The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

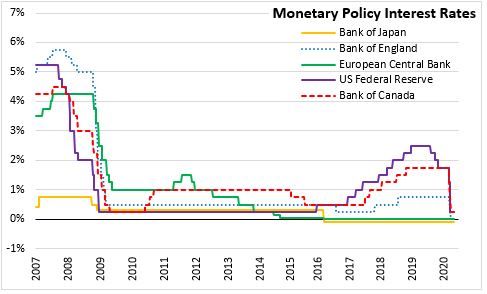

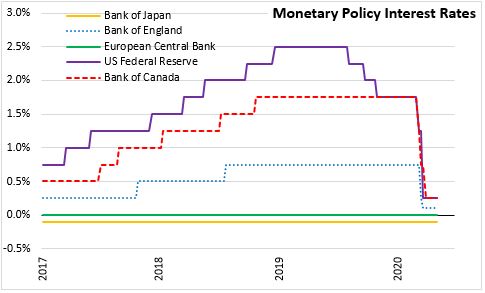

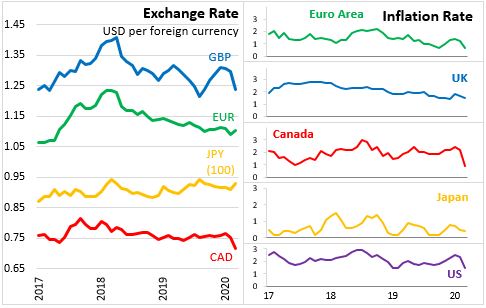

April 30, 2020EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank announced today that key interest rates would remain unchanged. They are expected to remain at present or lower levels until the inflation outlook converges (consistently and robustly) near to the 2 per cent target.

With the impact of the COVID-19 pandemic, the Euro Area faces an economic contraction that is unprecedented in peacetime. Consumer and business sentiment measures have plunged, suggesting a sharp contraction is underway in economic growth and labour markets. Current estimates indicate that Euro Area GDP could contract between 5 and 12 per cent in 2020. Recovery depends on the duration needed for virus containment measures and the speed of economic rebound is highly uncertain in any scenario.

The ECB has already undertaken significant easing measures since March, complemented by fiscal initiatives by governments across the Euro Area. The Governing Council of the ECB added to these measures today with further easing:

- Reducing interest rates on targeted longer-term refinancing operations from June 2020 to June 2021, reaching 50 basis points below the average interest rate on main refinancing operations.

- For those who meet net lending thresholds, interest rates will be reduced to 50 bps below the average deposit facility rate.

- Addition of new non-targeted pandemic emergency longer-term refinancing operations (PELTROs): 7 additional refinancing operations starting in May with maturity between July and September 2021.

The Governing Council of the ECB is committed to playing its role in supporting all citizens of the euro area through this extremely challenging time. To that end, the ECB will ensure that all sectors of the economy can benefit from supportive financing conditions that enable them to absorb this shock. This applies equally to families, firms, banks and governments.

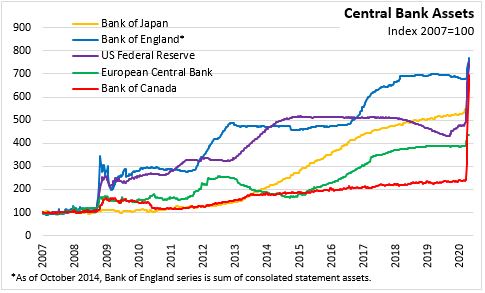

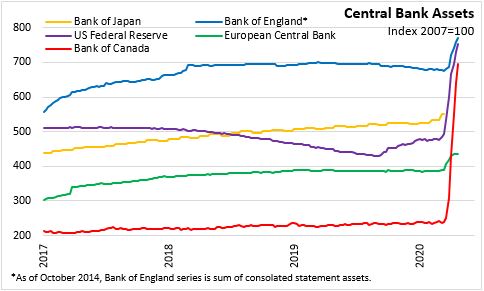

The Governing Council will do everything necessary within its mandate and is fully prepared to increase the size of its asset purchase programmes and adjust their composition, by as much as necessary and for as long as needed.

European Central Bank: Monetary Policy Decision, Remarks

<--- Return to Archive