The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

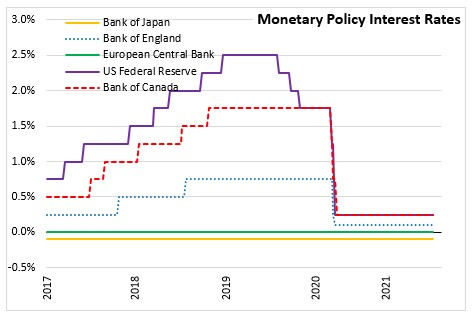

December 15, 2021US MONETARY POLICY At its scheduled Federal Open Market Committee (FOMC) meeting, the Federal Reserve announced that it would keep the target range for the federal funds rate at 0 to 0.25 per cent. The Committee expects to maintain this target rate until labour market conditions are at levels that are consistent with the Committee’s assessment of maximum employment as inflation has exceed 2 percent for some time.

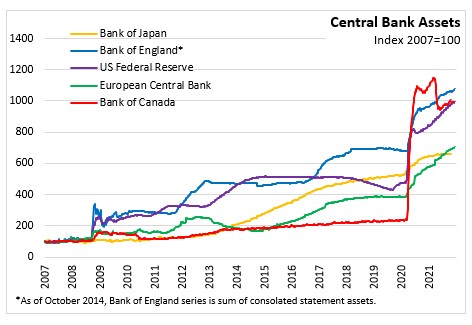

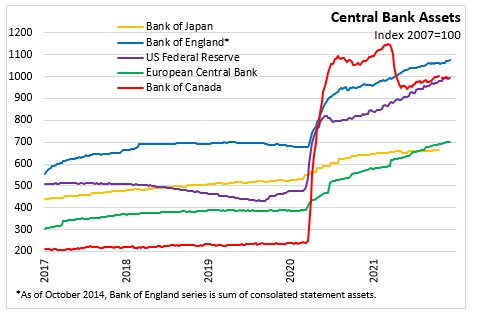

Based on inflation developments and improvements in the labour market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities. Beginning in January, the Committee will increase its holdings of Treasury securities by at least $40 billion per month and of agency mortgage‑backed securities by at least $20 billion per month. It is expected that similar reductions in the pace of net asset purchases will be appropriate each month based on market conditions, and will be adjusted based on the economic outlook.

US economic activity and employment have continued to strengthen, supported by wider vaccination rollouts and strong policy support. While the hardest hit sectors continue to be affected by the pandemic, recent indicators point an improvement in these sectors. With solid employment gains, the unemployment rate has declined. The FOMC projects real Gross Domestic Product (GDP) in the US to increase 5.5 per cent in 2021, 4.0 per cent in 2022 and 2.2 per cent in 2023.

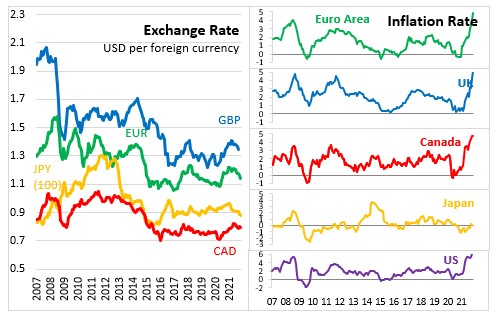

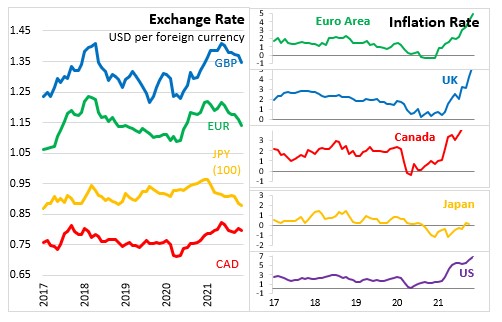

Inflation is elevated, reflecting largely factors that are expected to by transitory. The United States Consumer Price Index for All Urban Consumers increased 6.8 per cent year-over-year in November. Supply and demand imbalances combined with pent-up demand following reopening of the economy have contributed to price increases in some sectors as well. The FOMC projects US inflation to be 5.3 per cent in 2021, before falling down to 2.6 per cent in 2022 and 2.3 per cent in 2023. The current inflation projections show an upgrade for the next tree years compared to the September projections.

The Federal Reserve noted that the path of economic recovery continues to depend on the course of the pandemic. The Committee will continue to monitor economic developments and is prepared to adjust the monetary policy measures as appropriate. The next scheduled FOMC meeting will be held on January 25/26, 2022.

Source: US Federal Reserve, FOMC Statement, Projection Materials (December 15, 2021)

<--- Return to Archive