The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 25, 2025SURVEY ON BUSINESS CONDITIONS: Q4 2025 Statistics Canada has conducted its 21st iteration of the Canadian Survey on Business Conditions. In October and early November, Statistics Canada surveyed businesses to collect information on businesses' expectations, obstacles, plans and practices. In these results, there are new questions about expectations around wages and the impact of interest rates.

The results reported here are a selection of the impacts found for Nova Scotia businesses, by industry, by size of business (measured by number of employees), by age of business and by urban or rural location. There are comparisons of the Nova Scotia average (all industries, ages, sizes, locations) with the national and provincial averages. The horizontal axis in all charts measures the share of businesses reporting each outcome. The total for many outcomes does not add to 100% of respondent businesses as many replied that the outcome was not applicable in their circumstances, or data were suppressed.

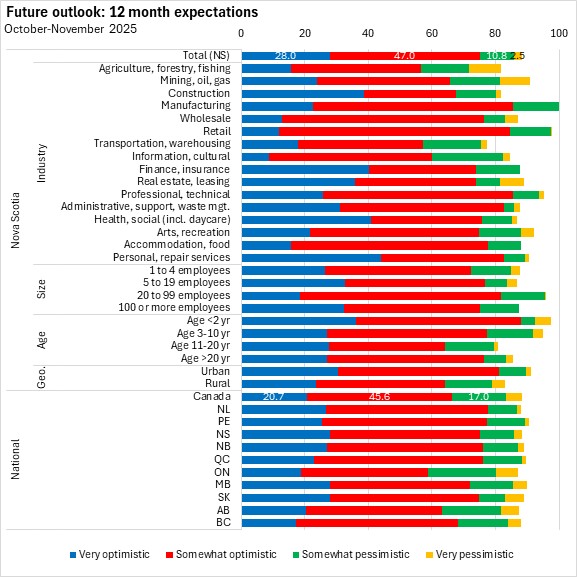

Future outlook over the next 12 months

In Nova Scotia, 28.0% of businesses were very optimistic about the next 12 months; a further 47.0% were somewhat optimistic, 10.8% were somewhat pessimistic and 2.5% were very pessimistic. Business optimism was notably lower (and pessimism higher) at the national level, particularly in Ontario.

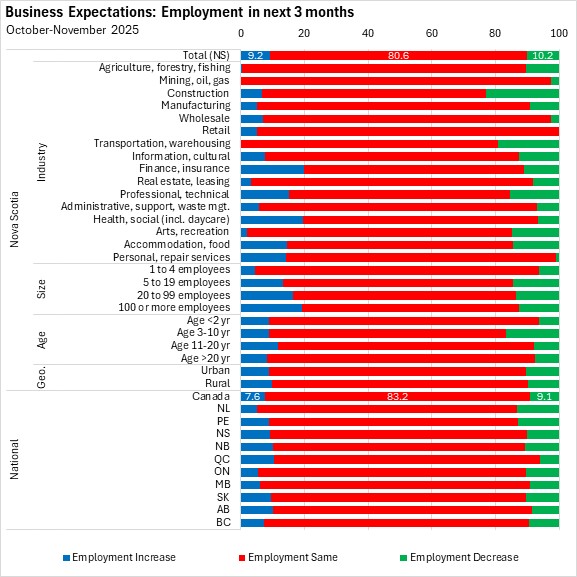

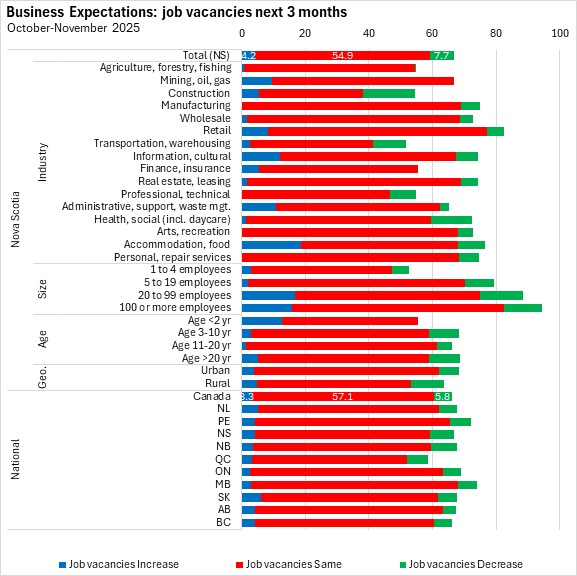

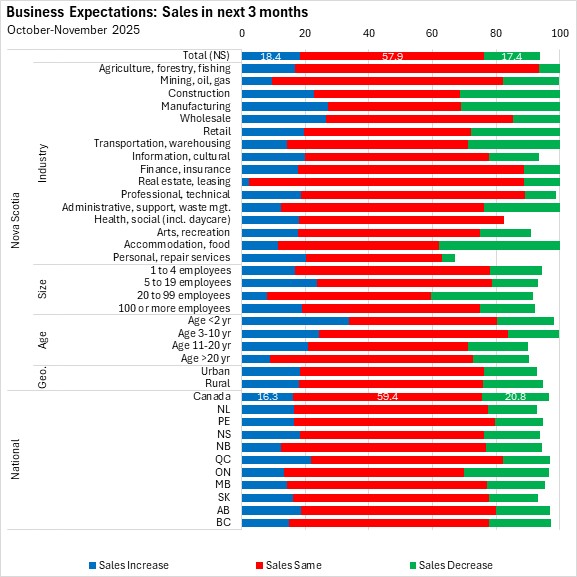

Business expectations for the next three months

The outlook for employment was stable for 80.6% of Nova Scotia businesses in the next three months. Rising employment is expected among 9.2% of Nova Scotia businesses while declining employment is expected by 10.2% of Nova Scotia businesses.

Most businesses in Nova Scotia (54.9%) expect stable job vacancies with more expecting declining vacancies (7.7%) than increasing vacancies (4.2%).

The majority of businesses in Nova Scotia (57.9%) expect stable sales while 18.4% expect rising sales and 17.4% expect declining sales.

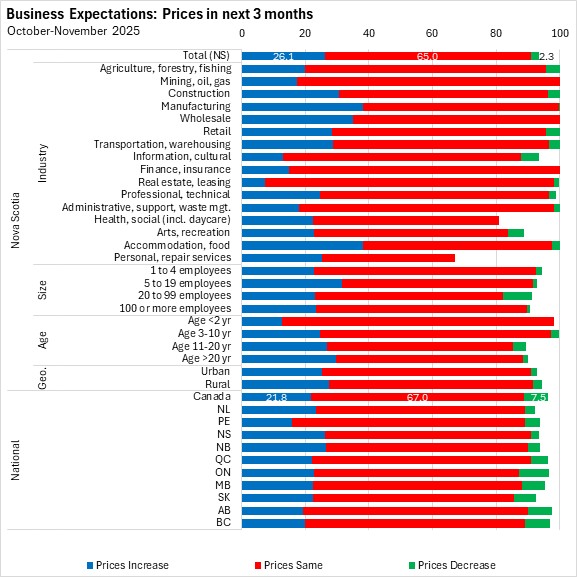

Prices are expected to be stable for 65.0% of Nova Scotia businesses while 26.1% expect rising prices, an increase from the prior quarter. A further 2.3% of Nova Scotia businesses expect declining prices.

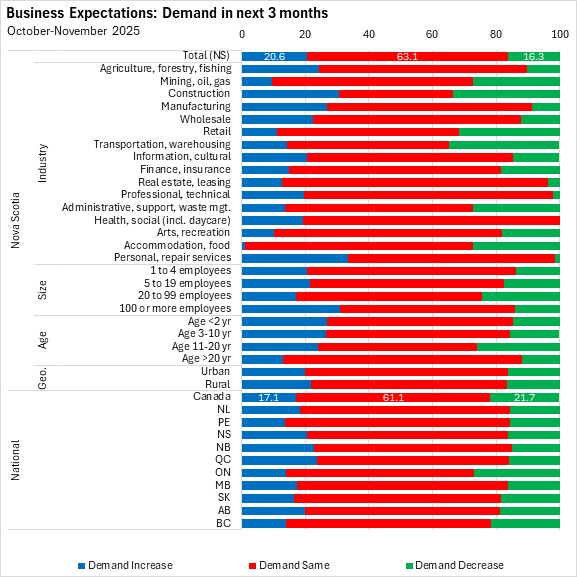

Almost two-thirds (63.1%) of Nova Scotia businesses expect stable demand while 20.6% expect increasing demand and 16.3% expect declining demand.

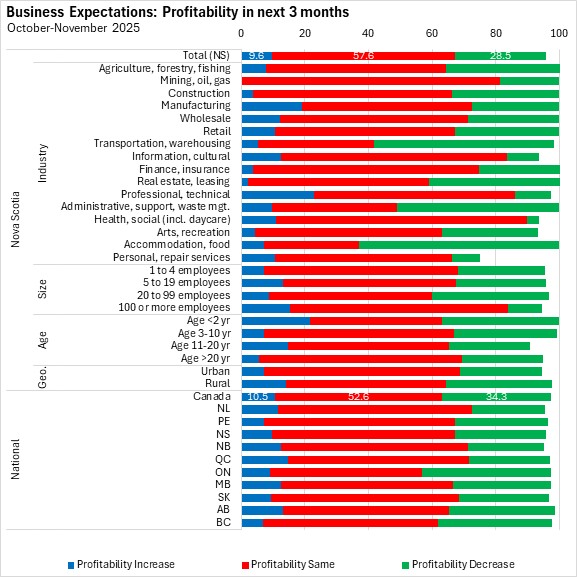

Stable profitability is expected by 57.6% of Nova Scotia businesses. Expectations of falling profitability (28.5%) outweighed expectations of rising profitability (9.6%).

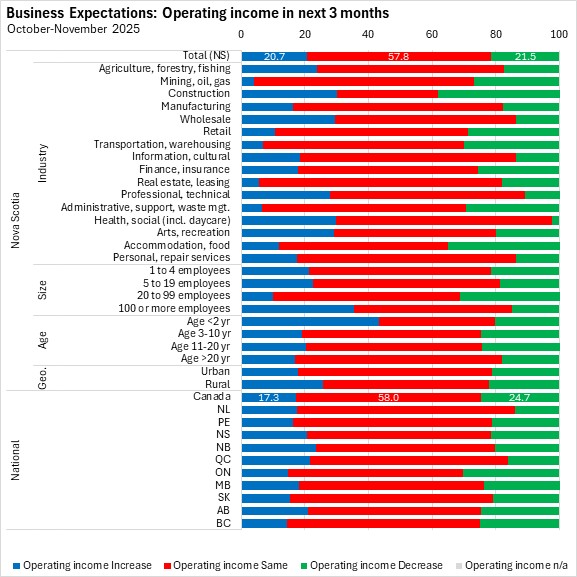

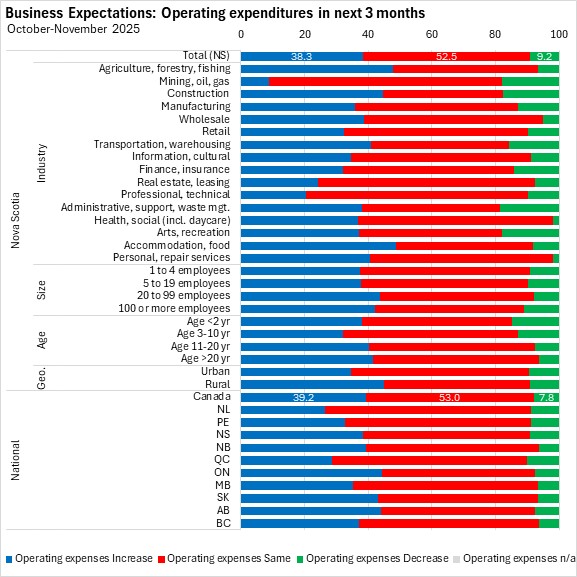

Rising operating income is expected by 20.7% of Nova Scotia businesses while higher operating expenditures are expected by 38.3% of Nova Scotia businesses. Stable operating income is expected by 57.8% of Nova Scotia businesses. Stable operating expenditures were expected by 52.5% of Nova Scotia businesses.

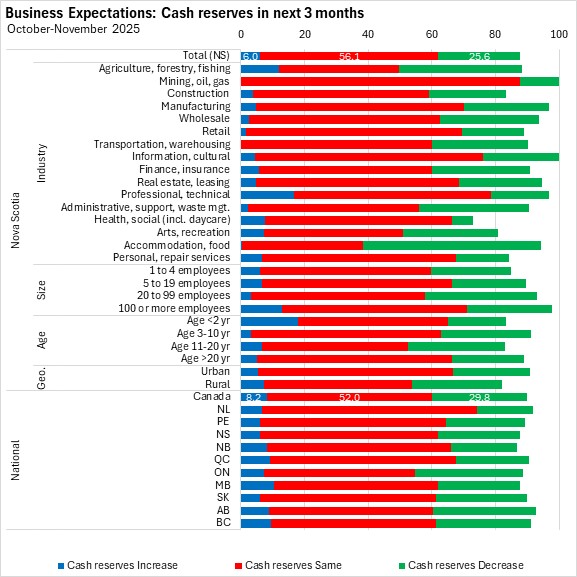

Cash reserves are expected to remain stable for 56.1% of Nova Scotia businesses while 6.0% expect rising cash reservices and 25.6% expect falling cash reserves.

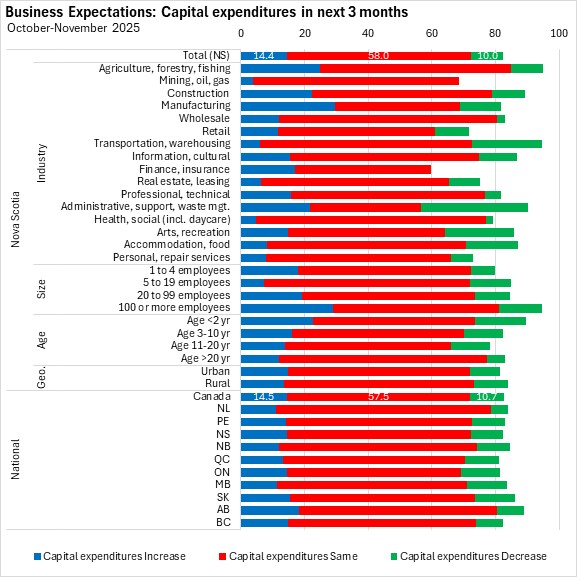

Capital expenditures are expected to be stable for 58.0% of Nova Scotia businesses; rising for 14.4% and falling for 10.0%.

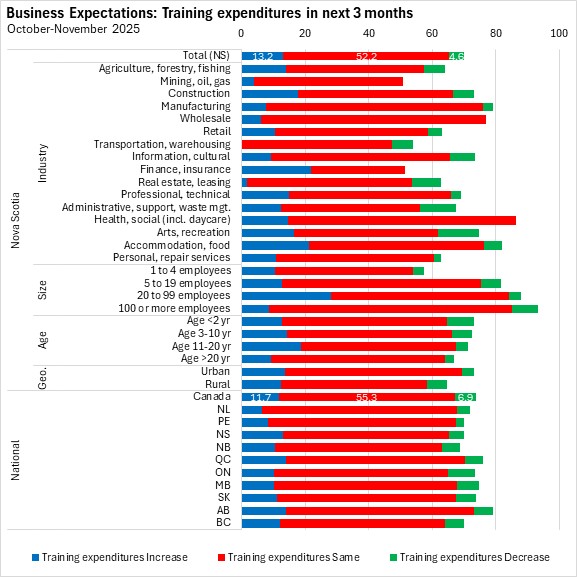

Training expenditures are expected to be stable for 52.2% of Nova Scotia businesses while 13.2% expect higher expenditures on training.

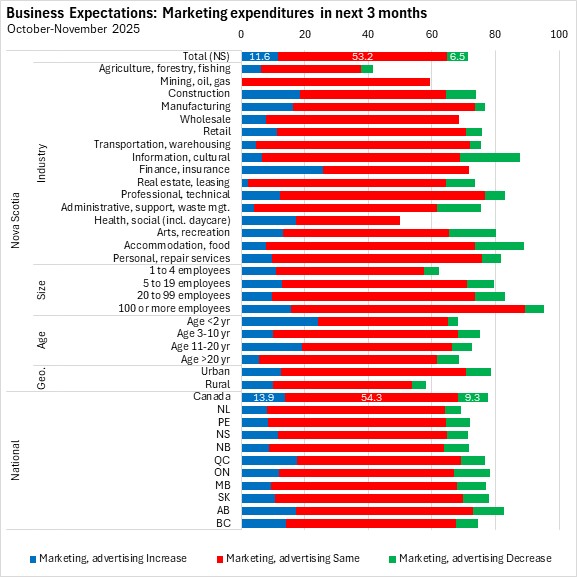

Over half of businesses in Nova Scotia (53.2%) expect stable marketing expenditures in the next three months while 11.6% expect rising marketing expenditures.

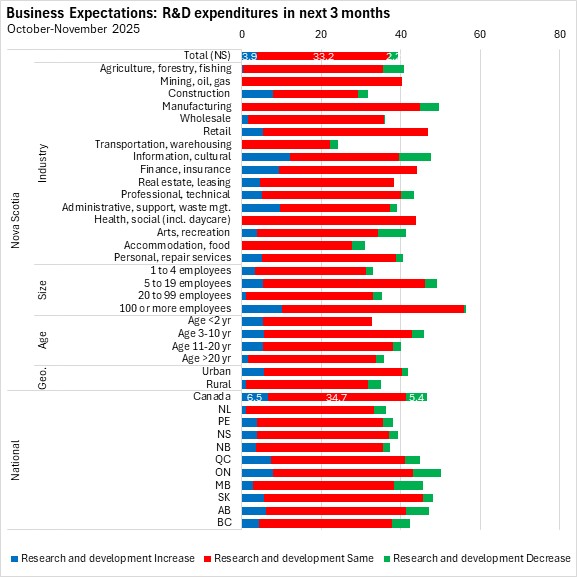

Although research and development (R&D) expenditures are not relevant for the majority of businesses, most businesses that conduct R&D expect stable spending (33.2%) in the next three months.

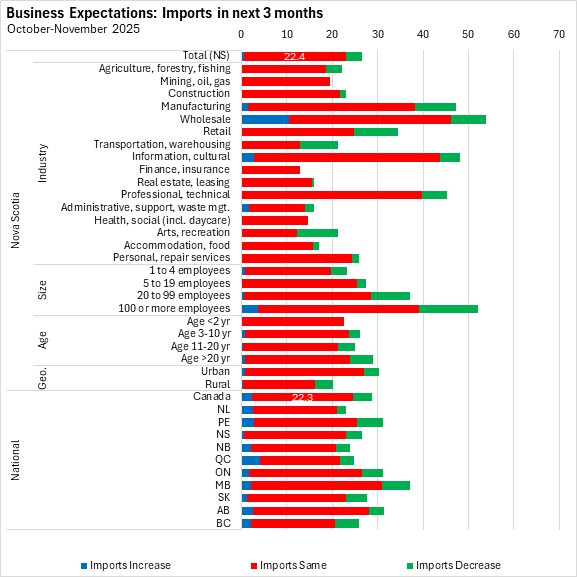

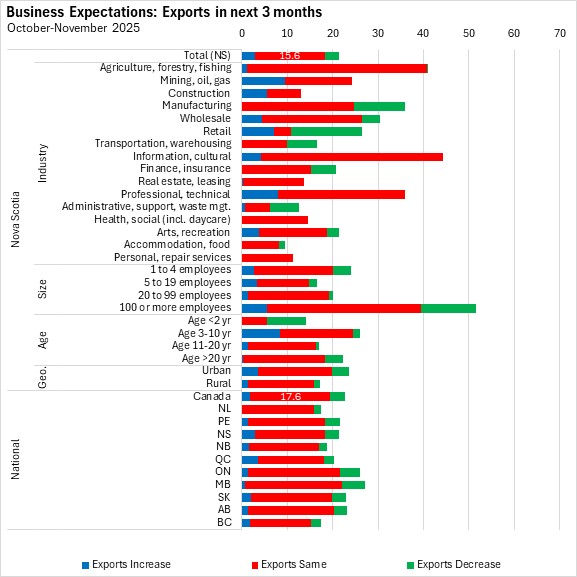

Although few Nova Scotia businesses participate directly in international trade, the majority of these expect stable imports and exports in the next three months.

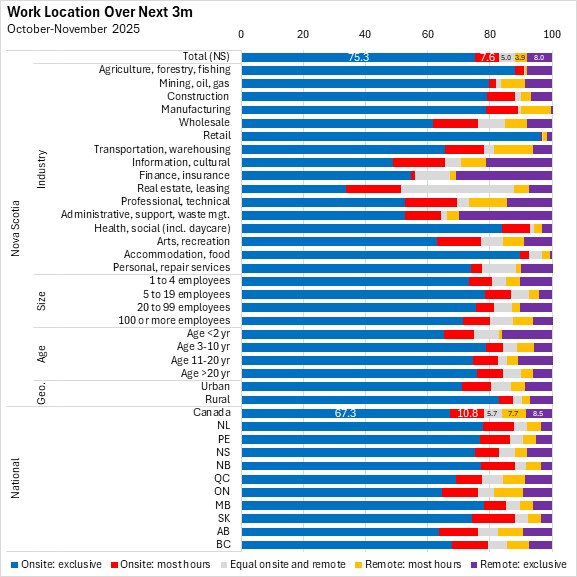

Work location

Nova Scotia businesses were asked about the expected work locations of staff in the coming three months. 82.9% of Nova Scotia businesses expect staff to work exclusively or mostly at a primary worksite. About 11.9% of businesses expect their workers to be mostly or exclusively working remotely while a further 5.0% expect staff to be split between onsite and remote work.

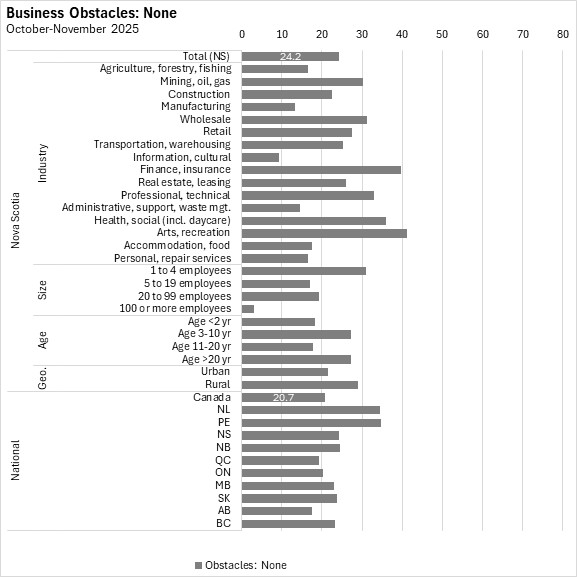

Obstacles for businesses

As part of the Survey of Business Conditions, businesses were asked about their obstacles. Among Nova Scotia businesses, 24.2% reported no substantial obstacles expected in the next three months (down from the previous quarter). Across Canada, 20.7% of businesses reported no obstacles.

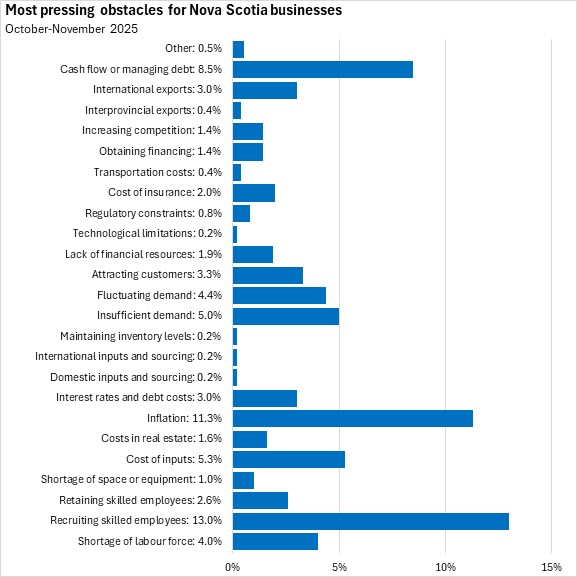

When asked what was the one most pressing obstacle for Nova Scotia businesses (across all industries), recruiting skilled employees (13.0%) and inflation (11.3%) were the most widely reported.

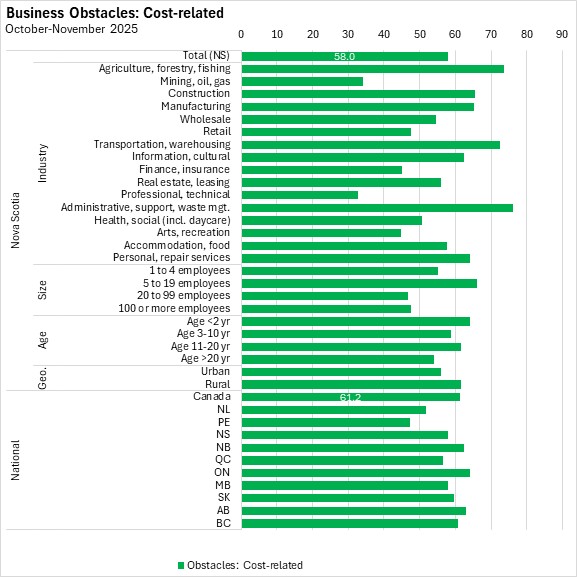

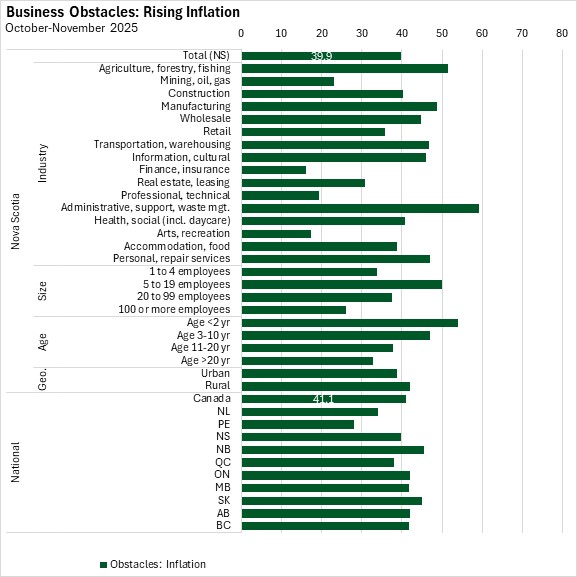

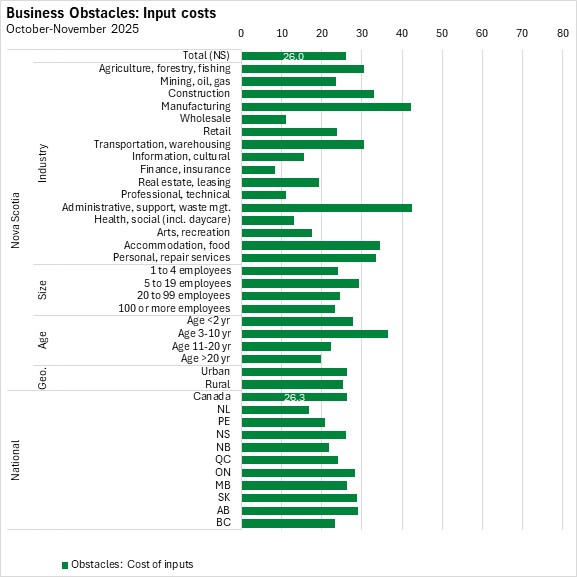

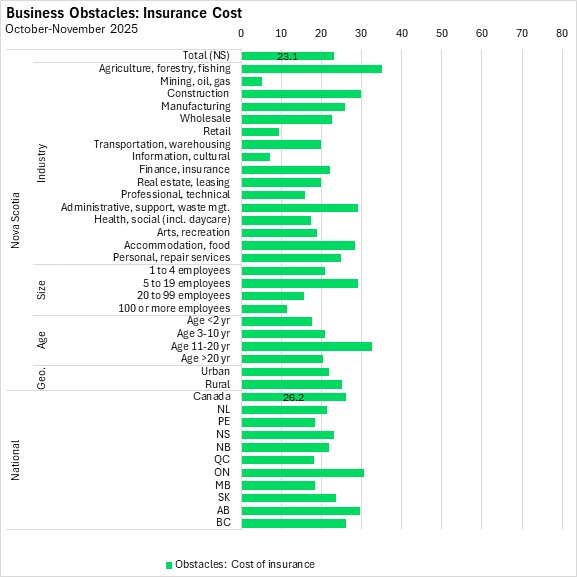

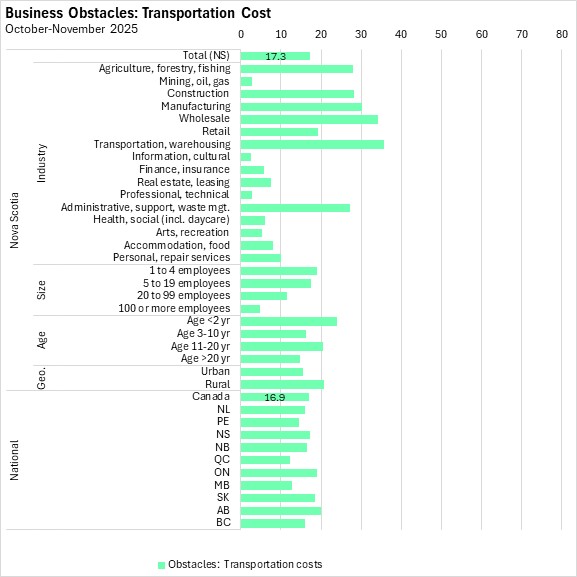

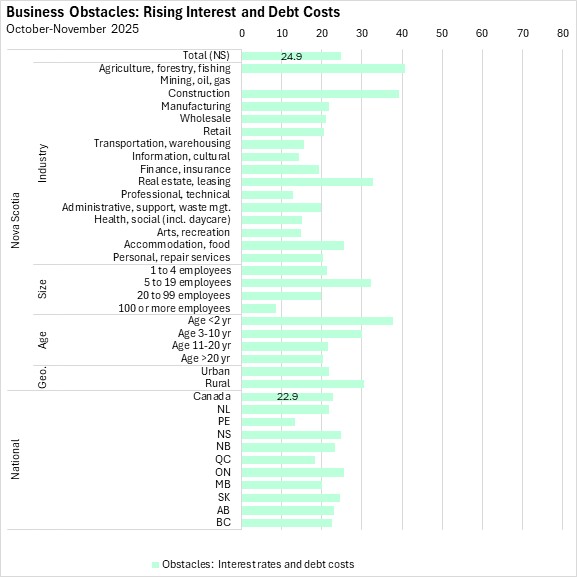

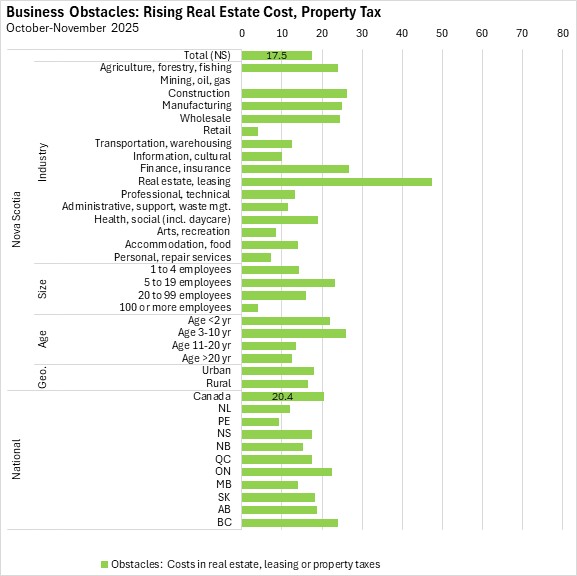

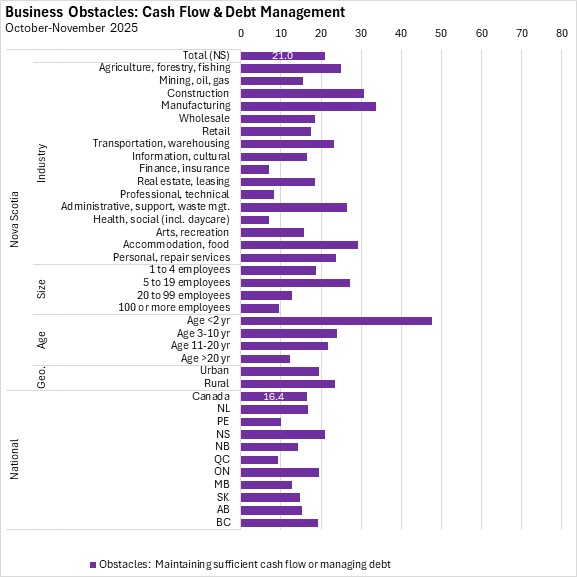

The most acutely-felt obstacles in Q4 2025 were cost-related. Obstacles in this category were reported by 58.0% of Nova Scotia businesses. General inflation was the most prevalent cost obstacle.

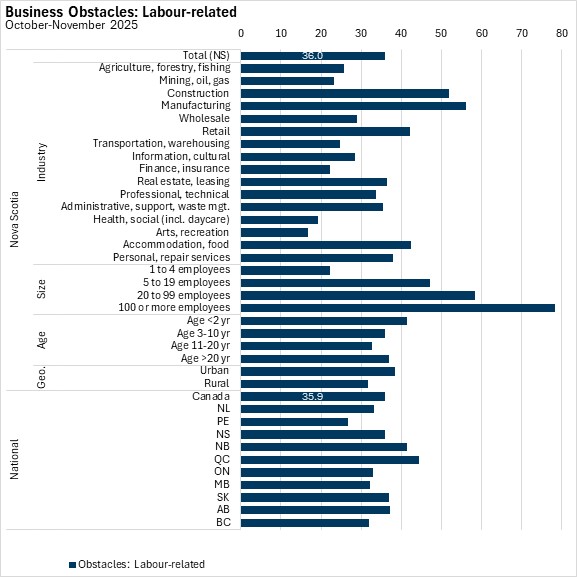

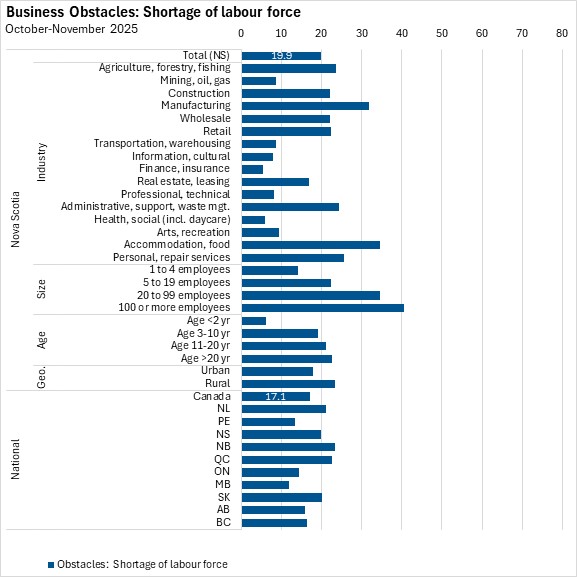

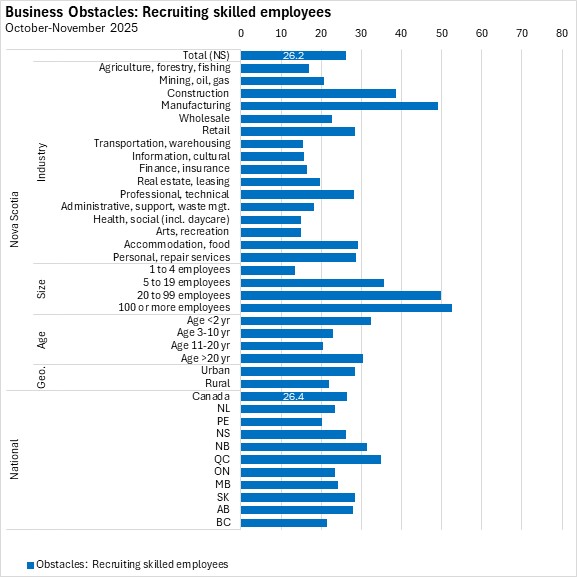

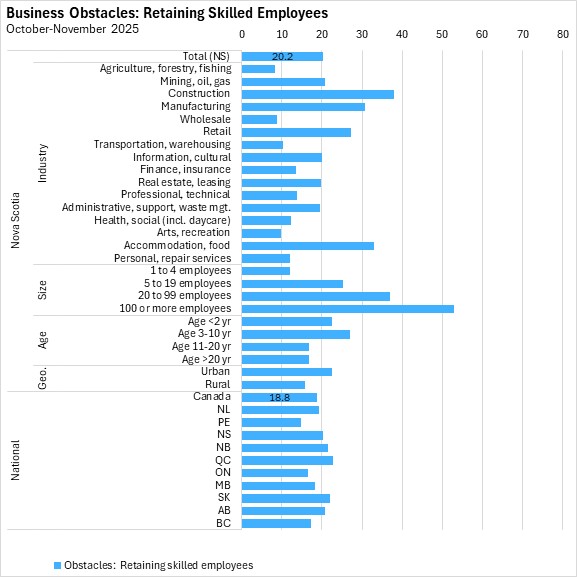

Labour-related obstacles were reported by 36.0% of Nova Scotia businesses, including: labour force shortages as well as recruiting and retaining skilled employees.

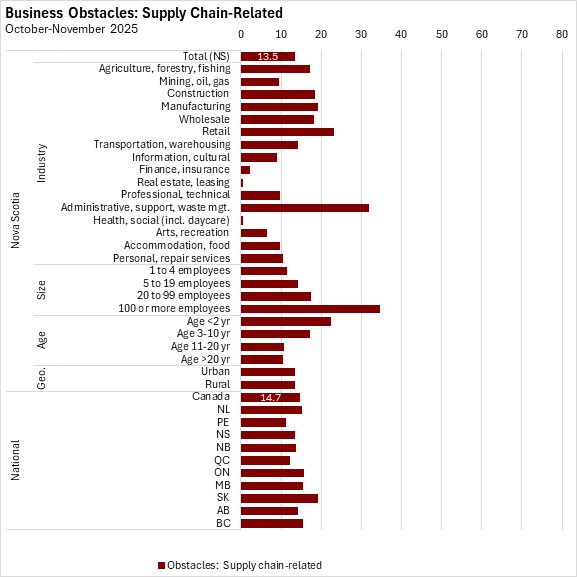

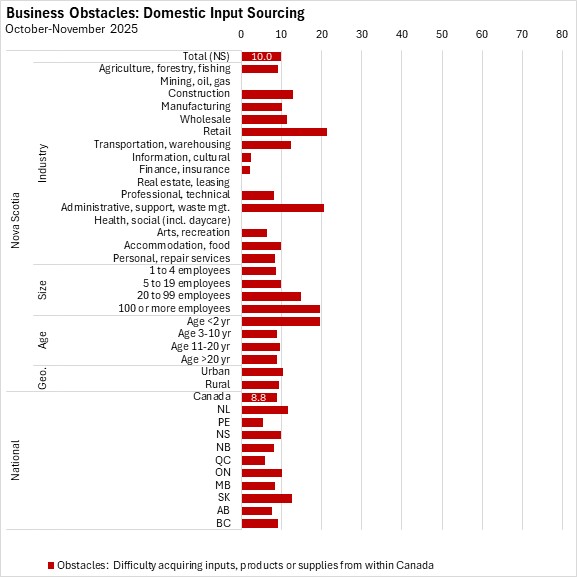

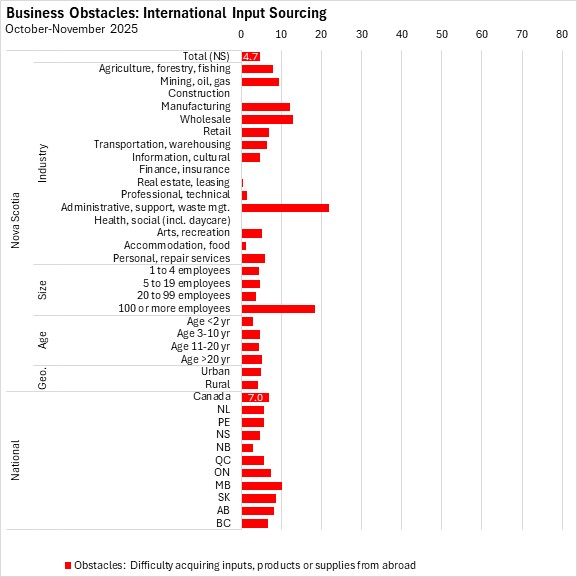

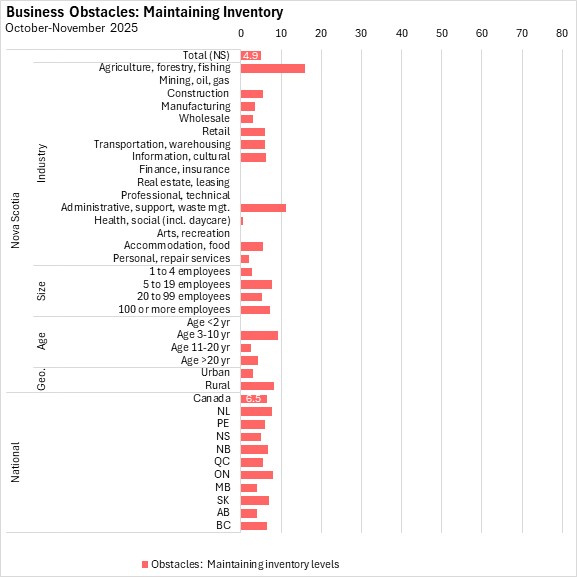

Supply-chain issues were reported as business obstacles by 13.5% of Nova Scotia's businesses, a decline from the previous quarter.

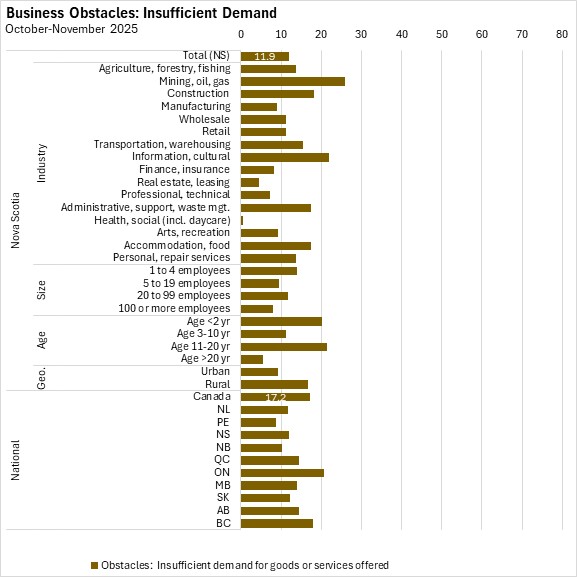

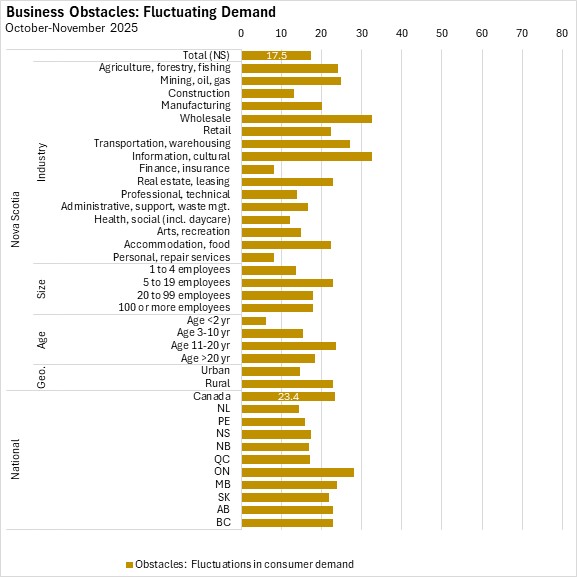

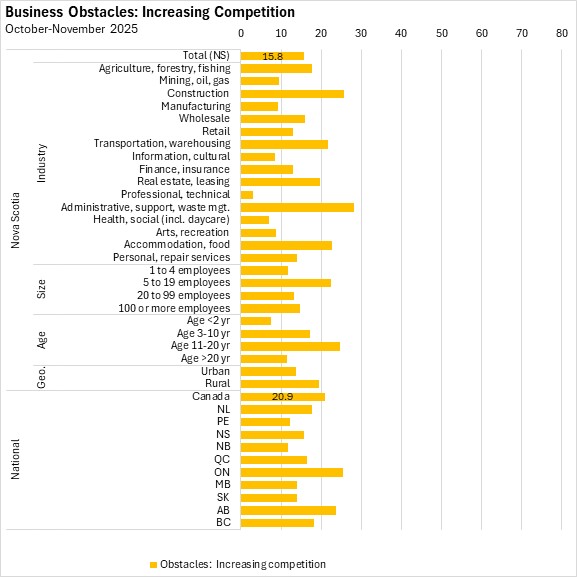

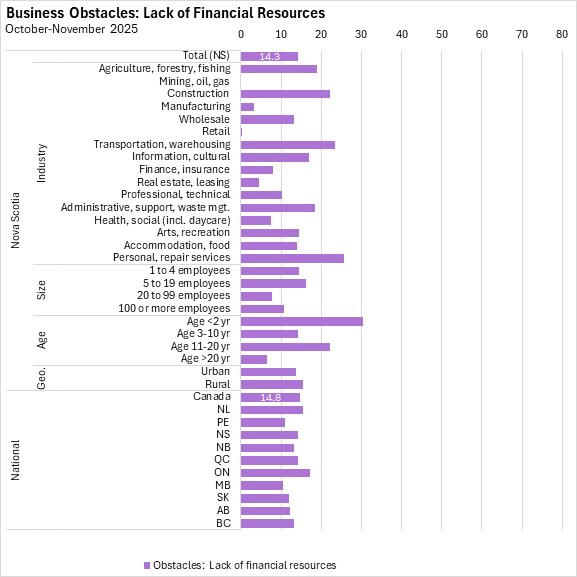

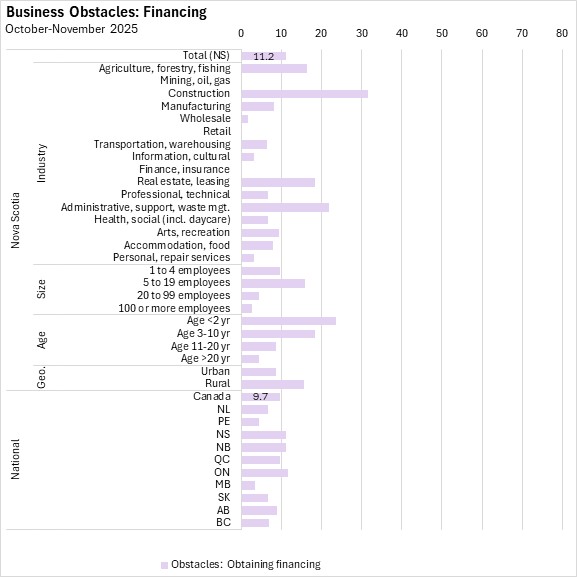

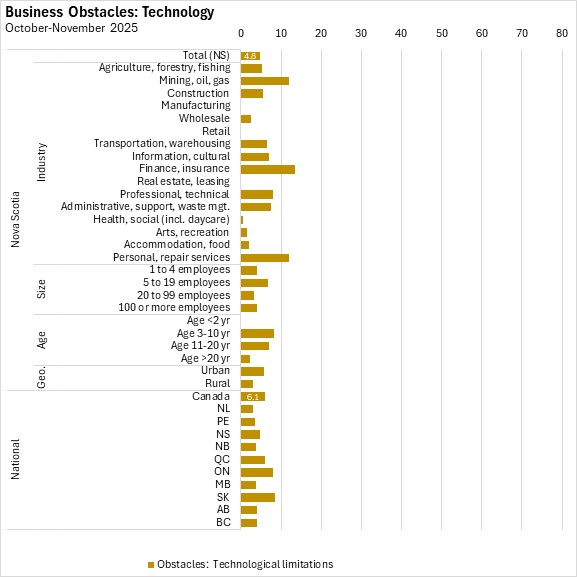

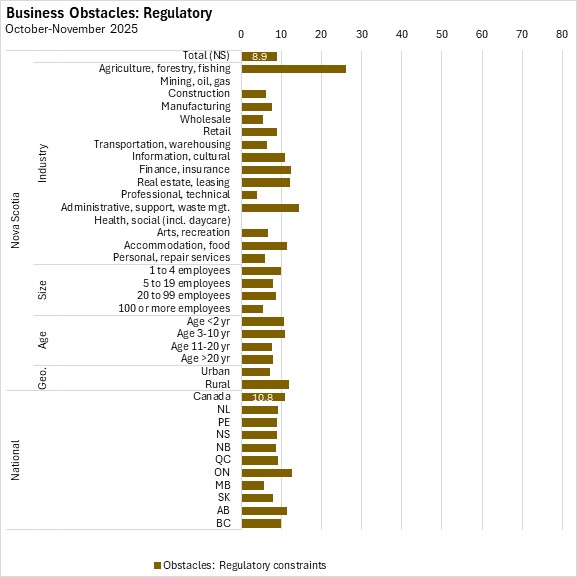

Market conditions, financing, regulatory barriers and technological limitations were less commonly cited obstacles.

Impacts of US tariffs

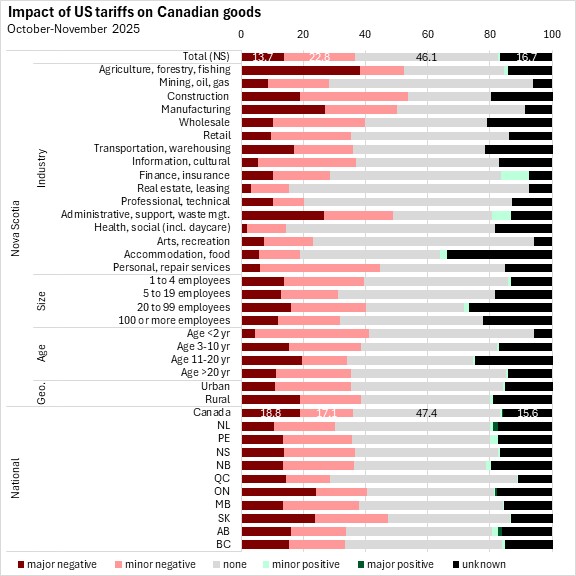

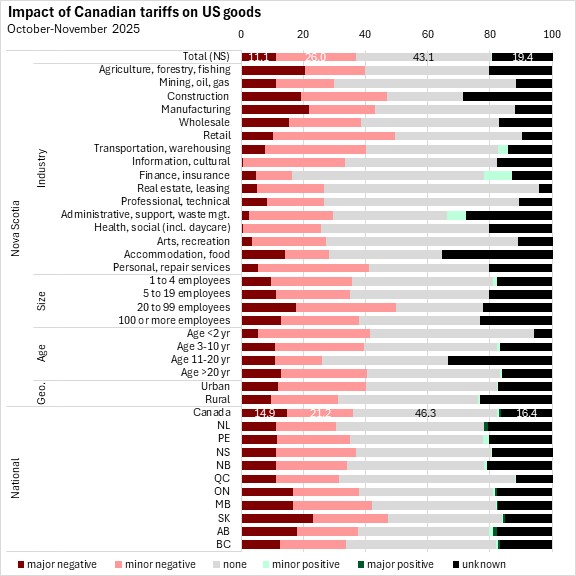

In Q4 2025, Nova Scotia businesses were asked questions for the second time about how the changing tariff landscape and the US administration is having an impact on business operations and results.

The majority of Nova Scotia firms reported no impact (46.1%) or unknown impacts (16.7%) from changes to US tariff policy. Among those that reported impacts, the vast majority reported minor negative impacts (22.8%) or major negative impacts (13.7%).

Likewise, the imposition of Canadian tariffs on US goods imports had no impacts (43.1%) or unknown impacts (19.4%) for the majority of Nova Scotia businesses. Major negative impacts were reported by 11.1% of Nova Scotia businesses along with minor impacts for 26.0% of Nova Scotia businesses.

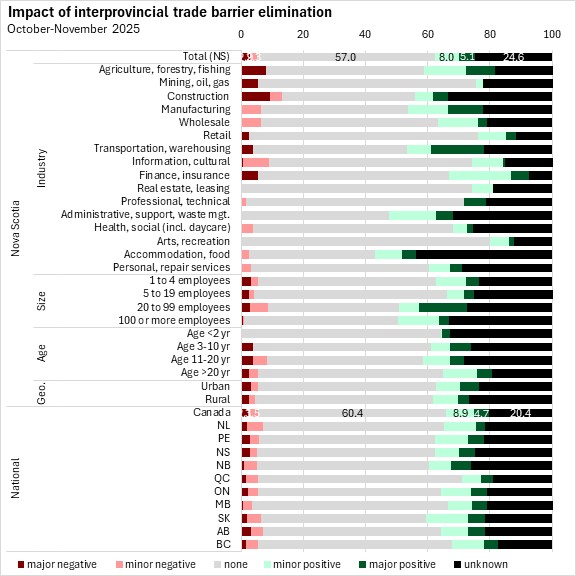

Elimination of interprovincial trade barriers had no expected impacts (57.0%) or unknown impacts (24.6%) for over three quarters of Nova Scotia businesses. Only 8.0% of Nova Scotia businesses expected minor positive impacts while 5.1% expected major positive impacts.

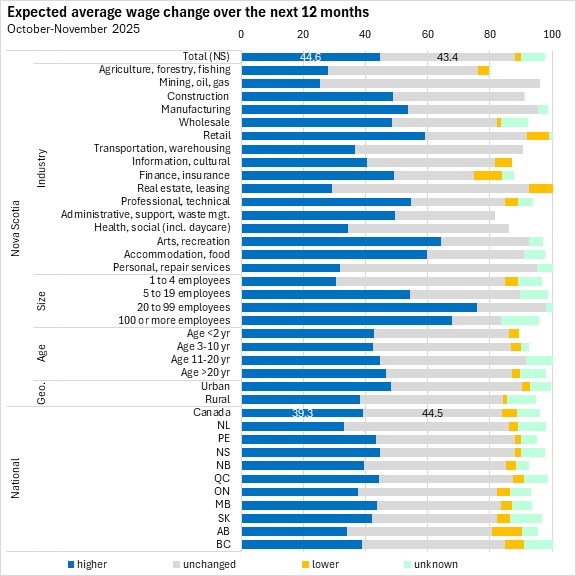

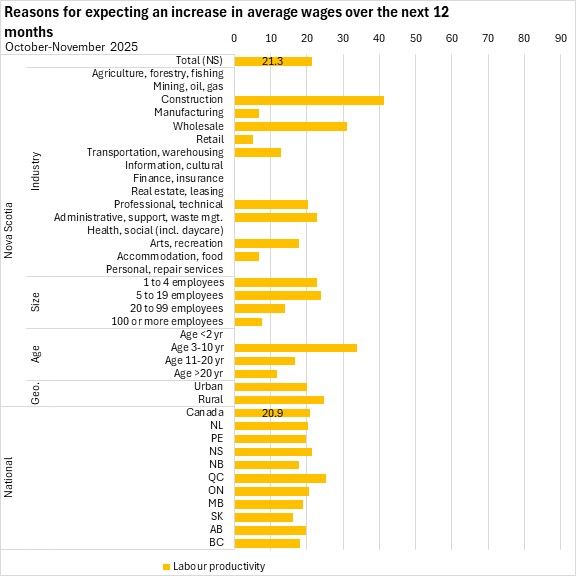

Expected average wage change over the next 12 months

In Q4 2025, businesses were asked about their expectations about wage changes in the next 12 months. In Nova Scotia, 44.6% of businesses expected average wages to increase over the next 12 months, while another 43.4% expected no change.

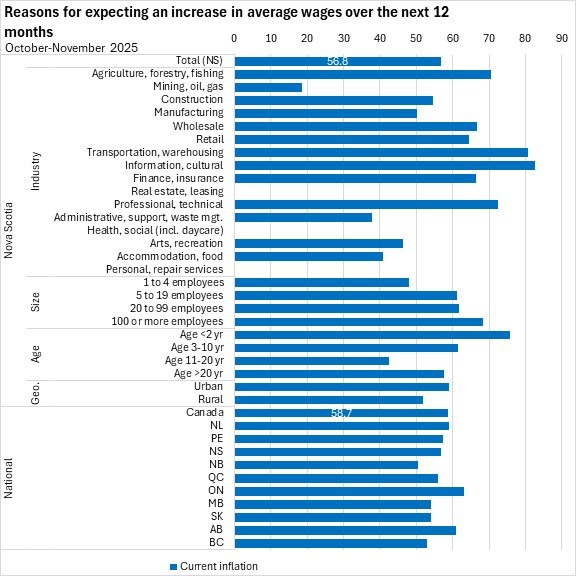

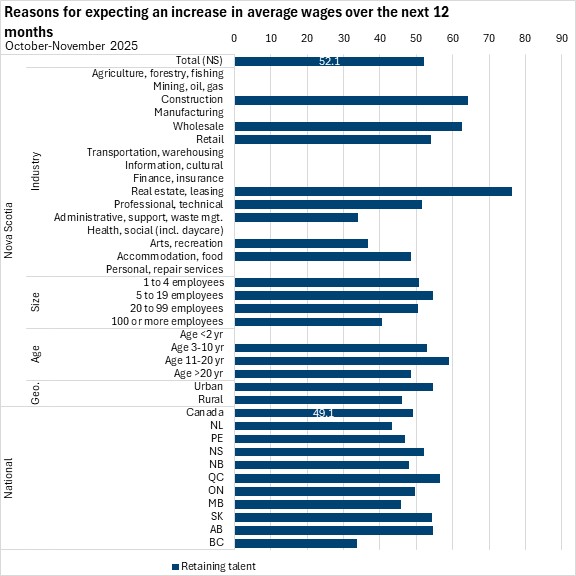

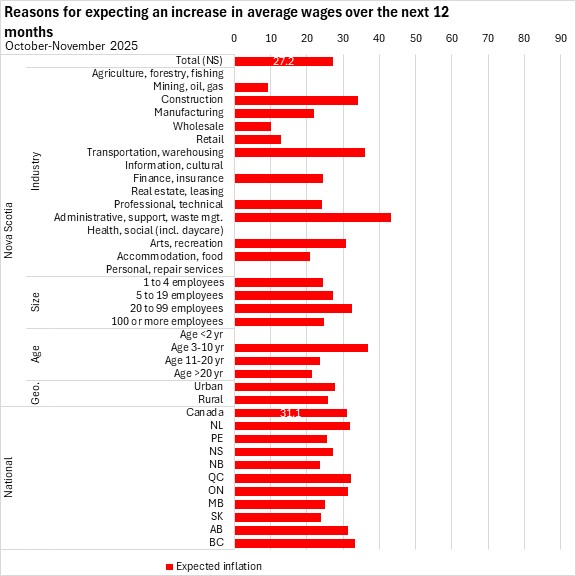

Among those who expected wage increases, 61.0% expect wages to increase at a similar pace as in the previous 12 months. Another 17.1% expect wages to increase faster, while 14.5% expect wages to increase slower. The primary reasons for expecting wage increases were the current rate of inflation (56.8%) and retaining talent (52.1%).

The most common reasons for expecting wage increases over the next twelve months were the current rate of inflation and retaining talent.

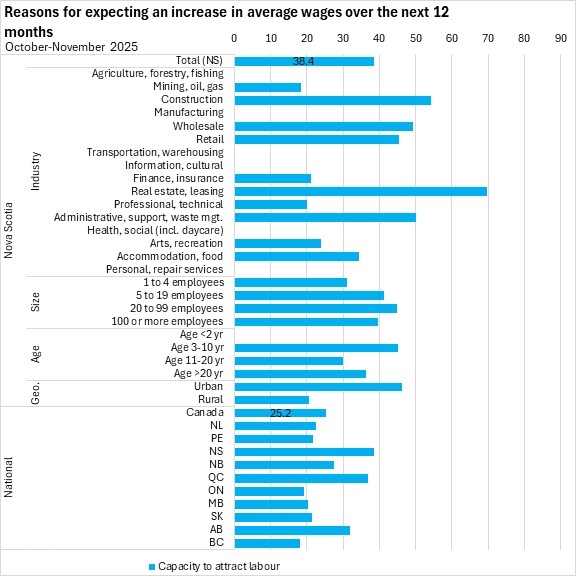

The capacity to attract labour was the third most cited reason among Nova Scotia businesses expecting wage increases in the next twelve months. Among provinces, businesses in Nova Scotia, Quebec and Alberta were more likely to report this reason.

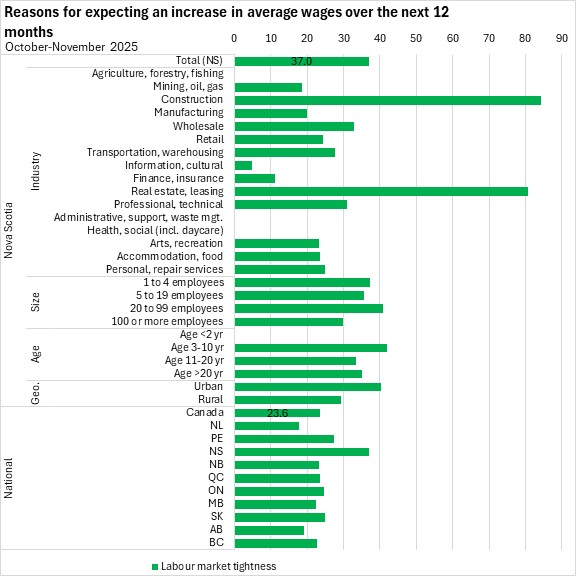

Labour market tightness was more commonly reported among construction and real estate/leasing industries. Nova Scotia businesses were more likely to report labour market tightness as a reason for expected wage increases compared to the national average.

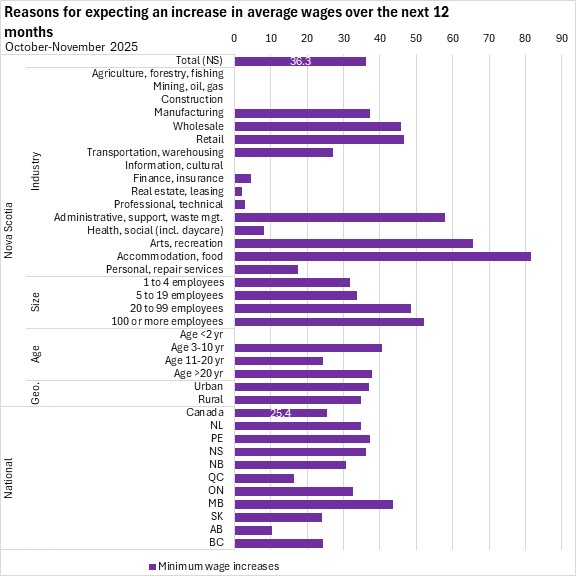

Minimum wage legislation was most commonly reported as a reason to expect wage increases by accommodation/food service, arts/recreation, and administration/support. Manitoba businesses were more likely than businesses in other provinces to report this reason.

Expected inflation and labour productivity were the least cited reasons to expect wage increases as reported by Nova Scotia businesses in Q4 2025.

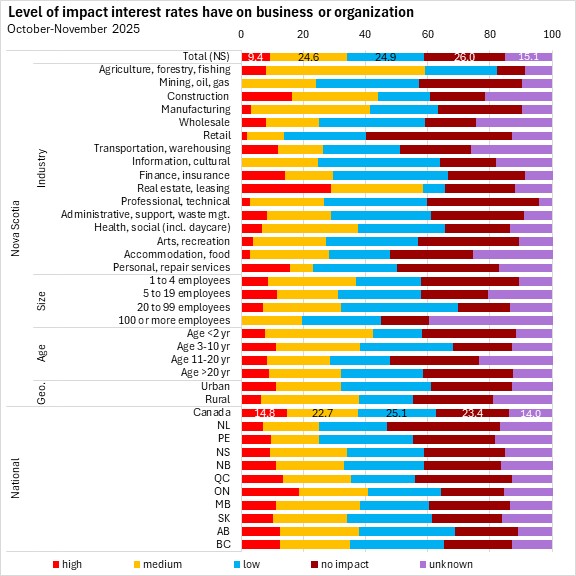

Level of impact interest rates have on business or organization

Businesses were asked about the level of impact that interest rates have on their business or organization. In Q4 2025, nearly half of Nova Scotia businesses reported low (24.9%) or medium (24.6%) impacts from interest rates, while another 26.0% reported no impact and 9.4% reported high impact. There were notably higher impacts among real estate/leasing and construction, as well as in Ontario.

Source: Statistics Canada. Table 33-10-1094-01 Future outlook over the next 12 months, fourth quarter of 2025; Table 33-10-1059-01 Business or organization expectations over the next three months, fourth quarter of 2025; Table 33-10-1060-01 Business or organization obstacles over the next three months, fourth quarter of 2025; Table 33-10-1061-01 Most challenging obstacle expected by the business or organization over the next three months, fourth quarter of 2025; Table 33-10-1093-01 Percentage of workforce anticipated to work on-site or remotely over the next three months, fourth quarter of 2025; Table 33-10-1069-01 Level of impact of tariffs or trade barriers on business or organization, fourth quarter of 2025; Table 33-10-1086-01 Expected average wage change over the next 12 months, fourth quarter of 2025; Table 33-10-1087-01 Reasons for expecting an increase in average wages over the next 12 months, fourth quarter of 2025; Table 33-10-1088-01 Level of impact interest rates have on the business or organization, fourth quarter of 2025

<--- Return to Archive