The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

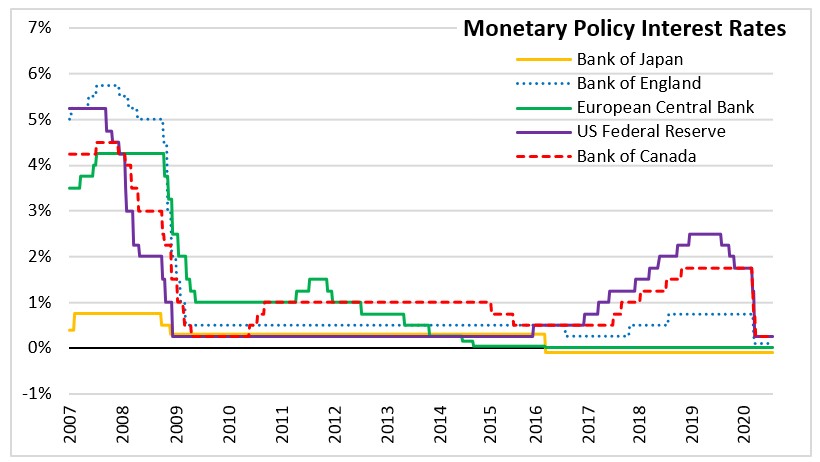

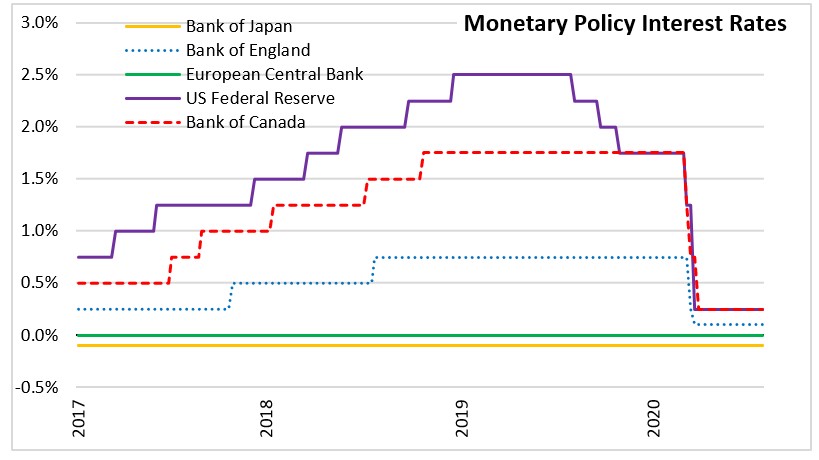

September 09, 2020BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at the effective lower bound of 0.25 per cent in its scheduled interest rate announcement today. The Bank Rate is correspondingly 0.5 per cent and the deposit rate is 0.25 per cent. The Bank is also continuing its quantitative easing (QE) program, with large scale asset purchases of at least $5 billion per week of Government of Canada bonds.

In line with the July Monetary Policy Report (MPR) scenario, activity in both the global and Canadian economies are bouncing back as countries continue to lift social distancing measures. The Bank expects that this strong reopening phase will be followed by a protracted and uneven recuperation phase. The pace of the recovery will depend on the path of COVID-19 and the policy support in place to limit the impacts of coronavirus on economies.

In Canada, the real GDP in the second quarter was 11.5 per cent lower than the first quarter of 2020. This resulted in a decline of just over 13 per cent in the first half of the year. The Bank notes that this level of GDP is in line with the July MPR central scenario and reflects a slowdown in all components of aggregate demand. Economic activity in the third quarter is expected to be faster than anticipated in the July MPR, mainly supported by stronger than expected household spending and export growth.

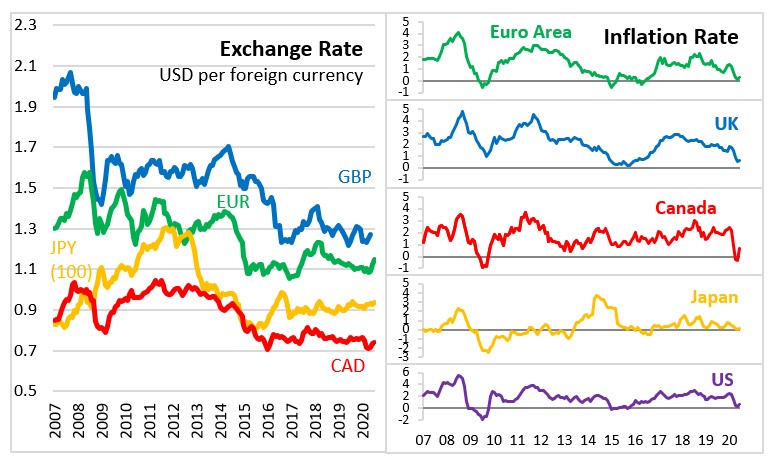

CPI inflation has decreased to near zero reflecting the downward pressure from energy prices and travel services. Measures of core inflation are between 1.3 per cent and 1.9 per cent, showing a large degree of economic slack.

The Bank noted that successful transition from reopening phase to recovery will require continuation of monetary policy support and reconfirmed its commitment to hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 per cent inflation target is sustainably achieved. The QE program w currently in place will continue until the recovery is well underway and will be calibrated to provide the monetary policy stimulus needed to support the recovery and achieve the inflation objective.

The next scheduled date for announcing the overnight rate target is October 28, 2020. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projections, will be published in the MPR at the same time.

Bank of Canada: Rate announcement

<--- Return to Archive