The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

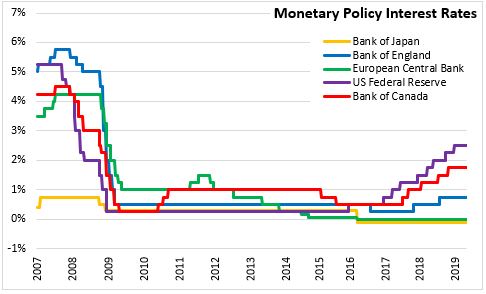

May 02, 2019BANK OF ENGLAND MONETARY POLICY The Bank of England's Monetary Policy Committee (MPC) voted to maintain the Bank Rate at 0.75 per cent. The MPC also voted to maintain the stock of UK non-financial corporate bonds stock at £10 billion and the stock of UK government bond purchases at £435 billion. The economic outlook depends significantly on the new trading arrangements between European Union and the United Kingdom with the Bank of England noting that the appropriate path of monetary policy will depend on economy adjustment to these events.

The Bank of England's May Inflation Report for their projections assume a smooth adjustment to average range of possible outcomes for Brexit resolution and gradual raising bank rate to 1.00 per cent by end of 2021. UK data has been volatile with shifting expectations regarding Brexit among financial markets, business and households. GDP is expected to grow 0.5 per cent in Q1 with companies in both United Kingdom and European Union building stock ahead of Brexit deadlines. Growth is expected to slow to 0.2 per cent in Q2 and be trending marginally below potential though the first half of 2019. Business investment is particularly sensitive to Brexit uncertainties and has been declining over the past year. Assuming global growth stability and subsiding Brexit uncertainty, economic growth will pick up and the economy will operate above potential by the end of the forecast period. The mean average real GDP projection are 1.5 per cent in 2019, 1.6 per cent in 2020 and 2.1 per cent in 2021.

CPI inflation was 1.9 per cent in March 2019 and expected to fall with lower retail energy prices. The UK labour market remains tight with unemployment rates are projected to edge down to 3.5 per cent by end of forecast period. Annual pay growth is at 3.5 per cent and unit labour costs are above historical averages. The Bank of England expects that as excess demand emerges in the economy that inflation pressures will firm and CPI will be above 2 per cent and be rising at the end of the three-year forecast.

Bank of England

<--- Return to Archive