The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 28, 2019CAPITAL AND REPAIR EXPENDITURES SURVEY, 2018 (PRELIMINARY) AND 2019 (INTENTIONS) Statistics Canada has released the results of its annual survey of capital expenditures for non-residential construction and machinery and equipment. The preliminary estimate for 2018 and intentions for 2019 are based on a sample survey of 25,000 private and public organizations conducted over September 2018 to January 2019.

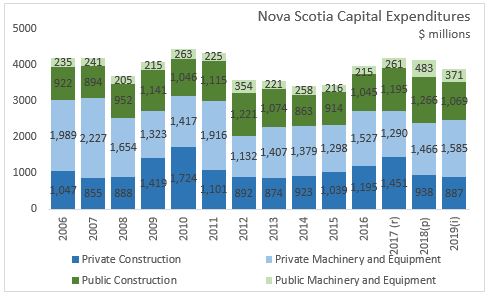

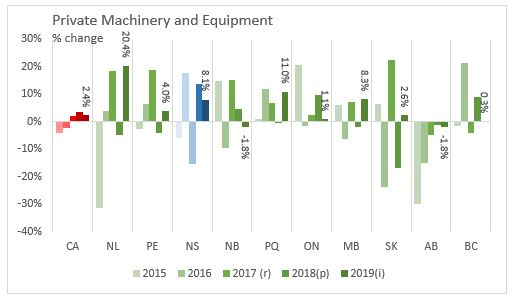

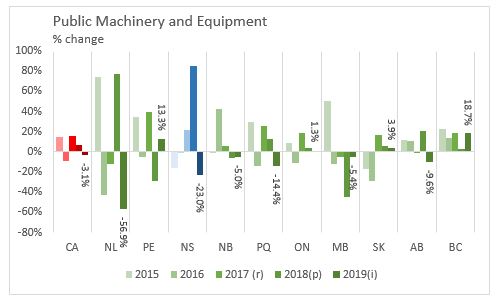

Capital expenditures include both non-residential capital construction and machinery and equipment spending. After increasing 14.9 per cent in 2016 and 5.4 per cent in 2017, capital expenditures declined 1.1 per cent in 2018 to $4.153 billion in Nova Scotia. The decline in 2018 was due to a decrease in private construction (-35.4%, -$513 million). Increases in private machinery and equipment (+13.7%,+$176 million), public construction(+5.9%, +$71 million) and public machinery and equipment (+85.0%,+$222 million) were not enough to offset the decline.

Capital expenditure intentions for 2019 are for a decrease of 5.8 per cent or by $240 million to $3.913 billion. Private construction (-5.4%, -$51 million) is expected to decline while private machinery and equipment spending (+8.1%, +$119 million) will increase. Following four years of increases, public capital expenditures are expected to decline 17.6 per cent or $308 million with decreases in construction (-15.5%, -$197 million) and machinery and equipment (-23.0%, -$111 million).

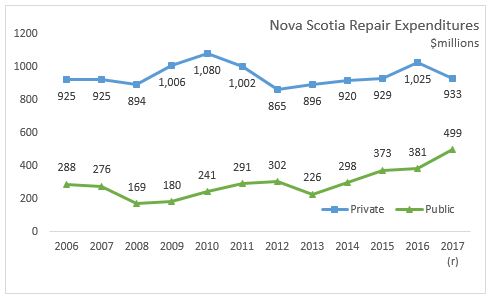

Repair expenditures increased 1.9 per cent in 2017, a slower pace than the previous three years. Repair expenditures increased structures (+42.1%) and declined machinery and equipment (-16.1%). Repair expenditures decreased for private (-8.9%) and increased for public (+30.9%) in 2017.

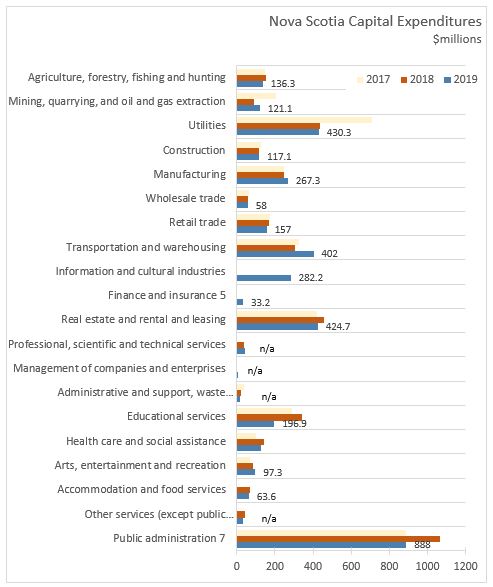

On an industry basis, the $44million increase in capital expenditures occurring in 2018 was due to large declines in mining, quarrying, and oil and gas extraction(-$116 million) and utilities (-$271 million) and smaller declines in construction, wholesale, retail trade, transportation/warehousing, and administration/support services. Increases occurred in public administration(+$179 million), education services (+$48 million), health care (+$43million), and real estate, rental and leasing (+$41 million)

For 2019, total capital expenditures are expected to decline by 5.8 per cent or $240 million. Capital intentions for 2019 are down in public administration(-$176 million), educational services (-$143 million), real estate, rental and leasing (-$34 million) and agriculture, forestry, fishing and hunting (-$17 million). The transportation and warehousing sector has intentions for $95 million more spending in 2019 to total of $402 million. Mining and quarrying (except oil and gas) is expected to see a 33.4 per cent or $30 million increase in 2019. Intentions are higher for manufacturing with increases among wood, paper, plastic/rubber, and fabricated metal offsetting lower intentions among food and transportation manufacturing.

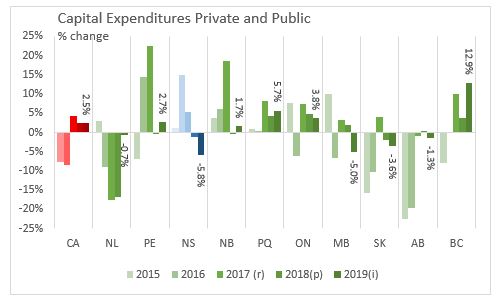

Canada is expected to see an increase of 2.5 per cent in capital expenditures in 2019 following on increases of 4.3 per cent in 2017 and 2.5 per cent in 2018.Private capital expenditures are expected to accelerate to 2.8 per cent and public outlays will be up 2.0 per cent in 2019. Capital expenditures will be higher in British Columbia (+12.9%), Ontario (+3.8%), and Quebec(+5.7%). Intentions are higher in the transportation and warehousing sector for 2019 with increase by both private and public organizations with increases across almost all transportation subsectors. Capital spending in the oil and gas extraction sector is expected to remain stable. Manufacturers anticipate higher capital spending with intentions higher for chemical manufactures in Alberta offsetting decline in transportation equipment in Quebec and Ontario.

The 2018 results had strong growth in public administration capital spending across Canada with increases by both provincial and territorial public administration, mostly in non-residential construction, and federal public administration mostly responsible for the rise in machinery and equipment spending. Manufacturing and transportation/warehousing capital spending were both up in 2018. Capital spending at education services was up for fifth consecutive year with some major projects funded through the Post-Secondary Institutions Strategic Investment Fund.

Capital and Repair Expenditures Survey, 2018 (preliminary) and 2019 (intentions)

<--- Return to Archive