The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

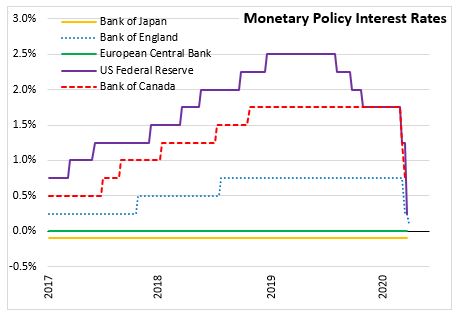

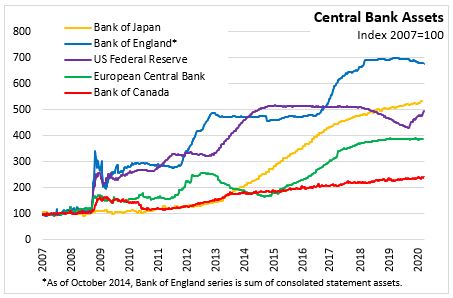

March 19, 2020BANK OF ENGLAND MONETARY POLICY The Bank of England held a special meeting on March 19, 2020 in which the Monetary Policy Committee (MPC) voted unanimously to reduce the bank rate by 15 basis points to 0.1 per cent. The Bank holdings of UK government bonds and sterling non-financial investment-grade corporate bonds by £200 billion to a total of £645 billion. The bank also expands the term funding scheme for small and medium-sized enterprises (TFSME), financed by the issuance of central bank reserves. Most of additional asset purchases will comprise UK government bonds. The purchases will be completed as soon as is operationally possible, consistent with improved market functioning.

On 11 March, the Bank’s three policy committees announced a package of measures to support UK businesses and households through this period. The Chancellor announced a number of fiscal measures with the same aim in his Budget. On 17 March, the combined package of measures was complemented by the announcement by HM Treasury of the COVID-19 Corporate Financing Facility (CCFF), for which the Bank will act as HM Treasury’s agent. By purchasing commercial paper, the CCFF will provide funding to non-financial businesses making a material contribution to the UK economy to support them in paying salaries, rents and suppliers while experiencing the likely disruption to cashflows associated with Covid-19.

Bank of England: Monetary Policy

<--- Return to Archive