The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

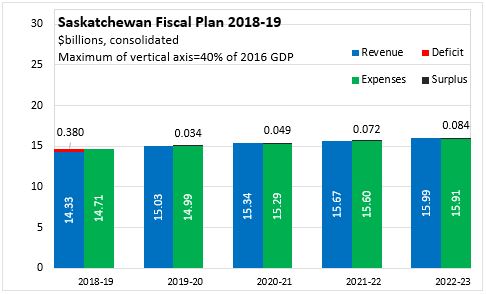

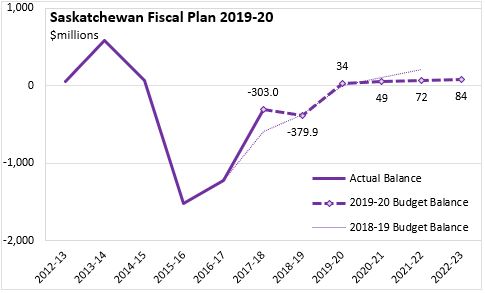

March 21, 2019SASKATCHEWAN BUDGET 2019-20 Saskatchewan tabled its provincial Budget on March 20, 2019. After ending the 2018-19 fiscal year with a deficit just under $380 million, the Saskatchewan government projects a return to balance with a 2019-20 surplus of $34 million. The surplus is projected to rise slowly in the following three years, rising to $84 million by 2022-23. From 2018-19 through 2022-23, revenues are projected to grow at an average annual pace of 2.8 per cent while expenditure growth is projected at 2.0 per cent per year.

Compared to the medium term outlook from Saskatchewan's 2018-19 Budget, Provincial revenues are projected to improve considerably in 2019-20 on gains in personal and corporate income taxes as well as sales tax and potash revenues. Higher revenues allowed the Saskatchewan government to meet its return to balance with somewhat higher expenditures than anticipated in last year's medium term outlook. Continued growth in revenues assumes rising prices for both oil and potash. Non-renewable resource revenues have increased by over $0.5 billion since 2016-17, but they remain 30 per cent below levels reported for 2014-15.

Saskatchewan's 2019-20 surplus of $34 million is in line with the outlook presented in the 2018-19 Budget. Ongoing surpluses in subsequent years are slightly smaller than those projected at this time last year. Saskatchewan's net debt:GDP ratio is projected to rise to 14.8 per cent by the end of 2019-20, after which it declines in each year reaching 13.1 per cent at the end of FY 2022-23.

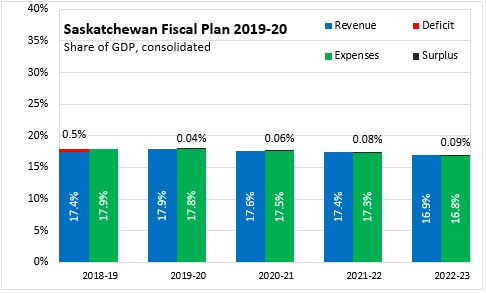

Saskatchewan's planned surpluses are small compared to the size of the provincial economy, amounting to less than 0.1 per cent of GDP in each of the next four fiscal years. Measured as a share of GDP, the Saskatchewan government's revenues are expected to decline from 17.9 per cent in 2019-20 to 16.9 per cent in 2022-23. Exepnditures are projected to decline by a similar percentage from 17.8 per cent in 2019-20 to 16.8 per cent in 2022-23.

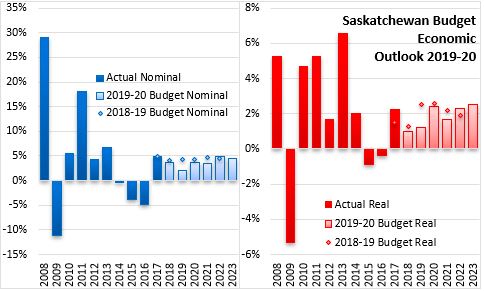

Saskatchewan's economy is concentrated in resource production. The output and prices of crops, oil, natural gas and potash can all be volatile, resulting in substantial swings in the pace of economic growth (particularly nominal GDP, which is influenced by commodity prices). Like many provinces, Saskatchewan's economy outperformed expectations for 2017 and real GDP growth is estimated to have slowed in 2018, particularly as investment declined. Growth in 2019 is expected to remain muted because of lower oil prices/investment and indefinite suspension of production at the McArthur River uranium mine. However, potash output and prices are still expected to grow in 2019 while last year's robust crop production is expected to repeat. Saskatchewan's economic growth is forecast to rebound in 2020 as oil prices start to recover, lifting investment and production.

Key Measures and Initiatives

Saskatchewan's Budget has lately focused on reducing the provincial deficit, with rising expenditures for many categories and few tax changes, including:

- Introduction of a $3,000 non-refundable tax credit for volunteer firefighters and volunteer medical first responders

- Elimination of deductions from the Potash Production Tax

Saskatchewan Budget 2019-20

<--- Return to Archive