The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

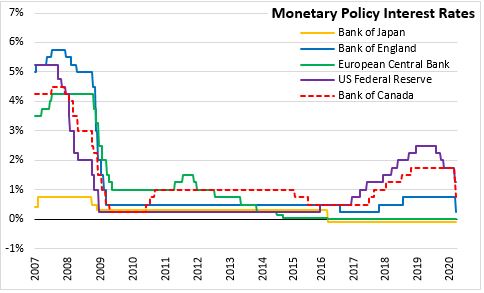

March 13, 2020BANK OF CANADA MONETARY POLICY The Bank of Canada made an unscheduled announcement today, reducing the target for the overnight rate by 50 basis points from 1.25 per cent to 0.75 per cent. This follows the previous (scheduled) rate announcement on March 4 in which the target for the overnight rate was also reduced by 50 basis points. The latest reduction in interest rates was made proactively to address negative shocks to the Canadian economy arising from the COVID-19 pandemic as well as the decline in oil prices. A further update will be provided on April 15. As the situation evolves, the Governing Council is ready to adjust monetary policy further if required to support economic growth and keep inflation on target.

To support liquidity in the Canadian financial system, the Bank of Canada also announced today a Bankers' Acceptance Purchase Facility to start March 23. The Bank will conduct secondary market purchases of 1-month Bankers' Acceptances issued and guaranteed by a Canadian bank of sufficiently high quality.

Yesterday, the Bank of Canada announced the expansion of its bond buyback program and term repo operations.

Bank of Canada: Rate announcement, Bankers' Acceptance Purchase Facility, Expanded bond buyback and term repo operations

<--- Return to Archive