The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 12, 2019STUDY: THE VALUE OF DATA IN CANADA - EXPERIMENTAL ESTIMATES Statistics Canada recently released a report highlighting experimental estimates on the value of data in Canada. Data, databases and data science have all taken a greater in role in modern life, with the business sector increasingly dependent on collection, processing and analysis of data to make production decisions and build marketing strategies. Economic growth had become more dependant on the use of data, changing the employment landscape and reshaping the marketplace. However, the economic value of data is not well measured by Statistics Canada’s current statistical system.

This report is a follow-up to another recent study which discussed the conceptual framework of valuing data and put forward ideas for expanding national accounting methodology to incorporate data as an asset. The information hierarchy advanced by this previous study suggests that when observations of everyday life are digitized, ‘data’ are produced. These data can then be further structured and organized into ‘databases’ and used in ‘data science’ to build valuable new findings about the world. While the latter two are represented as an asset in the system of national accounts, the asset data is notably absent.

This new study explores this previously discussed framework and presents a preliminary set of statistical estimates of the amounts invested in Canadian data, databases and data science in recent years. Statistics Canada has limited information on the market sales of data, databases and data science for valuation purposes. To overcome this obstacle, the study values these assets using a cost of production approach. Using employment and wage information collected by the Census of Population and the monthly Labour Force Survey, the study finds rapid growth in data, database and data science investments with significant accumulation of these kinds of capital over time.

Data

The value of data is estimated using the labour costs incurred in production plus associated indirect labour and other costs, such as infrastructure (e.g. electricity, telecommunications, building maintenance), human resource management and financial services. Data are assumed to be produced by National Occupational Classification (NOC) groups generally associated with converting observations into digital format. High and low assumptions are made regarding the amount of time worked on creating data. An additional 50% of salary costs is added to account for indirect costs, as well as another 3% for capital services.

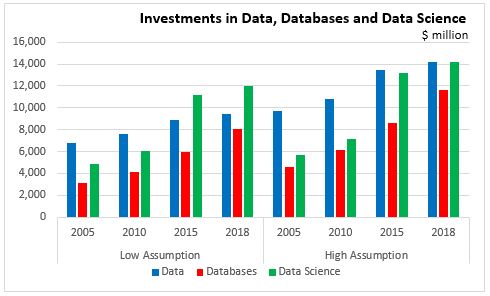

The results suggest that data accounted for between $9.4 billion (2.0%) to $14.2 billion (2.9%) of gross fixed capital formation in 2018. Investment is data has trended upward since 2005, with an average nominal growth rate around 2.9 per cent annually. It should be noted that that the estimated values for data reflect the replacement cost, and not the capitalized expected future returns attributable to the data.

Databases

Databases are recognized are as asset in the system of national accounts, but information is lacking to separate database development from other software. Statistics Canada, as with many other statistical agencies, assumes database investments are captured by estimates of gross fixed capital formation in software. The approach for valuing software follows a similar approach to the one used for data, where relevant occupational groups are identified, and assumptions are made regarding the relative amount of time spent on software development. Non-labour costs associated with the development of software are also included. This study further examines the relevant occupational groups to separate database development from general software development.

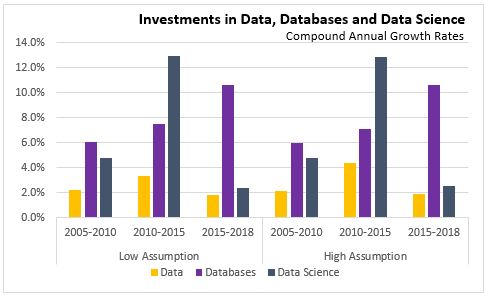

The total value of investment in databases in 2018 is estimated to be between $8.0 billion and $11.6 billion, up from $3.1 to $4.6 billion in 2005. Database investments have increased at an increasing rate since 2005, with 6.0 per cent (nominal) annual growth between 2005 and 2010, 7.3 per cent annual growth between 2010 and 2015, and 10.6 per cent growth per year between 2015 and 2018.

Data Science

Similar to databases, research and development is recognized as an asset in the system of national accounts, under the category ‘intellectual property products’. While this category conceptually includes all data science assets, information collected by Statistics Canada is likely biased towards the selection of firms engaged in more traditional forms of research and development (e.g. pharmaceuticals). The number and diversity of firms engaged in data science activities is likely underrepresented. To address this issue, the approach described above for data and databases is adopted for data science.

This approach yields gross fixed capital formation estimates for data science in the $12 to $14.2 billion range in 2018, up from $4.8 to $5.7 billion in 2005. Annual rates of growth in data science investment increased from 4.8 per cent between 2005 and 2010, to 12.9 per cent between 2010 and 2015, before dropping to 2.6 per cent in recent years.

Total investment in Data Products

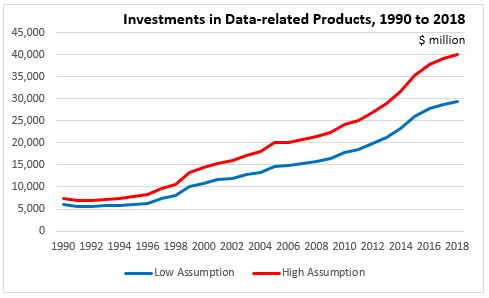

The combined fixed capital formation of all three data-related assets is estimated in the $29.5 billion to $40.0 billion range in 2018, double the amount invested in 2005 (in current dollars). The upper limit is greater than the annual investment in industrial machinery, transportation equipment, and research and development, and would account for 12% of total non-residential investment in 2018. Growth in data-related investments was relatively flat from 1990 to 1995. Since this time, investments have increased consistently with some slowdown in growth in recent years. Annual rates of growth in data-related assets increased from 3.8 per cent between 2005 and 2010, to 7.8 per cent between 2010 and 2015, before falling to 4.4 per cent between 2015 and 2018.

The Stock of Data-related Assets

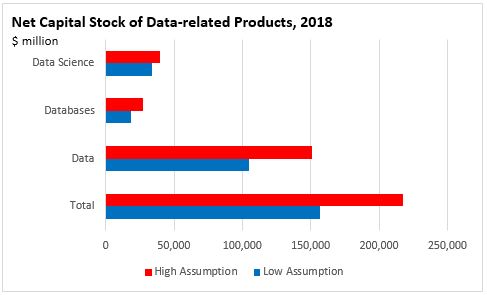

Estimates on the stock value of data assets are produced using the perpetual inventory method (PIM). This method accumulates constant dollar investment flows over time, with a discard function and a depreciation profile, and uses current price levels to derive a market value estimate of the asset. Although the stocks of data-related assets do not physically depreciate, a limited useful lifespan likely exists. The study assumes a useful lifespan of twenty-five years for data, five years for databases, and six years for data science. A geometric depreciation profile with zero discards is assumed for all three data-related asset types. Price indexes are calculated by assuming investment prices change in proportion to labour compensation rates, adjusted down by 1% per year to capture productivity growth.

The results indicate a net capital stock of between $157.1 billion and $217.7 billion by 2018. Data accounts for approximately 68 per cent of the total net stock, valued between $104.8 billion and $151.0 billion. The stock of databases is valued at $18.7 to $27.0 billion (12% of total), while the intellectual property from data science is valued in the $33.6 to $39.6 billion range, accounting for 20% of the total.

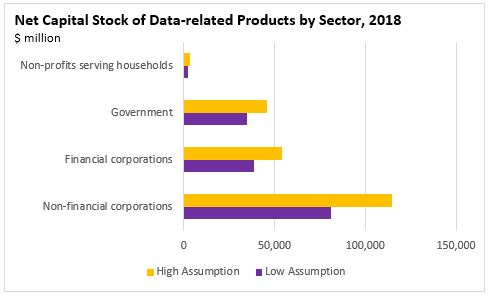

The stock of data-related products held by non-financial corporations in 2018 is estimated to be in the $80.9 to $114.6 billion range, accounting for approximately half of all data-related products held. Financial corporations held approximately 25 per cent of data-related stocks, with a value in the $38.8 to $54.1 billion range. Government sector stocks are valued at $34.8 to $45.6 billion, accounting for about one fifth of the total.

Note: Growth rates discussed in this article are based on high assumption values

Daily release | Full article

<--- Return to Archive