The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

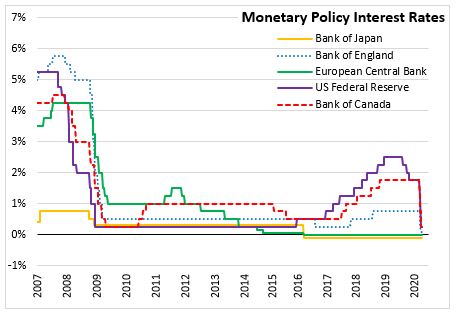

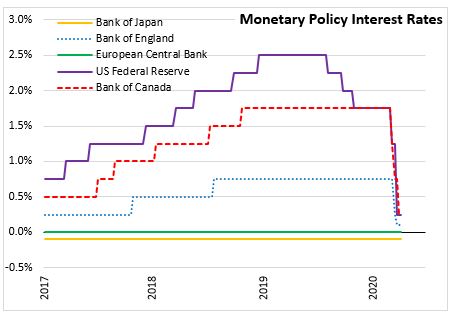

March 27, 2020BANK OF CANADA MONETARY POLICY Today, March 27, 2020, in an unscheduled announcement, the Bank of Canada lowered target rate for the overnight rate by 0.5 percentage points to 0.25 per cent. The Bank Rate is correspondingly 0.5 per cent and the deposit rate is 0.25 per cent. It was noted that the policy rate is now at its effective "lower bound". The Bank of Canada will launch a quantitative easing program with the purchase of a minimum of $5 billion per week of Government of Canada securities in the secondary market. Purchases will be made across the yield curve and adjusted as conditions warrant. These purchases will continue until the economic recovery is well underway. A Commercial Paper Purchase Program (CPPP) will help to alleviate strains in short-term funding markets used by businesses with more details forthcoming. The Bank of Canada Governing Council stands ready to take further action as required to support the Canadian economy, financial system and to keep inflation on target.

The Bank of Canada noted that fiscal action has been announced to defend Canadian households and the Canadian economy from damaging effects of COVID-19. Monetary policy is playing an important supporting role with low interest rates helping to cushion shocks by easing cost of borrowing. The Bank of Canada is working to keep the financial system functioning and making sure credit is available to people and companies. The announcements today have dual intent of supporting financial system to provide credit in the short-term and lay foundation to return to normalcy over the longer term.

Bank of Canada: Rate announcement, Press conference opening statement

The Bank of Canada's next scheduled date for announcing the overnight rate target is April 15, 2020. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR at the same time.

<--- Return to Archive