The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 28, 2025CANADIAN ECONOMIC ACCOUNTS, Q3 2025

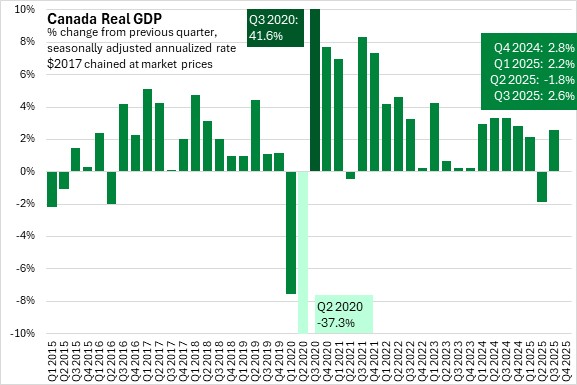

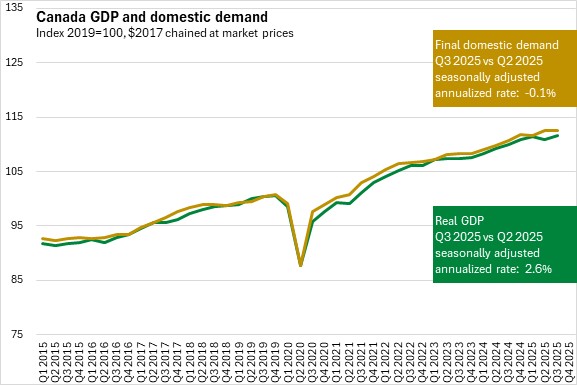

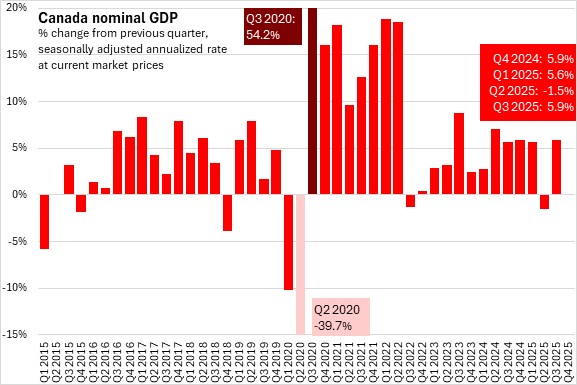

Canada’s Real Gross Domestic Product (GDP) grew at a seasonally adjusted annualized rate of 2.6% (all figures seasonally adjusted at annual rates) in the third quarter of 2025, following a 1.8% contraction in Q2 2025.

Growth was primarily driven by government capital investment and residential investment, as well as falling imports (which are subtracted from GDP). These were partially offset by declines in household consumption, government consumption, and non-residential investment.

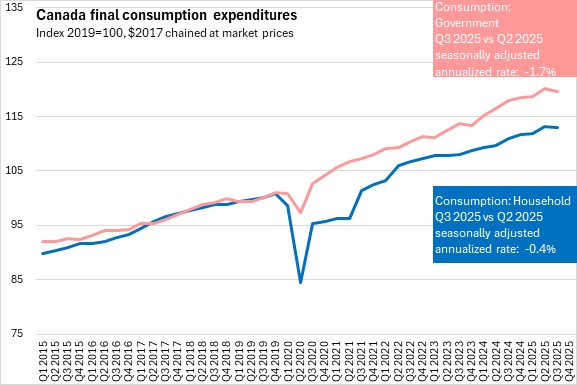

Household consumption growth declined at a seasonally adjusted annualized rate of 0.4% in Q3 2025. Decreased spending on new passenger vehicles was partially offset by higher expenditure on insurance/financial services. Government consumption expenditures fell by 1.7%, led by decreased spending in the federal government, partially coming off of higher spending in the second quarter due to the election.

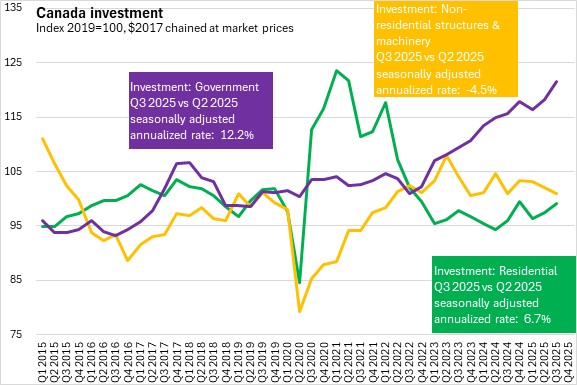

Residential investment increased by 6.7% in Q3 2025, driven by an increase in resale activity and renovations as new construction fell.

Non-residential investment fell by 4.5% in Q3 on lower investment in machinery and equipment, non-residential buildings and intellectual property products, while government investment was up 12.2% in Q3 2025.

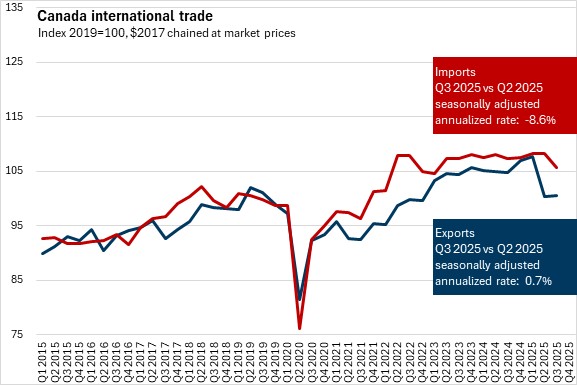

Exports increased 0.7% in Q3, following a drop of 25.1% in the previous quarter. Export growth was due to higher exports of crude oil and bitumen, and commercial services. Imports fell by 8.6%, the largest drop since the second quarter of 2022. Import declines were greatest for unwrought gold, silver and platinum, as well as industrial machinery.

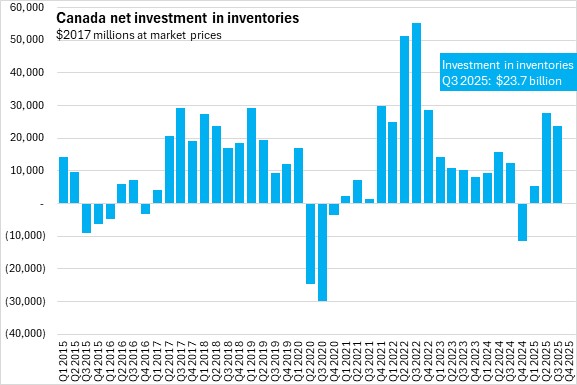

Investment in inventories was $23.7 billion in Q3 2025, down from $27.6 billion in Q2. Slowdowns in business inventory accumulation were notable in manufacturing, transportation and communication, and utilities.

Nominal GDP grew at a seasonally adjusted annualized rate of 5.9% in Q3 2025, following a 1.5% contraction in Q2 2025.

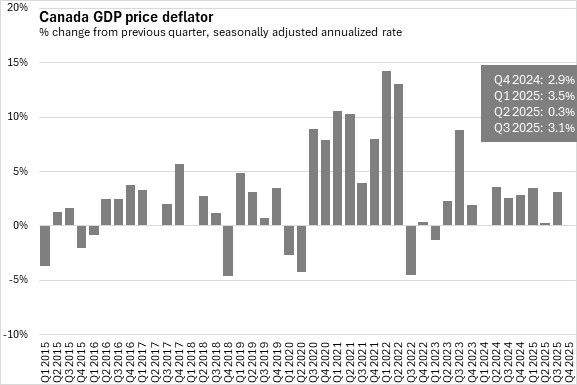

The overall GDP deflator (reflects overall price of domestically produced goods and services) grew 3.1% from the previous quarter.

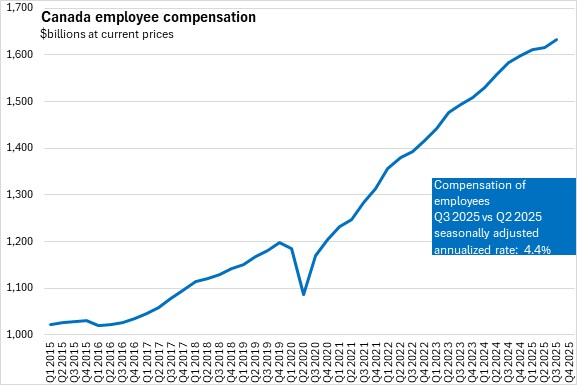

Employee compensation (measured in current prices, not real volumes) was up by a seasonally adjusted annualized rate of 4.4% in Q3. Wages were up in all industries except federal government public administration excluding military, with growth led by professional and personal services, finance/real estate/company management, and health care/social assistance.

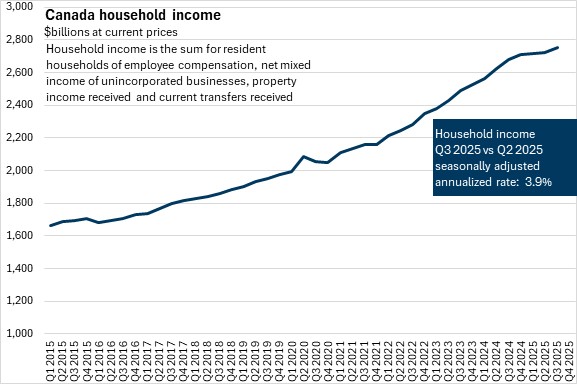

Including mixed income from unincorporated businesses, property income (such as interest and dividends from financial assets), current transfers (such as CPP and EI) with employee compensation, Canada's overall household income grew at a seasonally adjusted annualized rate of 3.9% in Q3 2025.

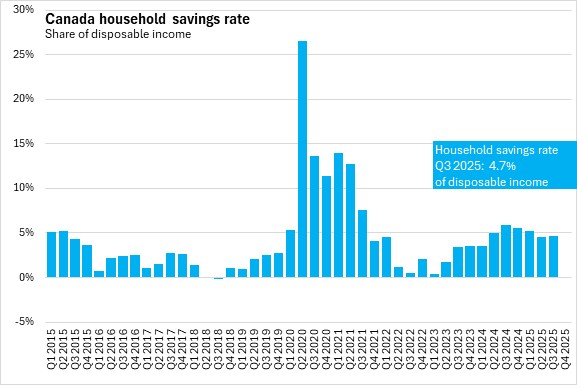

The household savings rate increased 0.1 percentage points to 4.7% of disposable income in Q3 as disposable income growth outpaced nominal household consumption.

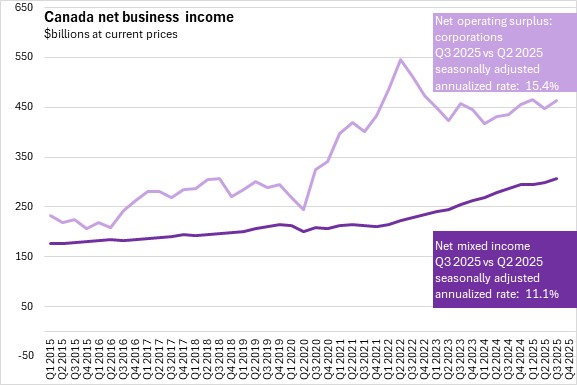

Net operating surplus for corporations grew at a 15.4% seasonally adjusted annualized rate, as rebounding oil and gas output increased income for non-financial corporations. Net mixed income of unincorporated businesses was up 11.1% in Q3.

Source: Statistics Canada. Table 36-10-0103-01 Gross domestic product, income-based, quarterly (x 1,000,000), Table 36-10-0104-01 Gross domestic product, expenditure-based, Canada, quarterly (x 1,000,000), Table 36-10-0112-01 Current and capital accounts - Households, Canada, quarterly; Table: 36-10-0106-01 Gross domestic product price indexes, quarterly

<--- Return to Archive