The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

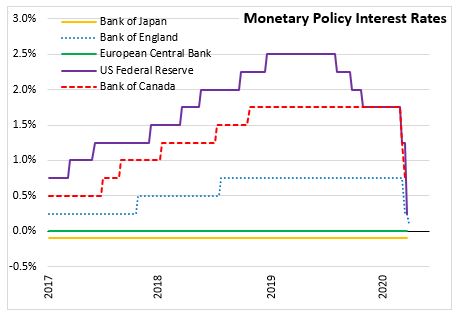

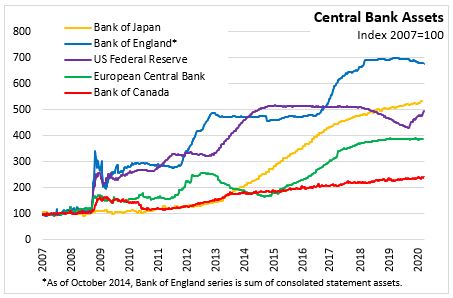

March 26, 2020BANK OF ENGLAND MONETARY POLICY The Bank of England announced today that the bank rate would continue to be 0.1 per cent. The Bank holdings of UK government bonds and sterling non-financial investment-grade corporate bonds will continue with a £200 billion increase to a total of £645 billion. The Bank will be closely watching pass-through of recent monetary policy changes. The Bank of England noted that "Monetary policy should take into account the broader public policy response to reduce the disruptive consequences for households and businesses of the spread of Covid-19. This should help to minimise the longer-term damage to the economy when the health crisis abates. In this environment, it is essential that monetary and financial stability are maintained, as these are pre-requisites of longer-term economic prosperity".

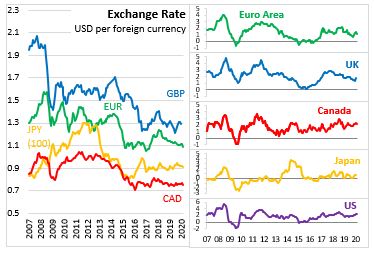

The Bank of England noted that the spread of COVID-19 and measures that are likely need to contain it have evolved significantly. Given the severity of economic disruption, there is risk that longer-term damage to economy if business fail on large scale or unemployment rises significantly. In the near term, working arrangements are being adjusted, consumer-facing companies are ceasing operations, and others need to scale back activities. Household spending is likely to decline and business are likely to postpone investments. Partially offsetting these are higher spending on essential goods and services. There is little evidence to assess magnitude of economic shock, but it’s likely global GDP falls in the first half of year and unemployment rate rises in many countries. Indicators of UK activity such as manager surveys, foot traffic in stores, and flights have declined sharply.

Bank of England: Monetary Policy

<--- Return to Archive