The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 18, 2026BRITISH COLUMBIA BUDGET 2026-27 The Province of British Columbia released its provincial budget for 2026-27 on February 17, 2026. This is the first 2026-27 provincial budget to be tabled.

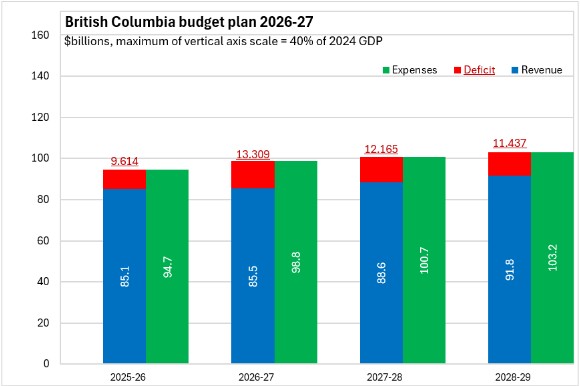

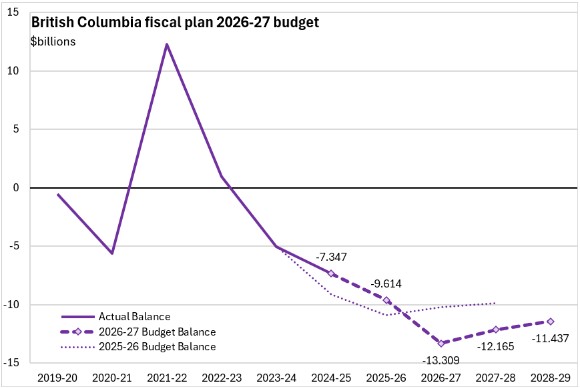

British Columbia's 2026-27 budget anticipates a deficit of $13.3 billion, widening from the $9.6 billion deficit now forecast for the 2025-26 fiscal year. Over the subsequent two fiscal years, British Columbia's deficit is projected to contract to $11.4 billion by 2028-29.

British Columbia's provincial government revenues are projected to slow to 0.5% growth in 2026-27 while expenditures are projected to rise by 4.4%. For 2027-28 and 2028-29, revenues are projected to grow by 3.6% in each year. British Columbia provincial government expenditures are projected to rise by 1.9% in 2027-28 and by 2.4% in 2028-29.

Expenses shown in British Columbia's budget plan include $5 billion in contingencies for each fiscal year from 2026-27 to 2028-29.

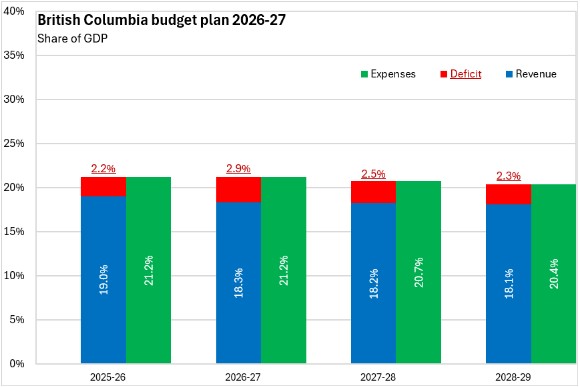

Measured as a share of GDP, the footprint of provincial government in British Columbia's economy amounts to 21.2% of GDP in 2026-27. This is projected to shrink slightly to 20.4% of GDP by 2028-29. British Columbia's deficit for 2026-27 amounts to 2.9% of projected 2026 nominal GDP.

British Columbia's net liabilities are expected to amount to 27.4% of GDP in 2026-27, rising to 33.2% by 2028-29.

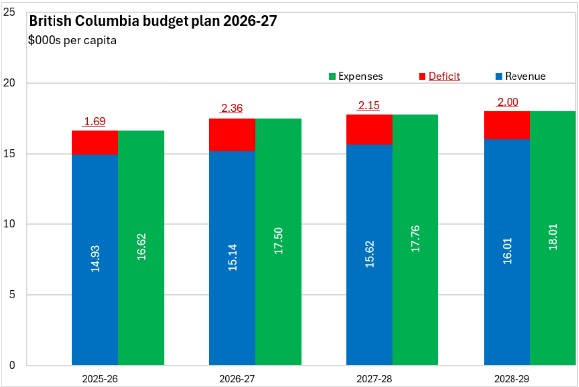

British Columbia's 2026-27 Budget expenditures amount to $17,502 per capita, funded by revenues of $15,145 per capita and a deficit of $2,357 per capita. Expenditures per capita are projected to rise by $507 by 2027-28 while per capita revenues rise $868 and the per capita deficit declines by $361.

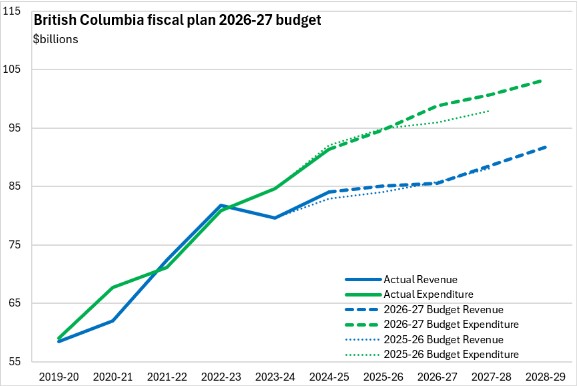

Compared with last year's fiscal plan, British Columbia's revenue projections for 2026-27 are little changed ($0.2 billion) while expenditures have been revised up by $2.9 billion.

With similar revenues and higher expenditures, British Columbia's deficit outlook has deteriorated compared to the 2025-26 projection.

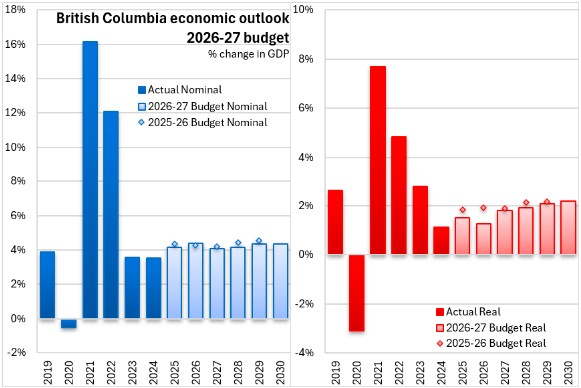

British Columbia's economic outlook is little changed from the 2025-26 projection, though real GDP growth in 2026 is now assumed to be slightly weaker as a result of slower population, employment and consumer spending growth. British Columbia's economic outlook assumes that residential investment remains stable while energy-related investment projects offset slowing non-residential investment in other sectors. Near-term exports are expected to be softened by existing tariff measures - those in place as of January 12, 2026. British Columbia's outlook for 2027 is more positive as trade related uncertainty is expected to ease while population growth resumes at a somewhat quicker pace. Residential investment and liquefied natural gas exports are also expected to support British Columbia's economic growth in the medium term.

Key Measures and Initiatives

British Columbia's 2026-27 Budget prioritizes safeguarding services, building homes/infrastructure, community safety, skills training and advancing major projects. There are also measures to manage expenditures and update the tax system Key measures include:

Protecting core services ($5.1 billion over 3 years)

- $2.8 billion for health, mental health and addictions care capacity

- $634 million for the K-12 education sector

- $330 million to support child care

- $475 million to support program redesign for children and youth with support needs

- $478 million for children and youth in care and alternative care

- $373 million to for income and disability assistance and for supports for adults with developmental disabilities

- $52 million for improved disability assistance for couples

Economic growth ($758 million over 3 years)

- $241 million to double SkilledTradesBC funding

- $30 million to train highly qualified professionals

- $12 million to enhance employer training grant and increase apprenticeships

- $400 million for a new strategic investment fund to secure federal funding

- $40 million to support permitting and advance priority projects

- $35 million for the 2026 intake of the Clean Industry Fund

- Up to $1 billion loan guarantee program to support equity ownership for First Nations

Community safety ($139 million over 3 years)

- $73 million for improved access to justice and court operations

- $26 million for Repeat Violent Offending Intervention Initiative

- $16 million for Chronic Property Offending Intervention Initiative

- $14 million for Special Investigation and Targeted Enforcement program

- $10 million for Community Safety and Targeted Enforcement program

Expenditure management and tax measures

- Increasing the tax rate on the first income bracket from 5.06% to 5.60% while pausing tax bracket indexation from 2027 to 2030

- Increasing the BC tax reduction credit by $115

- Broadening the Provincial Sales Tax to cover professional services

- Changing terms of property tax deferment loans

- Increasing the speculation and vacancy tax rates for foreign property owners to 4%

- Introducing a temporary manufacturing and processing investment tax credit

- Reducing administrative and discretionary spending by $3.5 billion over three years

- Streamlining government operations and reducing full-time equivalent employment by 15,000 to save $2.8 billion over three years

British Columbia Budget 2026-27

<--- Return to Archive