The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

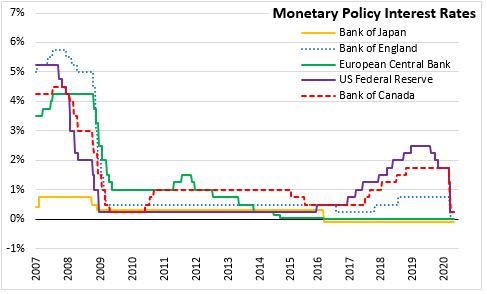

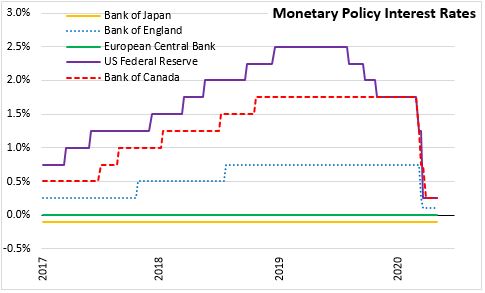

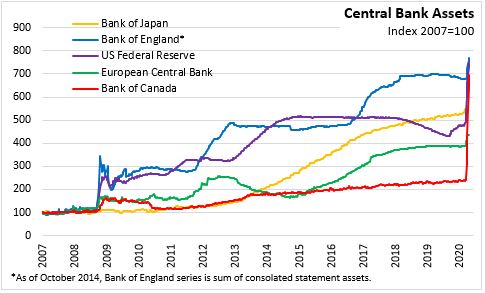

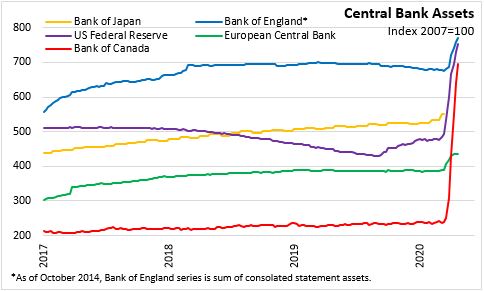

April 28, 2020BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan announced an enhancement of monetary easing in response to the severe situation unfolding with the spread of COVD-19. The Bank will continue to maintain the negative interest rate of -0.1 per cent on balances of financial institutions at the Bank along with previously-announced Quantitative and Qualitative Easing with Yield Control and purchases of ETFs and JREITs. The Bank's previous accommodations have had positive impacts, but corporate financing conditions are deteriorating.

The Bank is further enhancing monetary easing with:

- increased corporate paper and corporate bond purchases (up to ¥20 trillion), with increased in maximum amounts per issuer and extended maximum term for purchased assets to 5 years

- expanded range of eligible collateral to include private/household debt for Special Funds-Supplying Operations for Corporate Financing as well as increased interest rate on deposits (to +0.1%) for those that correspond to the operation's outstanding balances

- added purchases of Japanese Government Bonds and T-Bills to stabilize the yield curve at low levels

The Bank stated that it will not hesitate to take additional easing measures if necessary. The Bank expects short and long term policy interest rates to remain at present or lower levels.

Japan's economy is expected to remain in a severe situation during the domestic and global outbreak of COVID-19. The prospects are very unclear, but the economy is expected to improve as COVID-19 wanes in Japan and elsewhere. Recovery depends on loosening constraints on pent-up demand, but the inflation outlook is projected to be weak for the time being.

Source: Bank of Japan's Statement on Monetary Policy

<--- Return to Archive