The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

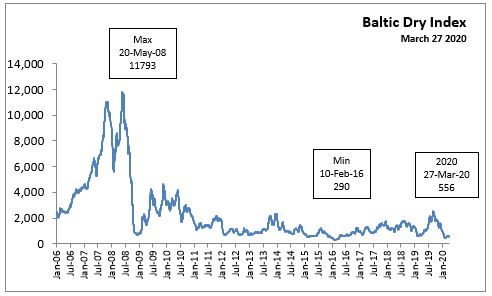

March 30, 2020BALTIC DRY INDEX MARCH 2020 The BDI measures procurement costs of shipping raw materials by sea. When these costs go down, producers benefit from increased margins, and consumers benefit from lower prices for finished products.

On May 20, 2008, the Baltic Exchange reported the BDI = 11,793 a new high for the index. Before the year was out, the BDI dropped to 663 on 5 December 2008.

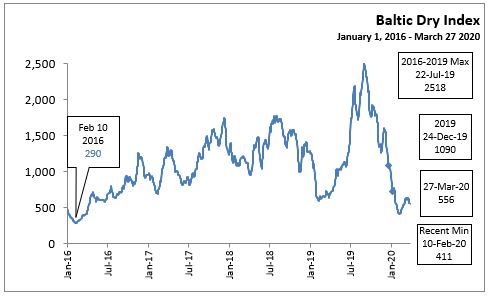

On February 10, 2016, the Baltic Exchange reported the BDI = 290 a new low for the index. When the index drops below 500, shipping companies tend to idle their fleets as variable costs cannot be recovered.

On the last trading day in 2019, the Baltic Exchange reported the BDI = 1,090, an increase of 800 points over February 10, 2016.

Recent Activity to March 27, 2020

The Baltic Exchange reported the BDI continued its slide from a high of 2518 on 22 July 2019 to a recent minimum of 411 on 10 February 2020. Since then, the BDI has reported a recovery to 617 on 23 March 2020.

Thus for the moment, demand for shipping raw materials (coal, iron ore, etc.) has improved, possible due the the sharp reduction in oil prices.

Since March 23, 2020, the BDI has returned to a declining mode. As of March 27, 2020 the BDI has declined to 556.

QUOTES

PROJECT CARGO JOURNAL

January 31, 2020

The Baltic Dry Index has dropped to its lowest point in four years time as a result of the coronavirus, IMO 2020 and seasonality. The index currently stands at 487 points, down more than 1,100 points in comparison with the beginning of December last year.

https://www.projectcargojournal.com/shipping/2020/02/04/coronavirus-and-imo2020-send-baltic-dry-index-crashing-down/?gdpr=accept

WALL STREET JOURNAL

March 24, 2020

A bellwether of the global shipping market has hit an all-time low as the spread of the coronavirus weighs on global trade.

The fast-spreading virus and uncertainty around its impact on the world’s economy have rocked markets and sent commodities prices to multi-month lows in recent days. That has added pressure to shipping freight rates—the price at which cargo is delivered from one point to another—for the world’s largest raw materials ships, known as capesize vessels.

https://www.wsj.com/articles/shipping-bellwether-hits-all-time-low-11580744101

Cross-correlations between Baltic Dry Index and crude oil prices

Ruan, Qingsong; Wang, Yao; Lu, Xinsheng; Qin, Jing

Abstract: This paper examines the cross-correlation properties of Baltic Dry Index (BDI) and crude oil prices using cross-correlation statistics test and multifractal detrended cross-correlation analysis (MF-DCCA). The empirical results show that the cross-correlations between BDI and crude oil prices are significantly multifractal. By introducing the concept of a ;crossover;, we find that the cross-correlations are strongly persistent in the short term and weakly anti-persistent in the long term. Moreover, cross-correlations of all kinds of fluctuations are persistent in the short time while cross-correlations of small fluctuations are persistent and those of large fluctuations are anti-persistent in the long term. We have also verified that the multifractality of the cross-correlations of BDI and crude oil prices is both attributable to the persistence of fluctuations of time series and fat-tailed distributions.

https://ui.adsabs.harvard.edu/abs/2016PhyA..453..278R/abstract

You Can’t Gauge the Global Economy Just by Looking at Ships

https://www.bloomberg.com/opinion/articles/2019-07-11/baltic-dry-index-is-losing-its-predictive-powers-for-economy

- economist Lutz Kilian created a similar home-brew index of ocean freight costs, and argued it could be used to spot turns in the global business cycle.

- after the index foreshadowed 2008’s precipitous slump in the S&P 500 and subsequent recovery, its record since then has been patchy.

- The Baltic Dry Index appeared to forecast the 2008 crisis and the pickup afterward -- but its record since then has been weaker

- economist James Hamilton argues shipping costs just don’t work as a useful measure of economic activity. An indicator based on measures of industrial production does a better job of isolating major economic shocks

- JPMorgan's global composite purchasing managers index might provide a better forward-looking guide to real economic activity

- If you think the global business cycle is fundamentally driven by Chinese raw-materials demand, then you might still find the Baltic Dry a useful indicator. But given China’s attempts to shift toward a more consumption-based economy, that doesn’t quite work these days.

- These measures aren’t entirely useless. Shifts in industrial activity can portend swings in the business cycle, and cargo bookings are a forward-looking indicator.

OTHER LINKS

" the index is considered as a leading indicator (forward looking) of economic activity..... A high BDI index is an indication of a tight shipping supply due to high demand and is likely to create inflationary pressures along the supply chain."

"A sudden and sharp decline of the BDI is likely to foretell a recession since producers have substantially curtailed their demand leaving shippers to substantially reduce their rates in an attempt to attract cargo."

"Between 2005 and 2009 when it behaved as a bubble.... A factor is that many ships were ordered during the “bubble years” and have entered the market, providing capacity growth above demand growth. In recent years the BDI remains low, underlining a situation of excess capacity in the shipping industry."

The Baltic Dry Index, 1985-2019, The Geography of Transport Systems

"July 15 (Reuters) – The Baltic Exchange’s main sea freight index hit a five-and-a-half-year high on Monday on the back of strong demand for capesize vessels shipping iron ore."

REFERENCES

The Surprising Relevance of the Baltic Dry Index, New Yorker, June 22, 2016

LLYod Baltic Dry

CNBC (one year+)

Baltic Dry Index Commodities

Trading Economics (intercative chart)

Bloomberg (interative chart)

Baltic Dry Index - BDI (BALDRY), wikinvest

The Shipping News

The Baltic Exchange

<--- Return to Archive