The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

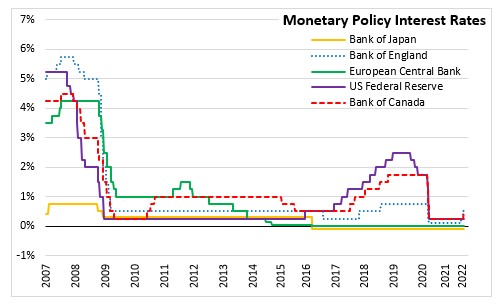

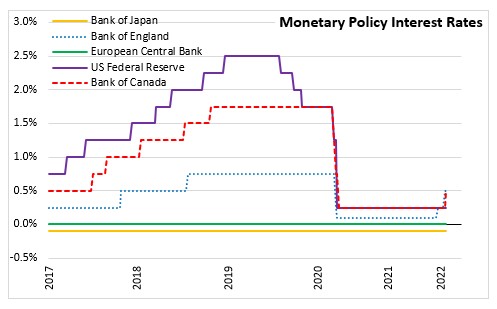

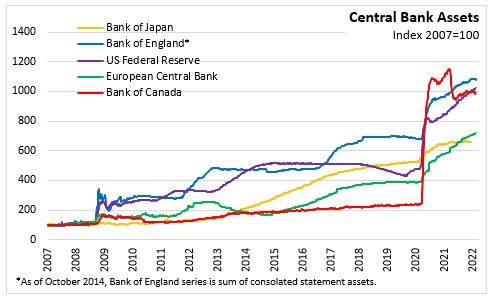

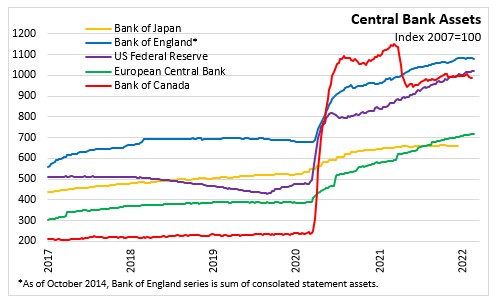

March 02, 2022BANK OF CANADA MONETARY POLICY The Bank of Canada today increased its target for the overnight rate by a quarter of a percentage point to 0.5%, with the Bank rate at 0.75% and the deposit rate at 0.5%. The Bank will keep its overall holdings of Government of Canada bonds on its balance sheet roughly constant until such time as it becomes appropriate to allow the size of its balance sheet to decline.

Global economic activity was broadly in line with the Bank's January Monetary Policy Report (MPR). While new variants of the virus remains as a concern, economies are emerging from the impact of the Omicron wave more quickly than expected. Strong consumer demand is providing support to economic activity. Global supply bottlenecks limit production although there are indications that some constraints have eased.

The recent invasion of Ukraine by Russia is a major risk to global economic activity. Strong increases in oil and other commodity prices will add to inflation globally, and negative impacts on confidence and new supply chain disruptions would limit global growth. Volatility in financial markets has also increased.

In Canada, economic growth in the final quarter of 2021 was stronger than the Bank's January MPR projection at 6.7%. This confirms the Bank's view that economic slack has been absorbed. With strong global demand, both exports and imports have increased. Temporary layoffs in service sectors due to the Omicron wave created some setback in Canada's labour market but the rebound appears to be underway. Solid housing demand is adding pressure to housing prices.

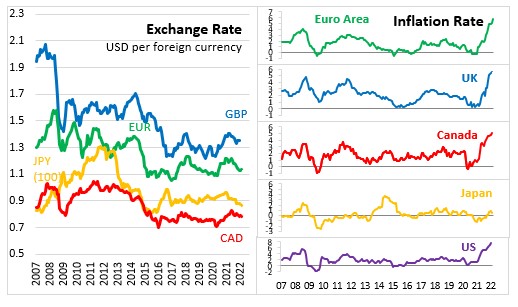

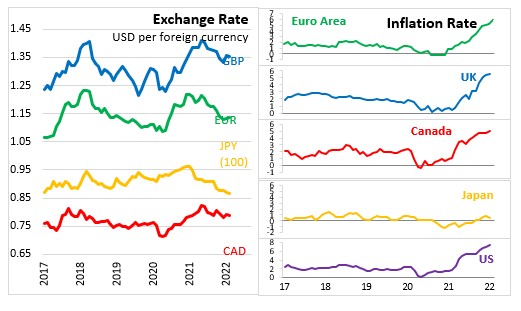

CPI inflation was 5.1% in January 2022, and remains well above the Bank's target range. The Bank noted that price increases have become more pervasive, and measures of core inflation have all risen. The invasion of Ukraine is expected to put upward pressure on energy and food-related commodity prices. Inflation is expected to be higher than anticipated in the January MPR over the near term with the risk that this could lead to an upward drift on longer-run inflation expectations.

The Bank noted that interest rates will need to rise further as the economy continues to grow and inflation pressures remain elevated. The Bank will assess the timing to end the reinvestment phase and allow its holdings of Government of Canada bonds to begin to shrink. The resulting quantitative tightening (QT) will complement increases in the policy interest rate. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target.

The next scheduled Bank of Canada interest rate announcement is April 13, 2022. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR at the same time.

Bank of Canada: Rate Announcement

<--- Return to Archive