The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 12, 2018FAMILY INCOME AND INDIVIDUAL INCOME, T1 FAMILY FILE, 2016 Statistics Canada has released estimates of family and individual income generated from 2016 T1 personal income tax returns. This data shows how income is changing over time for particular types of families as well as how it compares by type of income and geography.

Within Statistics Canada’s estimates, there are income results for those who are in census families (couples and lone-parent families) as well as for those who are not in census families. The data shows median income for families (which often include more than one earner) as well as for persons within families (which allows for comparison with those who are not in census families). There are data available for provinces, for Census Metropolitan Areas (CMA), smaller Census Agglomerations (CA) and areas outside CMA and CA communities.

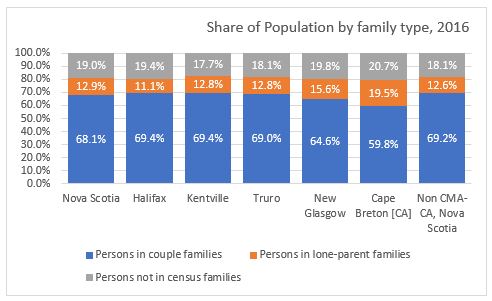

For Nova Scotia, the T1 records indicate a total of 907,080 persons (totals will not align with official population estimates). Of these, 68.1 per cent were in couple families – the lowest such proportion among the provinces while there were 12.9 per cent in lone-parent families (highest among provinces) and 19.0 per cent not in any form of census family (second highest among provinces).

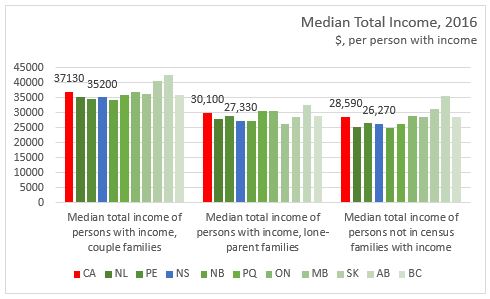

On an individual basis for couples (median among the individuals reporting income within couples), median total earnings were $35,200 in Nova Scotia in 2016 versus a national average of $37,130. Median income from all sources among persons in lone-parent families who had income in Nova Scotia during 2016 was $27,330 while the national median was $30,100. Median income from all sources among persons not in census families who had income in Nova Scotia during 2016 was $26,270 (national: $28,590).

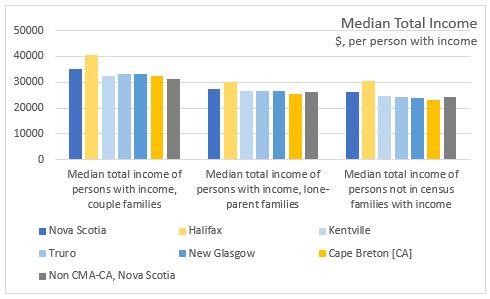

Within Nova Scotia, the Halifax CMA had higher median total income among couple families, lone-parent families, and persons not in families while areas outside of Halifax had lower median incomes across all family types.

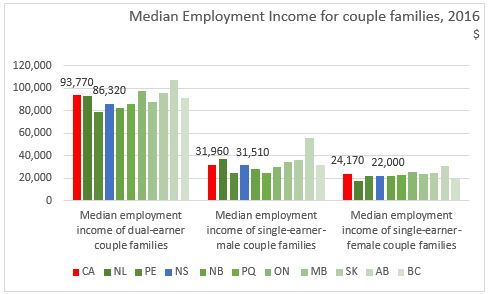

Dual-earner couple families in Nova Scotia earned $86,320 in 2016, below the national median amount of $93,770. Single-earner-male couple families had median employment income of $31,510 and single-earner-female couple families had median employment income of $22,000 in Nova Scotia in 2016.

Nova Scotia had the smallest share of total income from employment income in 2016 at 65.0 per cent. Nationally, 70.5 per cent of total income was derived from employment income with the highest share in Alberta (75.8%). The income share from CPP and OAS at 10.7 per cent and private pensions and RRSP withdrawals (10.5%) account for a larger share of Nova Scotia total income.

Within Nova Scotia, employment income makes up 69.3 per cent of total income in Halifax, 62.4 per cent in Kentville, 65.2 per cent in Truro, 60.5 per cent in New Glasgow, 59.3 per cent in Cape Breton, and 61.1 per cent outside the CMA-CA areas of the province. The share of income from CPP and OAS ranges for 7.6 per cent in Halifax to 14.3 per cent in Cape Breton.

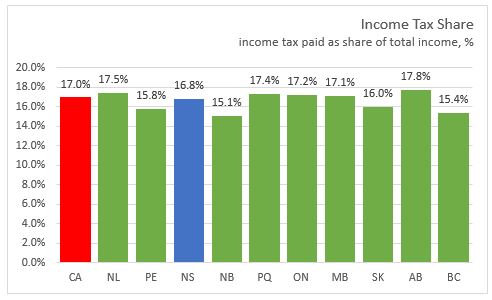

As a share of the total income in Nova Scotia, 16.8 per cent in paid is income tax. Nationally, 17.0 per cent of total income is paid to income taxes with the lowest proportion in New Brunswick (15.1%) and the highest in Alberta (17.8%).

Statistics Canada Notes:

Data from this release are based on the census family concept for families. Data are derived from personal income tax returns filed in spring 2017, and are not adjusted on the basis of Statistics Canada's population estimates.

Census family refers to a married or a common-law couple, with or without children at home, or a lone parent of any marital status, with at least one child living at home. There are no restrictions on the age of the children. This concept differs from the economic family concept used in most income data tables associated with the Canadian Income Survey and the Census of Population. Economic family refers to a group of two or more persons who live in the same dwelling and are related to each other by blood, marriage, common-law, adoption or a foster relationship.

The 2017 tax data are available for census metropolitan areas (CMA) and for census agglomerations (CA). A CMA or CA is formed by one or more adjacent municipalities centred on a population centre (also known as the core). A CMA must have a total population of at least 100,000, of which 50,000 or more must live in the core. A CA must have a core population of at least 10,000.

Statistics Canada. Table 11-10-0009-01 Selected income characteristics of census families by family type ; Table 11-10-0014-01 Sources of income by census family type ; Table 11-10-0034-01 Tax filers and dependants with income by sex, income taxes, selected deductions and benefits

<--- Return to Archive