The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

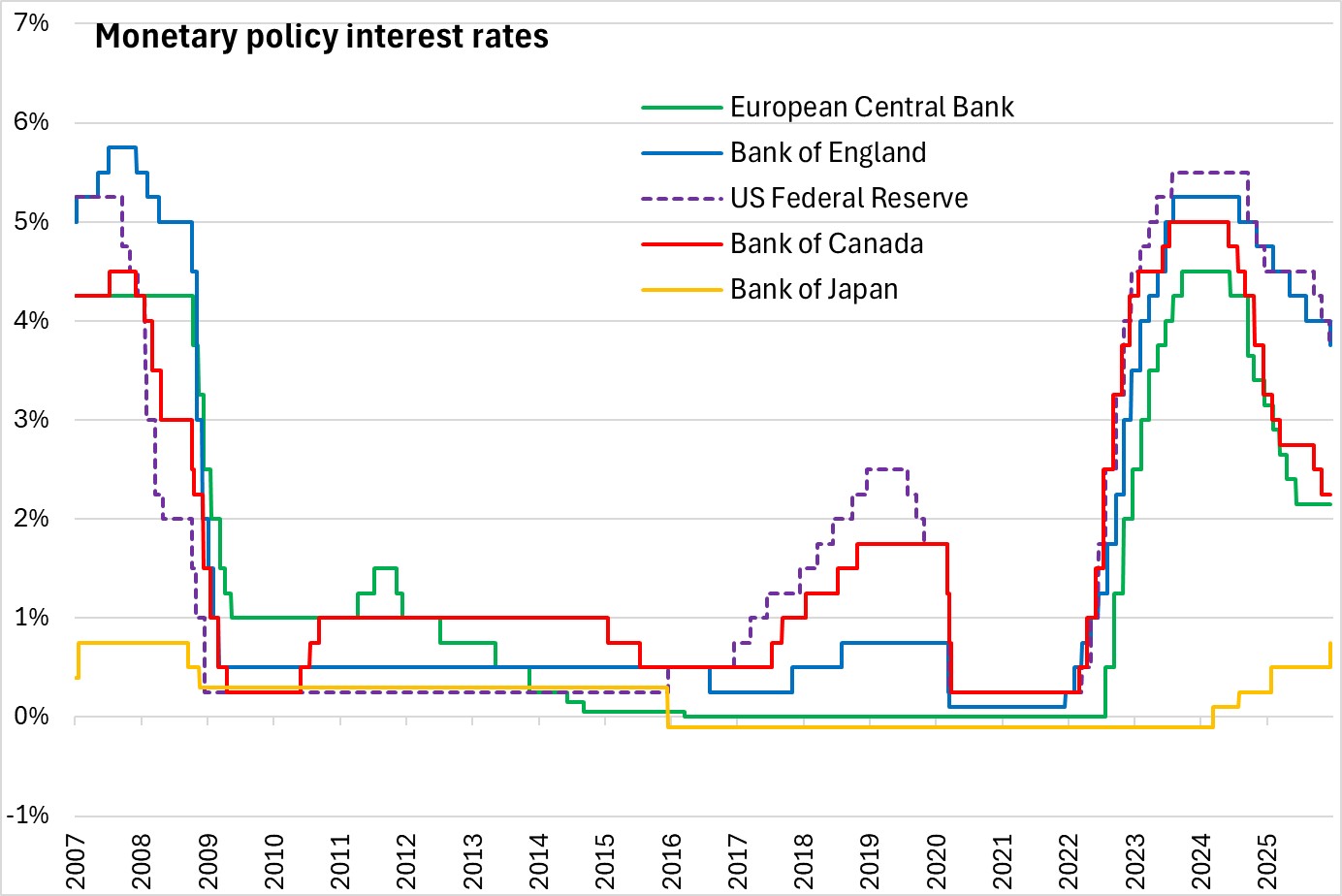

December 19, 2025BANK OF JAPAN MONETARY POLICY Today, the Policy Board of the Bank of Japan decided to increase their uncollateralized overnight call rate to around 0.75%.

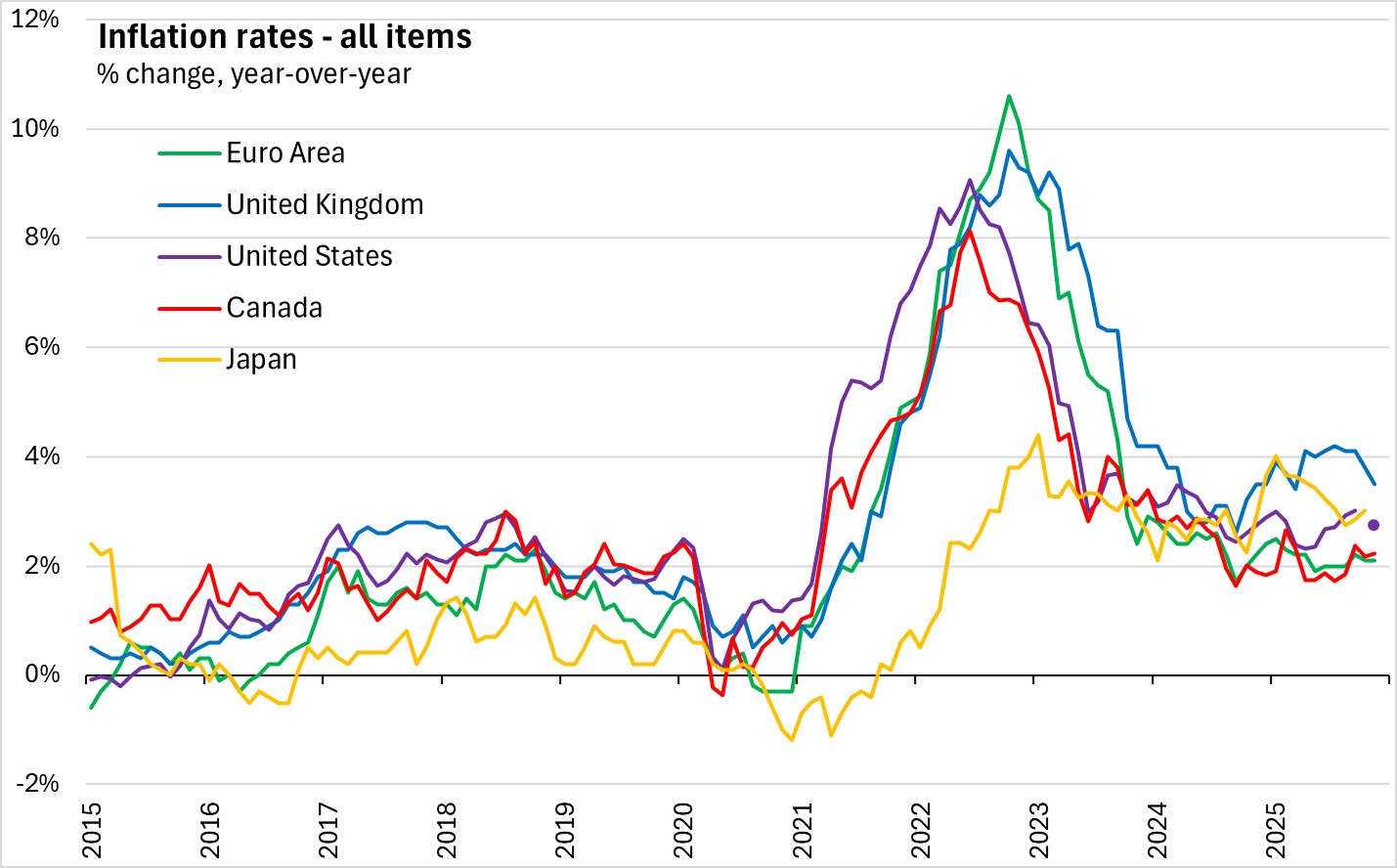

Japan's economy has recovered moderately, with some weakness in exports and industrial production. Labour market conditions continue to be tight and wage growth has been strong. The Bank of Japan expects wage gains to continue into next year. Despite the current tariff environment, corporate profits are expected to remain high. CPI inflation has continued to rise moderately as wage growth is passed through to consumers. Uncertainty regarding the US economy remains a risk to the outlook, but the degree of uncertainty has declined.

The Bank of Japan will continue to raise the policy interest rate and adjust the degree of monetary accommodation. The Bank will respond to developments in economic activity and prices, as well as financial conditions, to sustainably achieve the price stability (2 per cent) target.

The Bank will release their next monetary policy statement on January 23, 2026.

Source: Bank of Japan, Statement on Monetary Policy; Outlook for Economic Activity and Prices (October 2025)

<--- Return to Archive