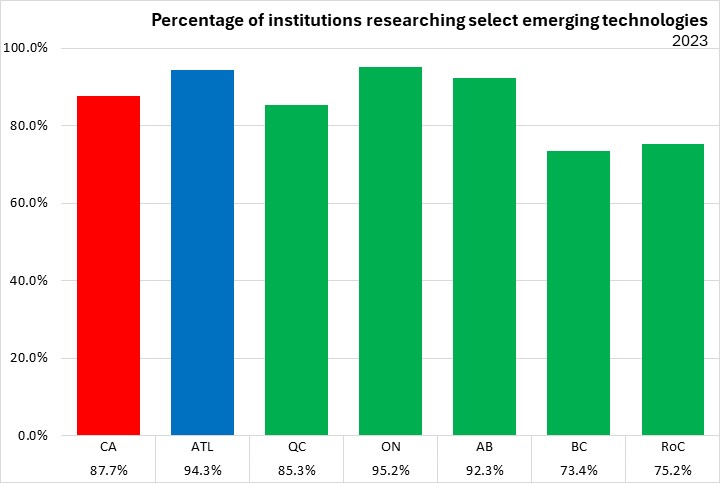

Among select emerging technologies, research was concentrated in Ontario, Alberta and Atlantic institutions, while British Columbia and the rest of Canada had notably lower proportions of institutions conducting emerging technology research. Artificial intelligence research was concentrated in Ontario, while Atlantic Canada had the highest concentration of institutions conducting research in internet integration systems, biotechnologies, geomatics/geospatial technology, nanotechnology and quantum computing. Institutions researching blockchain technologies were most common in Alberta.

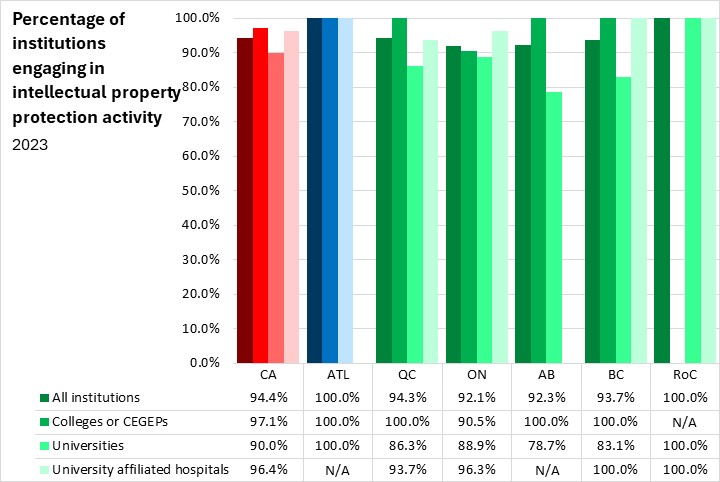

Institutions may engage in activities related to protecting the intellectual property they produce, such as filing patent applications, registering copyright protections, or utilizing resources such as Canadian intellectual property offices or foreign intellectual property offices. In Atlantic Canada and the Rest of Canada, all institutions responding to the survey reported engaging in at least one activity to protect their intellectual property. Ontario and Alberta had the lowest rates of intellectual property protection activity

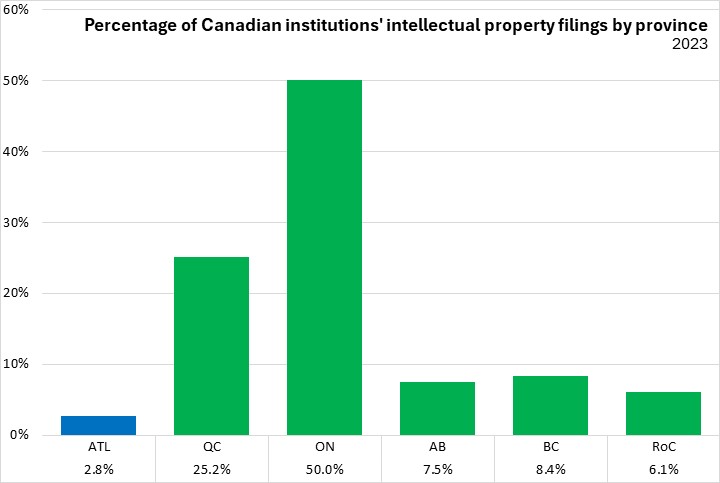

Across Canada there were 2,510 intellectual property filings by Canadian institutions. Half of these were from Ontario institutions, with Québec institutions being the second-most common source of intellectual property filings with 25.2%. Fewer institutional intellectual property filings came from Atlantic Canadian institutions than any other province or region with 2.8% of the national total.

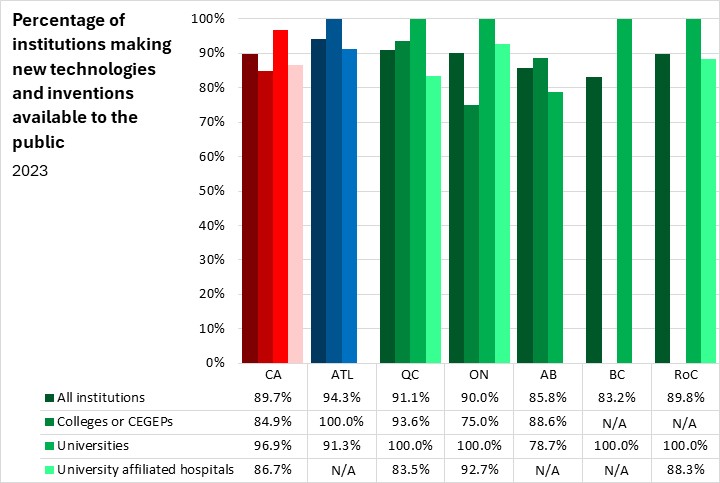

Post-secondary institutions may make their technologies or inventions available to the public in a variety of ways, such as publishing their findings in academic journals, presenting research at conferences and webinars, or publicizing their work in traditional media. Atlantic Canadian Colleges/CEGEPs were more likely than the Canadian average to publicize their findings, with 100% of Colleges/CEGEPs using at least one method to publish their work. In contrast, only Atlantic Canadian and Alberta universities had less than 100% of institutions engaged in making new technologies and inventions available to the public. Ontario university hospitals were the most likely to make new technologies and inventions available to the public.

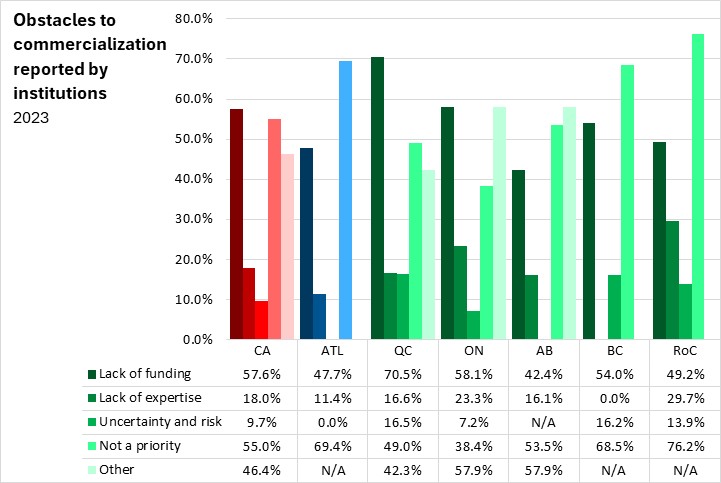

New technologies, inventions or processes may be commercialized by institutions by issuing commercial licenses to use their intellectual property. The most commonly reported obstacle to post-secondary institutions commercializing their findings was a lack of funding, followed by "not an institutional priority". This challenge was most acute in Québec where 70.5% of post-secondary institutions reported a lack of funding as an obstacle to commercialization, above the Canadian average of 57.6%. Institutions in Atlantic Canada, British Columbia, and the Rest of Canada were the most likely to report that commercialization was not an institutional priority.

Source: Statistics Canada, Survey on Research Activities and Commercialization of Intellectual Property in Higher Education, 2023

<--- Return to Archive