The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 13, 2025FEDERAL BUDGET 2026-27 Canada's Federal government tabled its 2026-27 Budget on November 4, 2025. Canada's Federal government has changed the schedule for its Budgets - now releasing the Budget in the fall prior to the start of the fiscal year. An economic and fiscal update will be presented in the spring.

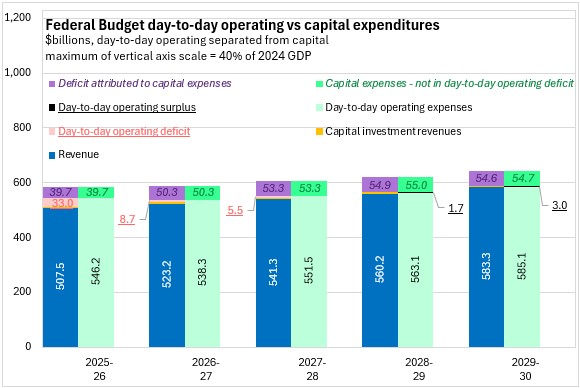

The Federal Budget adopts new reporting practices that distinguish expenditures for capital purposes from day-to-day operating expenditures. The "summary statement of transactions" reported in the Budget document is consistent with how final results will be presented in the Public Accounts of Canada.

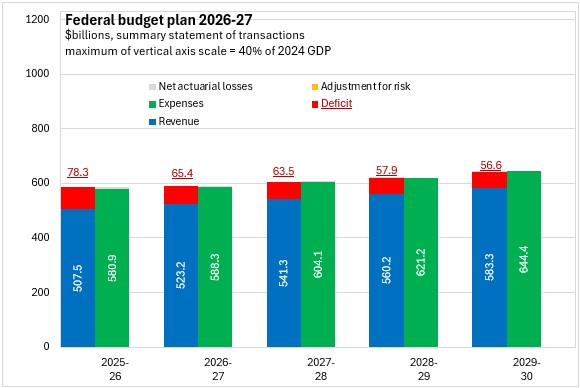

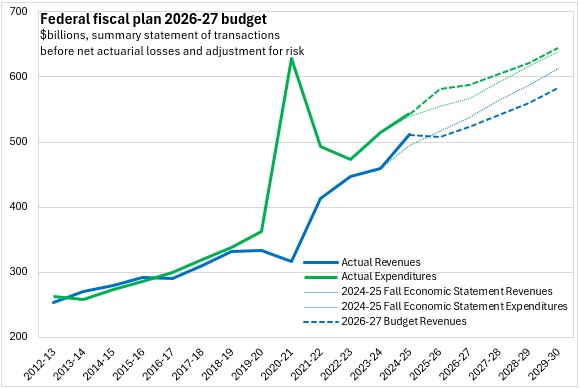

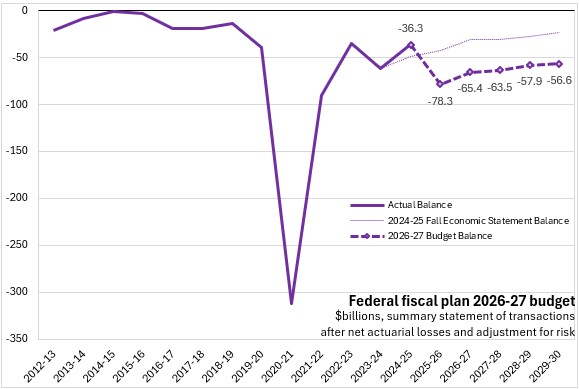

The Federal Budget deficit for 2026-27 (summary statement of transactions) is projected to be $65.4 billion, down from $78.3 billion now forecast for 2025-26. Revenues are projected to rise by 3.1% while expenditures grow by 1.3%. Although revenue growth is projected to outpace rising expenditures over the entire fiscal planning horizon, the Federal government anticipates Budgetary deficits in each year through to 2029-30.

The 2026-27 Federal Budget distinguishes capital investments from day-to-day operating expenses. These capital investments include capital grants and transfers, capital-focused tax incentives, amortization of Federal capital assets, support for private sector research and development, support to unlock large-scale private sector capital investments and measures to grow the housing stock. Outside of these expenditures (and adjusting for any revenues associated with capital investment), the Federal Budget's day-to-day operations are projected to have a deficit of $8.7 billion in 2026-27, falling to $5.5 billion in 2027-28 before generating small operating surpluses in 2028-29 and 2029-30. The remainder of the Federal deficit over the fiscal plannign horizon is associated with capital expenditures.

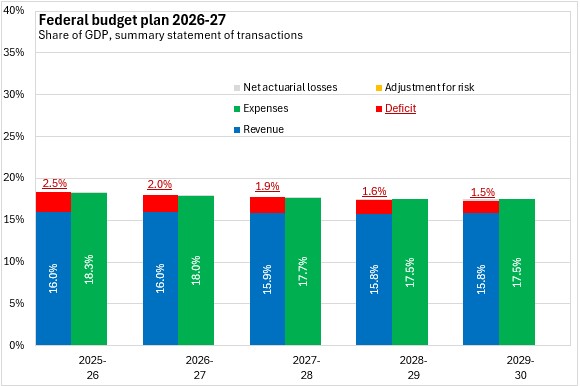

Measured as a share of GDP, the footprint of the Federal government in the Canadian economy amounts to 18.0% of GDP in 2026-27. This is projected to shrink slightly to 17.5% of GDP by 2028-29 and 2029-30.

Canada's federal deficit (summary statement of transactions) for 2026-27 amounts to 2.0% of 2026 nominal GDP.

Canada's Federal debt is expected to rise to 43.1% in 2026-27 (up from 42.4% in 2025-26) and then to peak at 43.3% of GDP in the next two fiscal years before contracting to 43.1% again by 2029-30.

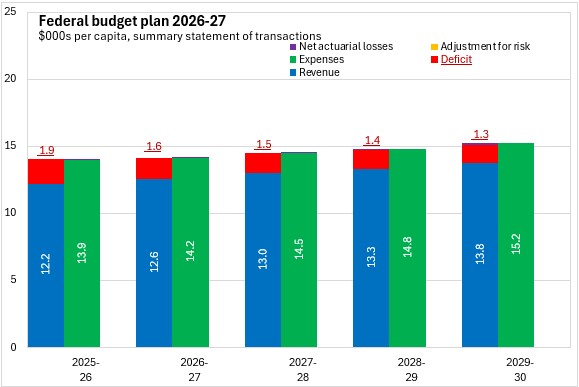

Federal Budget expenditures from the summary statement of transactions amount to $14,153 per capita in 2026-27 (assuming Canada's population grows at the same pace as reported in Statistics Canada's M1 medium population growth scenario), funded by $12,567 per capita in revenues and a deficit of $1,573 per capita.

Canada's Federal government did not present a 2025-26 Budget. Compared with the fiscal plan from the December 2024 Fall Economic Statement, Canada's Federal expenditures in the 2026-27 Budget plan (summary statement of transactions, before net actuarial losses) are projected to be higher than previously planned while revenues are now projected to be lower.

With lower revenues and higher expenditures, Canada's Federal deficit outlook has deteriorated compared to the 2024-25 Fall Economic Statement projection.

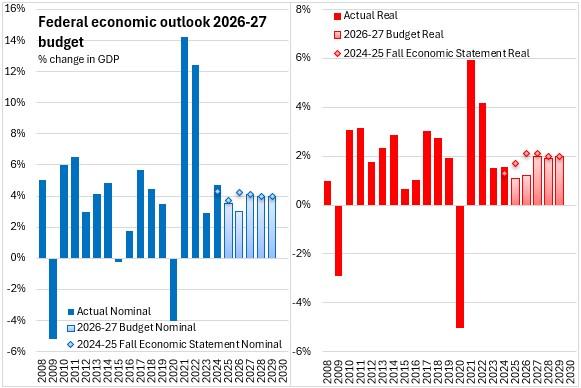

Canada's near-term economic growth projections have been materially weakened by new economic policies in the US - leading to weak investment and productivity growth along with job losses concentrated in key traded sectors. The Federal Budget assumes weak economic growth in 2025 (1.1% real, 3.5% nominal)

and 2026 (1.2% real, 3.0% nominal).

Economic growth is projected to return to historic trends as exports stabilize and domestic demand gets a lift from lower interest rates. In the medium term, Canada's economy is projected to grow at a pace of about 2% in real terms and about 4% in nominal terms. Inflation is projected to remain in the 2% range, as lower oil prices and a depreciated US dollar contribute to softer price pressures. This allows monetary easing to remain in place and lower the long-term costs of borrowing. Although the global economy has proven more resilient than expected, the impacts of tariffs and supply chain disruptions are becoming clearer through weaker corporate earnings.

Key Measures and Initiatives

Canada's 2026-27 Federal Budget prioritizes economic growth, security/defence spending, bringing down costs and making generational capital investments while reducing the size and cost of Federal public administration. Key measures include:

- Reductions of about 40,000 (~10%) in the size of the Federal public service, achieved largely through retirements and attrition. The results of the comprehensive expenditure review are projected to save $13 billion annually by 2028-29 and $60 billion over 5 years.

- Fast-tracking nation-building projects

- Implementing a Trade Diversification Strategy including a new Trade Diversification Corridors Fund for port, airport and railway infrastructure

- Building infrastructure with a Build Communities Strong Fund, part of $115 billion in planned infrastructure investments over 5 years

- Launching a Buy Canadian Policy to support domestic supply chains

- Launching a Defence Industrial Strategy to grow the defence sector

- Establishing a Productivity Super-Deduction to advance private sector investment and renewed productivity growth

- Eliminating GST for first time home-buyers purchasing newly-built properties under $1 million

- Starting Build Canada Homes - a new federal agency to speed up private capital investment in residential structures

- Making the National School Food Program permanent

- Starting automated Federal benefits

- Encouraging made-in-Canada artificial intelligence tools through a Digital Transformation Office

- Recruiting leading innovators with a $1.7 billion International Talent Attraction Strategy

Canada Federal Budget 2026-27

<--- Return to Archive