The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

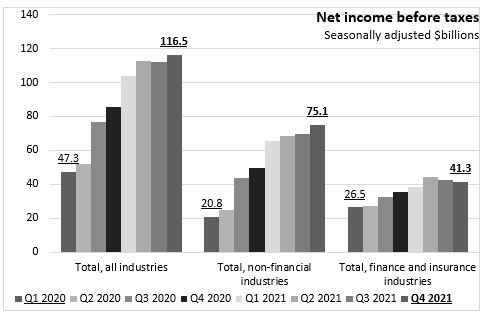

February 23, 2022QUARTERLY FINANCIAL STATISTICS FOR ENTERPRISES, Q4 2021 In Q4 2021, Canadian enterprise net income before taxes (seasonally adjusted) increased by $4.2 billion from the previous quarter to $116.5 billion. Net income before taxes was up $5.4 billion for non-financial corporations and was down $1.1 billion in finance and insurance corporations. The omicron variant and flooding in British Columbia disrupted certain sectors in Q4.

Compared with Q4 2020, net income before taxes increased by $31.2 billion: $25.4 billion for non-financial corporations and $5.7 billion for finance and insurance corporations.

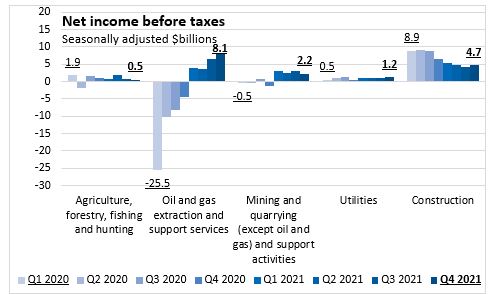

Oil and gas extraction (and related support activities) reported the largest improvements in net income before taxes, changing from a $4.5 billion loss in Q4 2020 to a profit of $8.1 billion in Q4 2021. There was also a $3.5 billion improvement in net income before taxes in mining and quarrying (and related support). Construction net income increased slightly in Q4 2021 after declining in the previous five quarters.

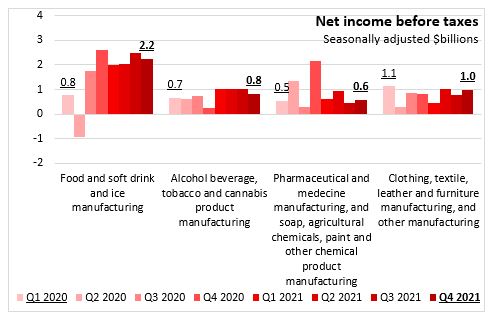

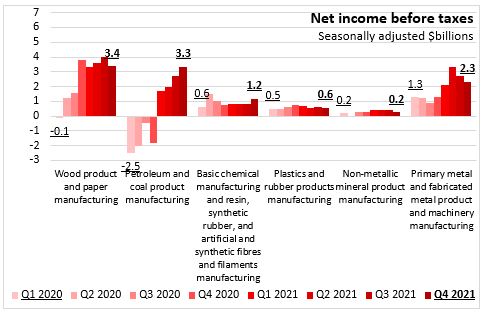

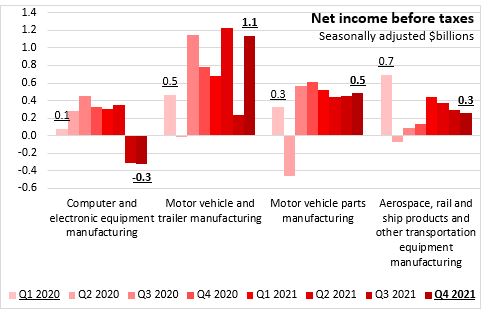

Across many manufacturing industries, there was substantial erosion in net income in Q2 2020. Since then, net income before taxes has recovered fully or partially for many manufacturing industries. For Q4 2021, net income was up in the most in petroleum and coal products, and primary metal and fabricated metal product and machinery manufacturing compared to last year. Pharmaceutical and medicine manufacturing, and soap, agricultural chemicals, paint and other chemical product manufacturing had the largest decline.

Flooding and disruption to rail service from the Port of Vancouver, contributed to bottlenecks for output from the wood and paper product manufacturing and inputs into the primary metals and fabricated metal products sector. Both sectors had net income decline in Q4 2021.

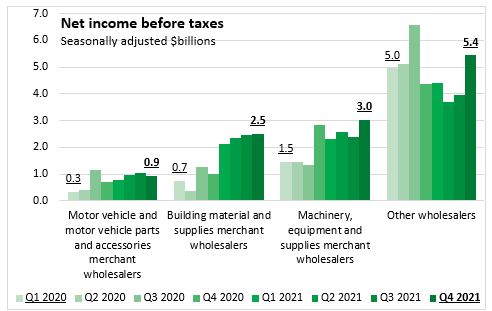

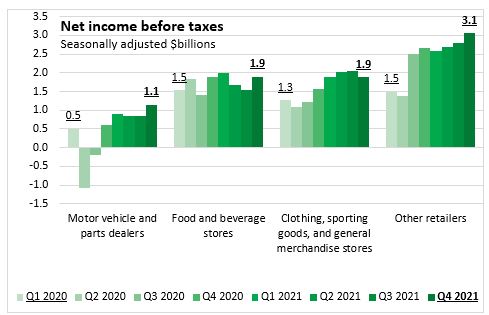

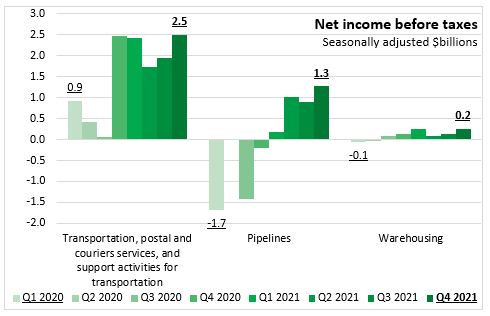

In service industries associated with distribution of goods (wholesale, retail, transportation/warehousing), net income before taxes was up notably compared to last year for pipelines, building material wholesalers, and other wholesalers in Q4 2021.

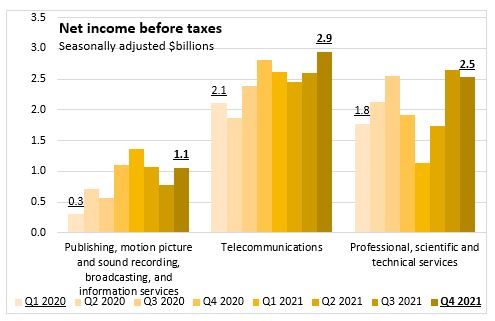

Net income before taxes has increased for publishing/broadcasting/information services, professional services, and telecommunications compared to Q2 2020.

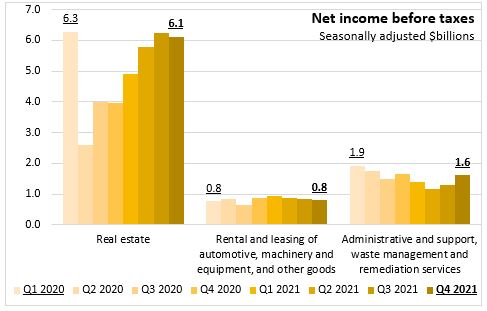

Real estate corporate net income was particularly high in Q1 2020 before it fell in Q2 2020. Net income for real estate corporations declined slightly in Q4 2021.

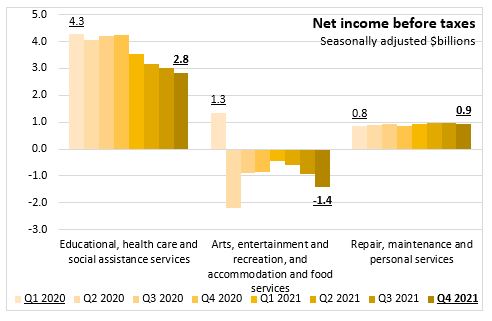

Net income for the arts, entertainment and recreation, and accommodation and food services sector have been particularly hard hit by the pandemic. These corporations continue to post negative net income before taxes in Q4 2021. The negative net income in Q4 2021 is the largest loss since Q2 2020.

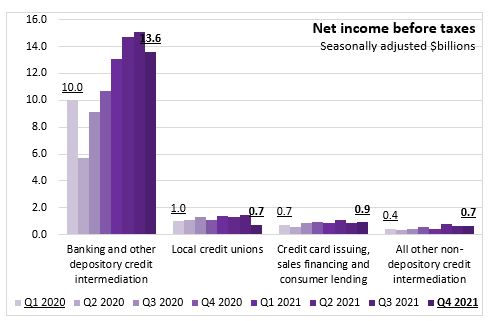

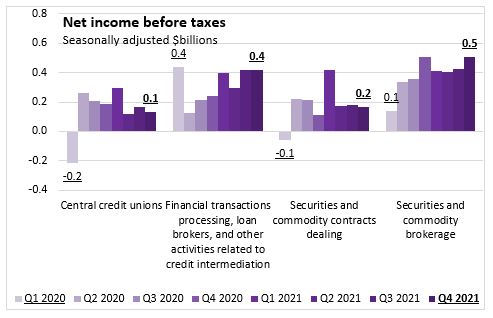

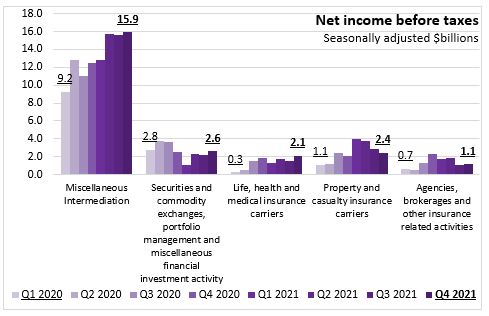

Among financial corporations, increasing net income is particularly concentrated in banking/depository credit intermediation as well as miscellaneous intermediation. In Q4 2021, banking/depository credit intermediate decreased (-$1.5 billion). Floods in British Columbia were associated with higher insurance claims and a 13.9% decline in net income before taxes among property and casualty insurance carriers in Q4 2021.

Source: Statistics Canada. Table 33-10-0226-01 Quarterly balance sheet and income statement, by industry, seasonally adjusted (x 1,000,000)

<--- Return to Archive