The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

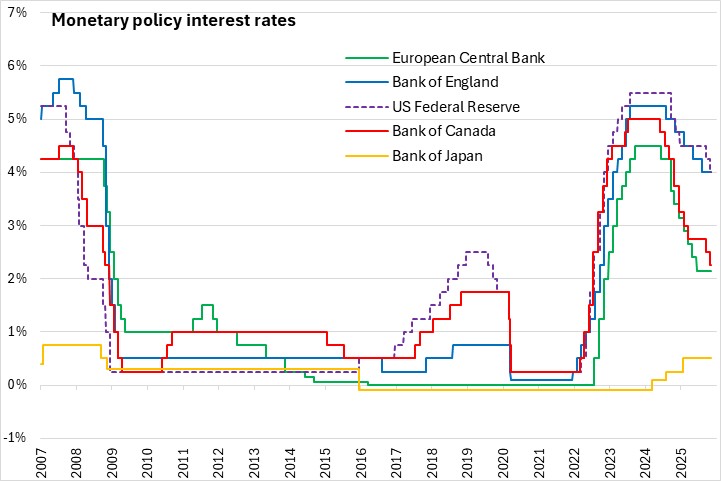

November 06, 2025BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain the Bank Rate at 4.0% in their November meeting.

UK GDP is expected to have grown 0.2% in Q3 2025, slightly below August Report expectations. Global and domestic uncertainty may be weighing on growth, as the coming Autumn Budget appears to have weighed on some survey indicators. Headline GDP growth is expected to pick up slightly in Q4 2025 to 0.3%.

Since the August report, the US effective tariff rate had risen and is now estimated to be close to 18%, 4 percentage points higher than expected. Resilient global growth in the first half of the year could be, in part, attributed to frontloading of exports to the US, a lag in implementation of tariffs, and rerouting of some trade goods through alternative routes. As a result, the impact of higher tariff rates could be slower, although not necessarily smaller, than previously assumed.

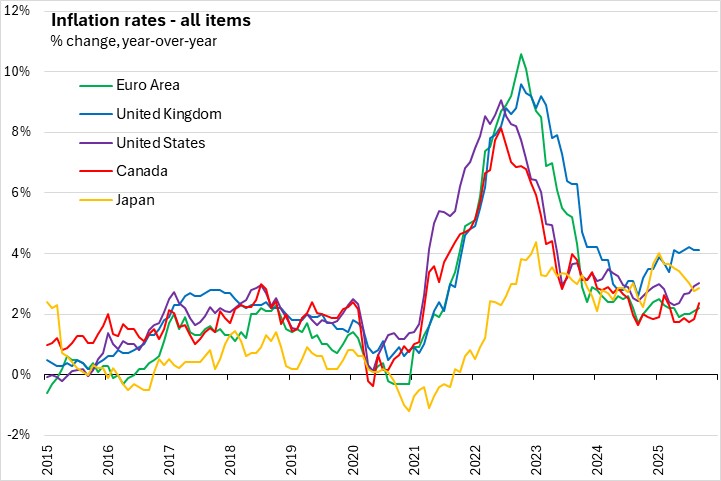

Twelve-month CPI was 3.8% in September, 0.2 percentage points below expectations in the August Report. The Monetary Policy Committee has judged that inflation has likely peaked, with underlying price and wage pressures continuing to ease. Inflation is expected to fall to near 3.0% early in 2026, and gradually return to the 2.0% target over the subsequent year.

The Committee judged that a careful approach to the further withdrawal of monetary policy restraint remained appropriate. The timing and pace of future reductions in the restrictiveness of policy would depend on the extent to which underlying disinflationary pressures would continue to ease. Monetary policy was not on a pre-set path, and the Committee would remain responsive to the accumulation of evidence.

The next scheduled monetary policy meeting will be on December 18, 2025.

Source: Bank of England, Monetary Policy Summary, November 2025

<--- Return to Archive