The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

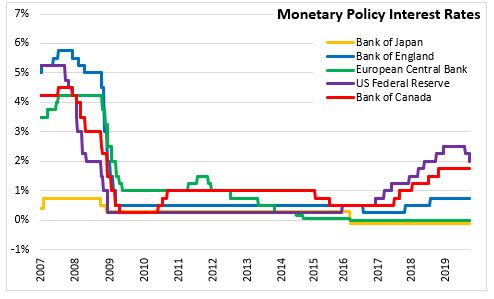

September 18, 2019US MONETARY POLICY After a 0.25 percentage point reduction in July 2019, the Federal Open Market Committee (FOMC) voted to lower the target range for the federal funds rate by 0.25 percentage points to the range of 1.75 to 2.00 per cent on September 18, 2019. The Committee noted that today's rate cut was due to global developments impacting the economic outlook and muted inflation pressures. The interest rate reduction supports the Committee's view that continued economic expansion, strong labour markets and inflation near the 2 per cent objective are the most likely outcomes for the US economy. In terms of the future path of the target range for the federal funds rate, the Committee will continue to monitor incoming information and will act as appropriate to sustain the expansion with a strong labour market and inflation near the symmetric 2 per cent objective.

Recent information has FOMC noting that the labour market remains strong and economic activity has been rising at moderate rate. On average job gains have been solid and the unemployment rate remains low. Household spending has been rising at strong pace but business fixed investment and exports have weakened. Overall inflation and inflation for items other than food and energy are running below 2 per cent. Market-based measures of inflation compensation remain low and longer-term expectations are little changed.

US Federal Reserve

<--- Return to Archive