The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

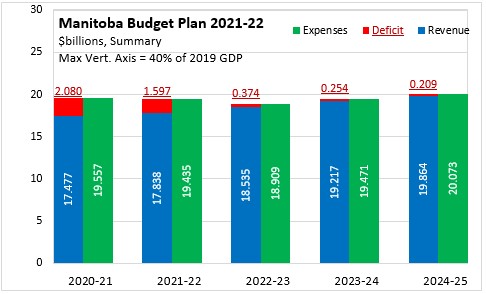

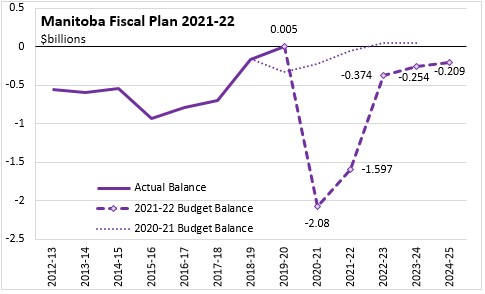

April 12, 2021MANITOBA BUDGET 2021-22 Manitoba tabled its 2021-22 Budget on April 7, 2021. The deficit for 2021-22 is estimated at $1.597 billion, down from the $2.08 billion forecast for 2020-21. The deficit is expected to narrow substantially in 2022-23. Over the subsequent two fiscal years, the deficit is projected to narrow further, but not to close. The Budget Address notes that the deficit will be eliminated within 8 years.

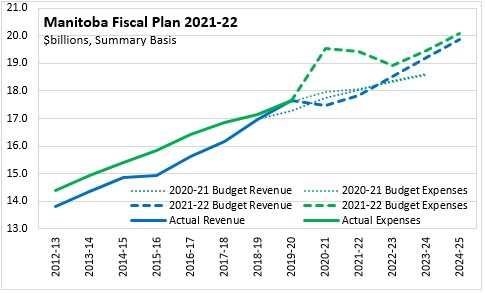

The Province of Manitoba's 2020-21 fiscal plan was published prior to the full understanding of the impacts of COVID-19 on the Province's fiscal situation. COVID-19 resulted in both a large increase in expenditures and a drop in revenues for 2020-21. Although expenditures are projected to fall in 2021-22, they are still well above previous plans. After declining again in 2022-23, Manitoba's expenditures are projected to follow a rising trend - above the pre-COVID expenditure projections. Manitoba's provincial revenues are projected to recover to their pre-pandemic plan by 2022-23 and are thereafter expected to grow more rapidly than previously anticipated.

The Manitoba Budget achieved an unexpected surplus of $5 million in 2019-20 - closing the deficit three years earlier than planned. However, with COVID-19, the deficit grew significantly to over $2 billion. The Manitoba Budget deficit is projected to narrow by over $400 million in 2021-22 and by over $1.2 billion in 2022-23. Although deficits continue to narrow, the Manitoba fiscal plan does not anticipate a return to balance by 2024-25.

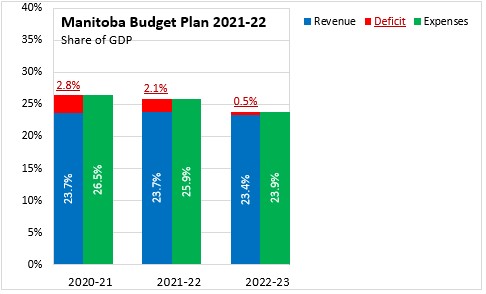

The Manitoba Budget deficit for 2021-22 amounts to 2.1% of GDP, down from 2.8% forecast for 2020-21. The footprint of Manitoba's government relative to its GDP is expected to have peaked at 26.5% in 2020-21 before falling to 23.9% by 2022-23 (note that Manitoba does not publish nominal GDP projections beyond 2022).

Manitoba's net debt is forecast to have risen to 38.5% of GDP at the end of 2020-21. In 2021-22 net debt is projected to rise to 39.9% of GDP before declining in subsequent years to 38.4% of GDP by 2024-25.

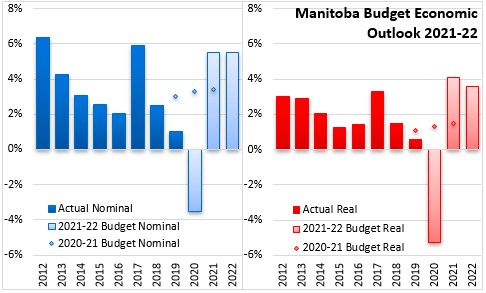

The Manitoba Budget is predicated on an economic outlook that incorporates vaccine rollout and economic recovery in 2021. This includes a population lift from an inflow of immigrants, new housing construction in a low interest rate environment and private investment (notably in food industries). Under these assumptions, Manitoba's economy is expected to recover with a 4.1% rise in real GDP in 2021 (5.5% in nominal terms), followed by a 3.6% gain in 2022 (5.5% in nominal terms). In comparison, Manitoba's economy (real GDP) is estimated to have declined by 5.3% in 2020. The Manitoba economic outlook is tempered by the uncertainty around vaccine supply, new variants of the virus, a third wave of outbreaks and potential household deleveraging.

Key Measures and Initiatives

Like many provinces the Manitoba Budget focuses on near-term priorities to protect and recover from COVID-19. However, the province is also implementing tax reductions.

Key initiatives include:

- $1.2 billion funding for COVID costs and contingencies, including personal protective equipment, testing, vaccination, contact tracing and preparation for additional outbreaks.

- Creating dedicated departments for Mental Health, Wellness and Recovery as well as Advanced Education, Skills and Immigration

- Increasing Rent Assist payments for lower income households

- Introducing a refundable teaching expense tax credit

- Removing provincial sales tax from personal services such as hair care

- Beginning the phase out of education property taxes (including rebates on current taxes)

- Increasing exemption thresholds on payroll taxes

- Boosting the Small Business Venture Capital tax credit

- Enhancing and extending tax credits for film, digital media, book publishing, cultural industries/printing and community development

- Lowering vehicle registration fees

- Initiating a tax competitiveness review

- Creating a private-sector-led economic development agency to attract investment and increase trade

Manitoba Budget 2021-22

<--- Return to Archive