The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

December 10, 2020CANADA'S INTERNATIONAL INVESTMENT POSITION, Q3 2020 The COVID-19 pandemic has caused significant volatility in the prices of global financial assets and foreign exchange rates.

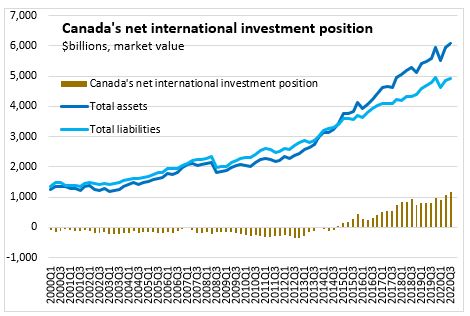

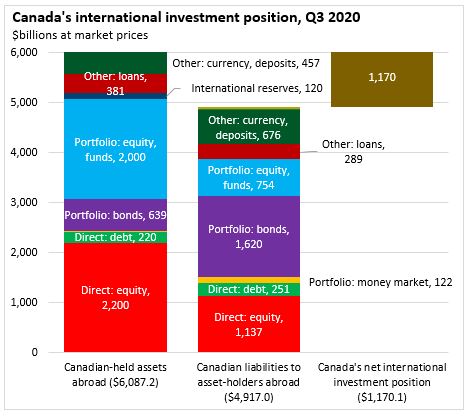

As of Q3 2020, Canada had a positive net international investment position (at market value) of $1,170.1 billion. This consists of Canadian-held assets abroad worth $6,087.2 billion net of the Canadian liabilities to asset-holders abroad valued at $4,917.0 billion. The recent rebound in asset and liability values is associated with recovering equity prices as major stock markets reported gains in Q2 and Q3.

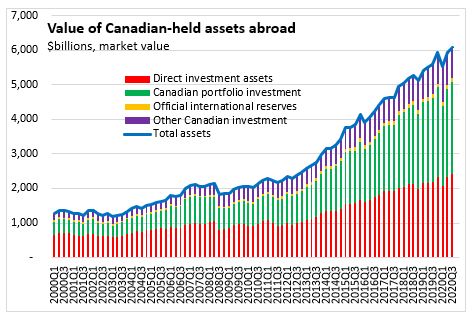

This volatility affects Canada's international assets more than it does Canada's international liabilities. Canada's international assets were up $139.2 billion to a record high. Upward revaluation from market prices were partially offset from exchange rates fluctuations. Liabilities were up $44.8 billion on higher market prices and increased foreign borrowing.

CANADA'S INTERNATIONAL INVESTMENT POSITION BY DETAILED ASSET CATEGORY

Canada's international assets abroad consist of nearly 70 per cent equity (either direct investment or portfolio investment). Debt, bonds, loans, currency/bank deposits make up the bulk of the rest of Canada's international asset position. In contrast, Canada's liabilities to asset-holders abroad consist more of debt (direct debt, bonds, money market securities and currency/bank deposits) than of equity, which only accounts for 38 per cent of liabilities.

Source: Statistics Canada. Table 36-10-0485-01 International investment position, book and market values, quarterly (x 1,000,000)

<--- Return to Archive