The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 26, 2022BANK OF CANADA MONETARY POLICY The Bank of Canada announced today that it will hold its target for the overnight rate at the effective lower bound of 0.25%, with the Bank rate at 0.50% and the deposit rate at 0.25%. The Bank has removed its exceptional forward guidance on its policy rate due to overall economic slack now being absorbed. The Bank will continue its reinvestment phase and keep its overall holdings of Government of Canada bonds roughly constant at least until it begins to raise the policy interest rate.

Global Economy

Global economic activity saw a robust growth in 2021. Despite some near-term moderation due to the emergence of the Omicron variant, global economic activity is expected to continue to increase over the next two years.

Public health measures related to the Omicron variant are expected to slow down economic activity in the first quarter of 2022. However, the economic impact is expected to be less severe compared to the previous waves.

More broad based supply chain disruptions pushed inflation up in most advanced and emerging-market economies. Supply shortages are expected to dissipate gradually by the end of 2022. Inflation pressures from strong demand for goods, supply-chain disruptions and high energy prices are expected to subside in 2022. Inflation is expected to decline to about 3.0% by the end of the year.

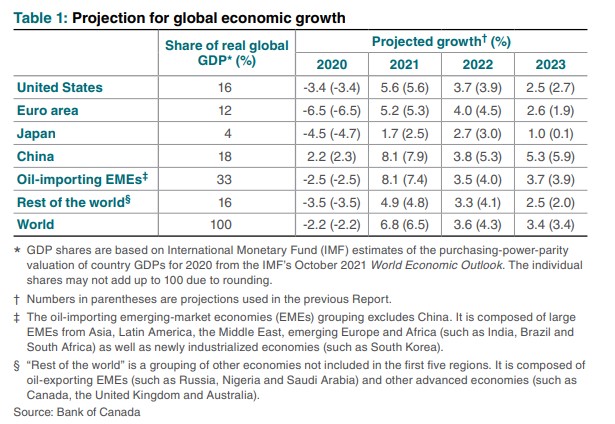

The Bank of Canada projects global real GDP growth to be slower than anticipated in its October 2021 forecast with an increase 6.8% in 2021, 3.6% in 2022, and 3.4% in 2023. This is due to tighter-than-anticipated travel and public health restrictions due to the Omicron variant, ongoing correction and weakness in China's property sector and anticipated withdrawal of policy stimulus in the United States.

In the United States, gross domestic product (GDP) rebounded in the last quarter of 2021 following a period of softening at the end of summer. The labour market has improved with declining unemployment rate and elevated number of job vacancies. Strong labour markets and accumulated household savings during the pandemic will support consumption over the next two years. With the withdrawal of policy stimulus, real GDP growth in the US is expected to moderate from 5.6% in 2021 to 3.7% in 2022 and 2.5% in 2023.

While the upward price pressures from high energy prices and supply-demand imbalances are expected to decline gradually, excess demand in the economy is expected to keep US personal consumption expenditures (PCE) inflation to peak at 5.7% in Q1 2022 and reach 2.4% at the end of 2023.

Many countries in the Euro Area reintroduced targeted restrictions at the end of 2021, slowing economic growth in the region. The new wave of restrictions are expected to be short-lived. Economic growth in the Euro Are is expected to continue going into 2022 and 2023.

Growth in China is expected to slow to 3.8% in 2022 as weakness in property sector weigh on demand. Tightening of regulations in the property sector resulted in a decline in housing activity in China. This combined with other regulatory changes in the technology and education sectors are expected to drag domestic demand. While growth is expected to increase to 5.3% in 2023, uncertainty around the impacts of China's zero-COVID policy and the weakness of the property sector could slow down the growth.

Canadian Economy

The Canadian economy saw a strong rebound in the second half of 2021. Economic growth is expected to slow down in the first quarter of 2022 due to the impacts of the Omicron variant. However high vaccination rates and improved adaptability of businesses and consumers are expected to limit the impacts of this wave of the pandemic.

Labour market conditions had recovered to pre-pandemic levels by the end of 2021. Given the change in demographics, firms are having difficulty finding workers putting pressure on wage growth.

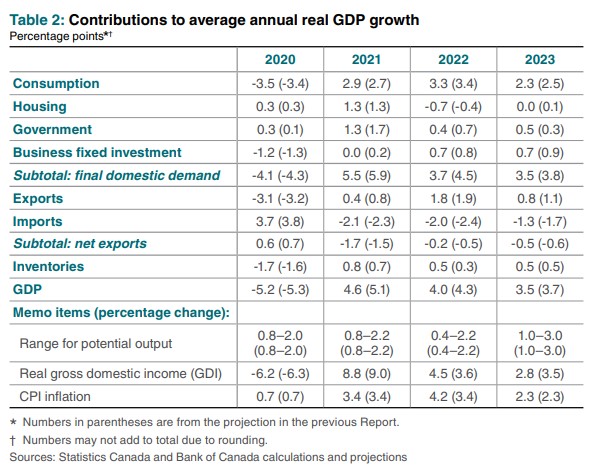

As strong demand continues and supply bottlenecks recover, the Bank of Canada projects real GDP to grow 4.0% in 2022 and 3.5% in 2023. This growth is slightly weaker compared to the Bank's October projections.

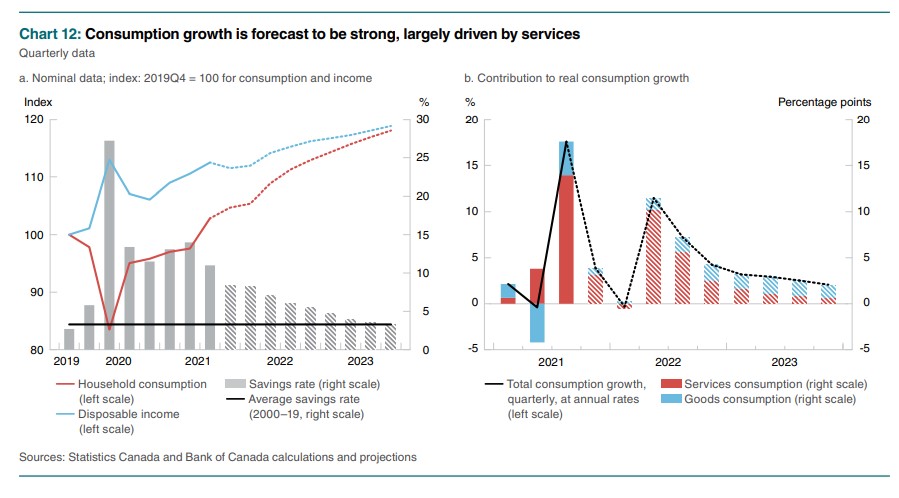

Consumption growth is leading Canada’s recovery with a rebound in in-person spending combined with elevated good purchases. Spending on hard-to-distance services is expected to increase as cautiousness around the pandemic fades. Housing market activity is expected to slow down from the current levels but will remain elevated. Reduced support from accumulated savings, increasing borrowing rates and slowing pandemic-induced demand will weigh on resale activity. The easing of supply chain constraints will support residential construction and help balance market supply and demand. This will contribute to a moderation in house price growth.

Canada’s job gains have been robust as in-person services have resumed. The Omicron variant is weighing on employment mostly in service sectors but the impacts are expected to be short lived. Wage growth is picking up and productivity is expected to increase with more workers finding jobs that better fit their skills.

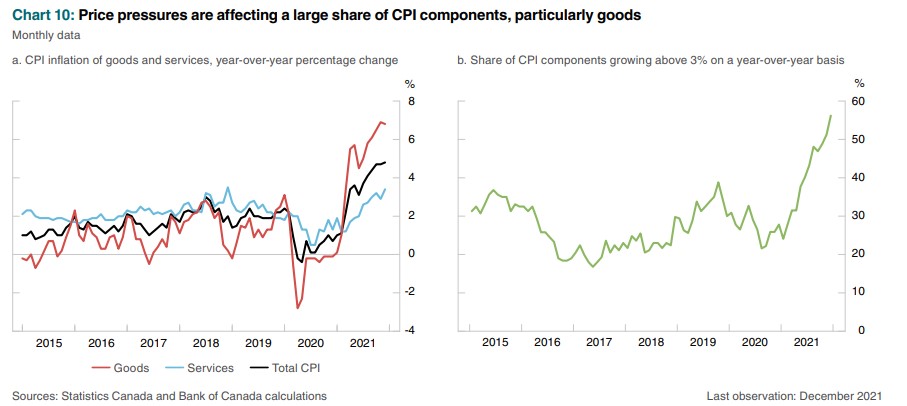

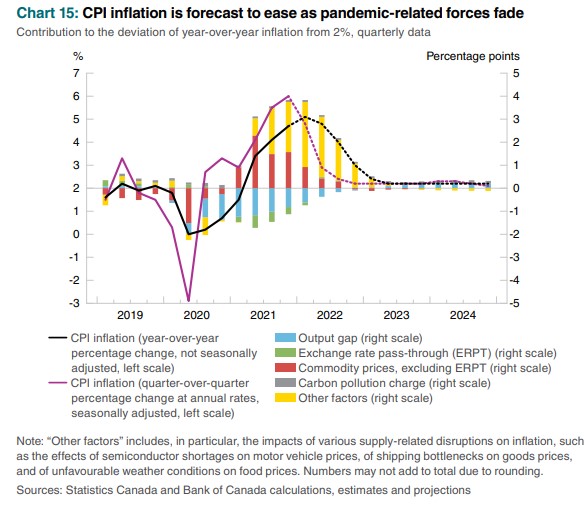

Consumer price index (CPI) inflation is expected to average around 5.0% in the first half of 2022 because of higher prices for durable goods, energy and food. Durable goods prices are being pushed up by global supply chain disruptions, while Canadian energy prices are higher because of elevated global oil and natural gas prices.

Services price inflation has increased to 3.5% driven by higher prices for building materials and labour. As a result, price pressures have broadened across CPI components. Core measures of inflation have also increased since the October MPR.

Upward pressure on inflation is expected to ease in the second half of 2022 as pandemic-related impacts fade. The Bank of Canada projects inflation to average 4.2% in 2022 and decline to 2.3% in 2023.

Bank of Canada: Rate Announcement; Monetary Policy Report - January 2022

<--- Return to Archive