The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

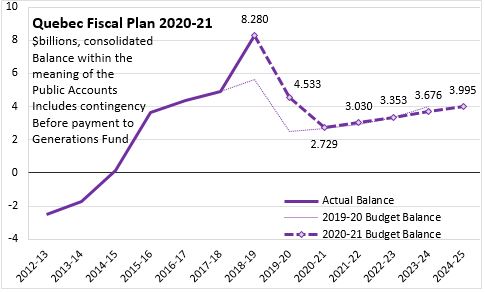

March 11, 2020QUEBEC BUDGET 2020-21 The government of Quebec has released its 2020-21 Budget, anticipating a contribution of $2.73 billion to the Generations Fund in the upcoming fiscal year. These contributions to the Generations Fund represent the planned excess of revenues over expenditures. In the forecast for 2019-20, the Province of Quebec also anticipates a surplus of $1.9 billion beyond its planned contributions to the Generations Fund. Contributions to the Generations Fund are expected to increase to $4 billion by 2024-24.

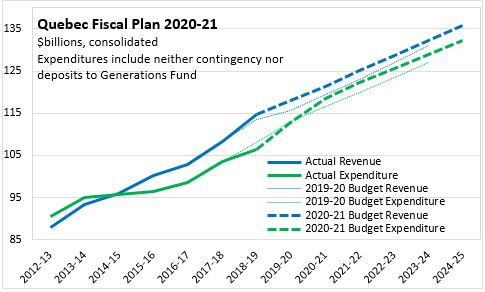

Quebec's revenues are projected to rise by an annual average rate of 2.9 per cent per year from 2019-20 to 2024-25. Expenditures are projected to rise 3.1 per cent per year over this time. The expenditure projections are adjusted by shortfalls to be offset in 2021-22 through 2024-25 ($125 million in the first year and $250 million in each subsequent year). Quebec's Stabilization reserve is forecast to be valued at $13.9 billion as of March 31, 2020 - making it possible to cover risks to the financial framework.

Compared with the fiscal outlook presented in the 2019-20 Budget, Quebec's revenues and expenditures are both higher in the 2020-21 fiscal plan.

Although Quebec's budget balance has outperformed expectations, the outlook for contributions to the Generations Fund is largely unchanged from the one presented as part of the 2019-20 Budget.

The size of the Quebec government (revenues and expenditures measured as a share of GDP) is projected to shrink slowly in the coming years. Revenues are projected to decline from 25.6 per cent of GDP in 2019-20 to 25.0 per cent of GDP in 2024-25. Expenditures are projected to fall over the same period from 24.7 per cent of GDP in 2019-20 to 24.2 per cent of GDP by 2024-25.

Quebec's contributions to the Generations Fund are projected to rise from 0.6 per cent in 2019-20 to 0.7 per cent by 2024-25.

Quebec's net debt-to-GDP ratio is projected to fall from 37.3 per cent in 2019-20 to 36.1 per cent in 2020-21, to 35.2 per cent in 2021-22, to 34.4 per cent in 2022-23, to 33.6 per cent in 2023-24 and to 32.7 per cent in 2024-25.

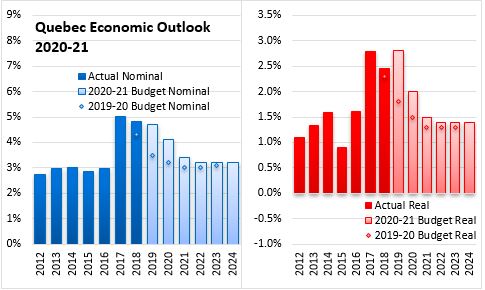

The Quebec Budget for 2020-21 assumes that strength in GDP growth will slow, returning to trend growth for potential GDP. Quebec's near term economic outlook remains stronger than projected in the 2019-20 Budget. The outlook for real GDP growth is 2.0 per cent in 2020 and 1.5 per cent in 2021. Nominal GDP is projected to rise by 4.1 per cent in 2020 and by 3.4 per cent in 2021. Labour market gains and wage growth are projected to support consumer spending in the near term while the residential sector catches up with rising demand. Non-residential investment is expected to grow as trade tensions resolve, public investment rises and businesses focus on productivity improvements. Quebec's long term economic outlook depends on rising productivity to offset the impacts of an aging population on labour supply and employment.

Key Measures and Initiatives

Quebec's robust economic growth and strong fiscal performance affords the opportunity to focus on expanded priorities, including:

- Responding to climate change with eletrification initiatives for private vehicles (purchase and charging incentives), public transit and residential heat

- Reducing school tax rates (July 1, 2020)

- Promoting culture through financial support for production, dissemination and outreach of Quebec cultural products and services, including a tax credit for sound recording and show production.

- Stimulating investment and innovation with: tax credits for manufacturing equipment, computer hardware and management software; a tax credit for business investment in share capital of small and medium sized enterprises (to promote business networking); deduction for commercialization of innovations

- Supporting labour market integration, regional development, tourism, forestry, mining and Quebec agriculture.

Quebec Budget 2020-21

<--- Return to Archive