The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

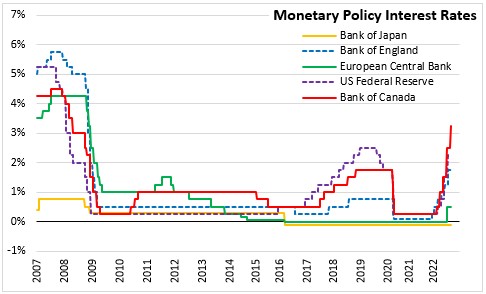

September 07, 2022BANK OF CANADA MONETARY POLICY The Bank of Canada today increased its target for the overnight rate by 75 basis points to 3.25%, with the Bank rate at 3.5% and the deposit rate at 3.25%. The Bank is also continuing its policy of quantitative tightening.

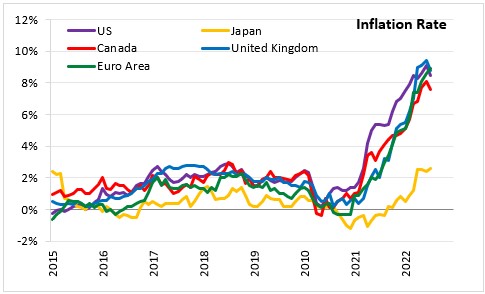

The Russian invasion of Ukraine, the effects of COVID-19 pandemic and ongoing supply disruptions all continue to weigh on activity while boosting inflation. Global inflation remains high and central banks continue to tighten monetary policy around the world. Globally labour markets are tight, and commodity prices are volatile.

In Canada, real GDP increased 3.3% in the second quarter of 2022, weaker than the Bank's July Monetary Policy Report. Housing market activity is moderating from exceptionally high levels as mortgage rates rise. With weaker global demand as well as tighter monetary policy, the Canadian economy is expected to register a moderate growth in the second half of the year.

In Canada, inflation slowed to 7.6% in July 2022 due to decline in gasoline prices. Inflation excluding gasoline prices increased which indicated further broadening of price pressures specifically in services. The Bank’s core measures of inflation ranging between 5.0% and 5.5% in July 2022. The Bank suggests that inflation expectations will remain higher in short-term.

Against the backdrop of persistent inflation and the economy operating in excess demand, the Governing Council continues to judge that interest rates will need to rise further. The pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation.

The next scheduled date for announcing the overnight rate target is October 26, 2022.

Bank of Canada: Rate Announcement

<--- Return to Archive