The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

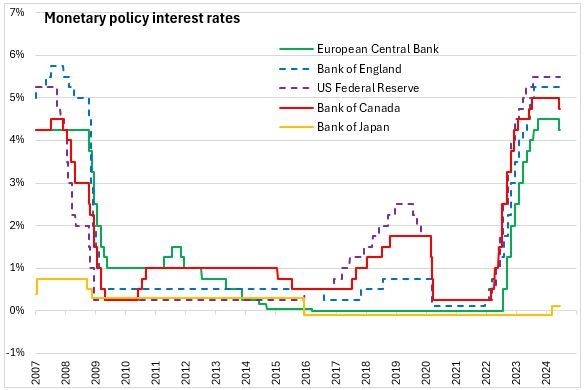

June 14, 2024BANK OF JAPAN MONETARY POLICY On June 14, 2024, the Policy Board of the Bank of Japan decided leave their uncollaterized overnight call rate to a range of 0.0%-0.1%.

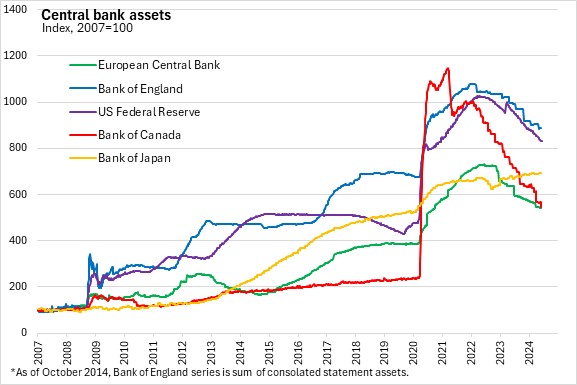

The Bank of Japan will also purchase approximately the same amount of Japanese government bonds (JGBs) as before, currently it is about 6 trillion yen per month. The Bank will also reduce Commercial Paper (CP) and corporate bonds and will discontinue the purchases in about one year. The current plan is to follow the March 2024 monetary policy meeting decisions. Thereafter, the Board will meet at the next monetary policy meeting to decided on the detailed plan for the reduction of its purchase amount during the next one to two years.

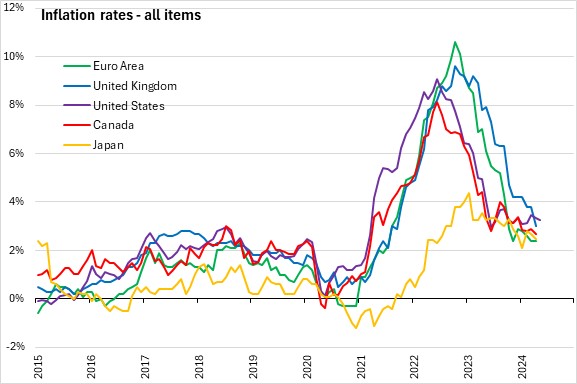

Japan's economy has recovered moderately. Moderate growth in overseas economies has supported growth, to some extent, but exports remain flat. Industrial production has been pushed down recently by suspension of production and shipment of automakers. Business fixed investments improved moderately with improvements in corporate profits. Employment and income have also slightly improved. Consumer price index (all items less fresh food) has been in the range of 2.0%-2.5% as service prices have continued to rise reflecting wage increases. Expectations of inflation have risen moderately.

Japan's economy is likely to continue growing at a pace above its potential growth rate with growth in overseas economies. Inflation is likely to continue to grow at above 2.0% rate through 2024 as the effects of the government's economic measures pushing down CPI inflation wane. Underlying CPI inflation is expected to increase gradually with a projected output gap improvement and inflation expectations rise.

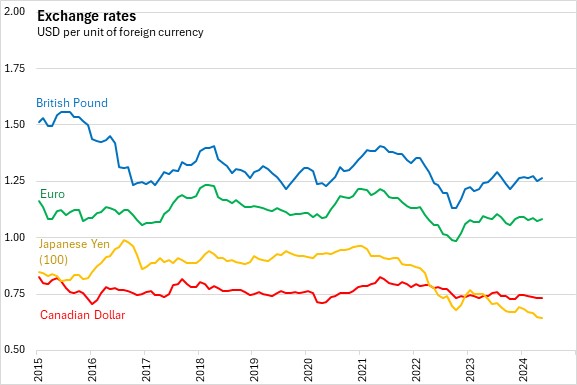

With current economic conditions, the Bank anticipates that the financial conditions will be maintained for the time being while paing attention to developments in financial and foreign exchange markets and their impact on Japan's economy.

The Bank will release their next monetary policy statement on July 31, 2024.

Source: Bank of Japan, Statement on Monetary Policy

<--- Return to Archive